Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: PBoC MLF, Australia Jobs (Jul), China Activity Data (Jul), UK GDP (Jun), US Retail Sales (Jul), US Philly Fed (Aug), US Initial Jobless Claims

Earnings: Alibaba, Walmart, JD.com, Grab, Applied Materials, Amcor

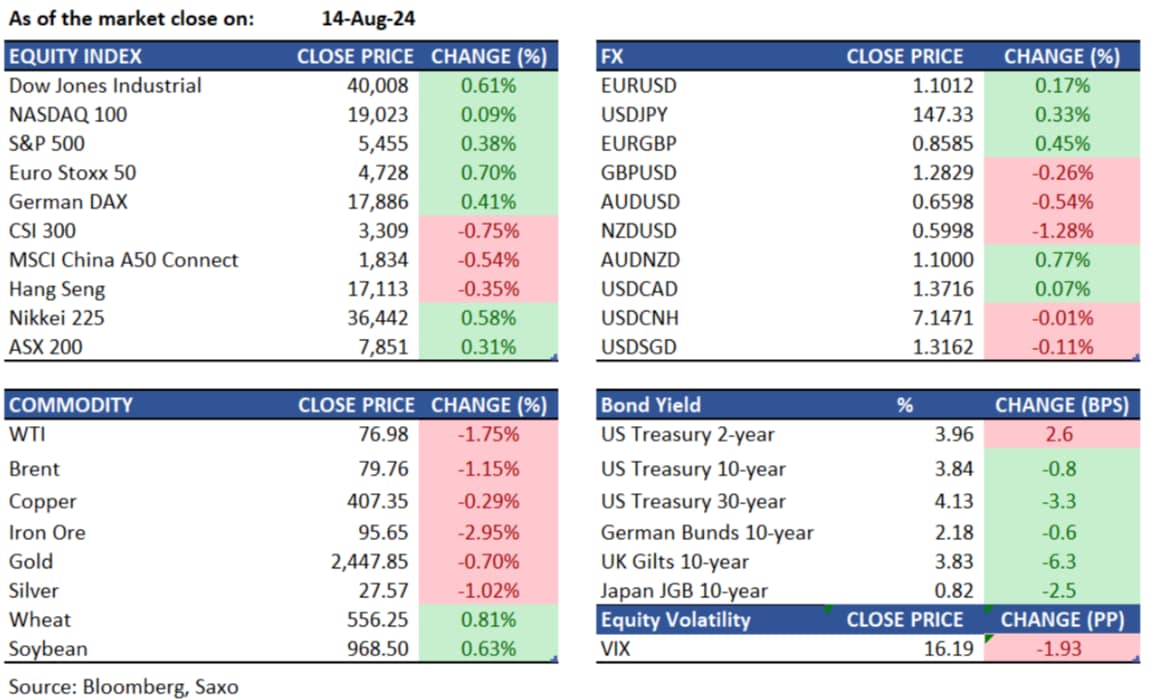

Equities: On Wednesday, U.S. stocks closed higher as traders evaluated the latest Consumer Price Index data. The S&P 500 rose 0.4%, marking its fifth consecutive win, the Dow advanced 242 points, and the Nasdaq finished marginally up. July's CPI revealed a 2.9% year-over-year rise, the first sub-3% inflation since 2021. This reassured investors and stirred speculation that the Federal Reserve might cut interest rates next month. Financial and energy stocks outperformed, while communication services lagged, with Alphabet dropping 2.3% amid breakup rumors. In extended trading, Cisco Systems jumped 5% on strong results, Ulta Beauty surged 14% after Berkshire Hathaway's stake, and Nike popped 3.4% on Pershing Square's investment.

Fixed income: The front end of the Treasuries curve underperformed as swap pricing shifted back towards expecting a 25 basis point interest rate cut in September, rather than a half-point reduction, following July's CPI data, which largely met expectations. Conversely, the long end of the curve rallied, with 30-year yields improving by around 5 basis points, contributing to a flattening bias. In SOFR options, upside structures were unwound and adjusted in response to the slightly hawkish re-pricing across the swaps curve. Treasury 2-year yields increased by approximately 1.5 basis points, while yields from the belly to the long end of the curve improved by 0.5 to 5 basis points. As a result, spreads tightened, with the 2s10s and 5s30s trading near their flattest levels of the day in the late session, dropping 4 and 4.5 basis points, respectively, compared to Tuesday's close.

Commodities:Gold prices fell 0.7% to $2,447.85 due to routine profit-taking and revised expectations for a smaller September Fed rate cut of 25 basis points instead of 50. WTI crude futures declined by 1.75% to $76.98, and Brent crude futures slipped 1.15% to $79.76, both influenced by EIA data showing an unexpected inventory build of 1.357 million barrels versus the anticipated draw of 2 million barrels. Wheat prices dropped to $5.20 per bushel, driven by a better-than-expected production outlook from Ukraine. Additionally, US natural gas futures surged over 5% to $2.27/MMBtu, the highest in around a month, due to decreased production and forecasts for hotter weather later in August.

FX: The US dollar saw some downside after the soft US inflation report but ended the day unchanged as markets found little new information in the report. The New Zealand dollar led the decline after rising to four-week highs against the US dollar as the central bank of New Zealand surprised markets with a dovish rate cut. The Australian dollar also followed suit, and will be watching the labor data out in today Asian session. Markets will also be on alert for China’s activity data. The Japanese yen was volatile after reports of Japan PM Kishida stepping down from the party leadership in September, and focus remains on US data with retail sales and jobless claims on watch today.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.