Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Democratic National Convention (Aug 19-22), Fed's Jackson Hole Economic Policy Symposium (Aug 22- 24), ECB Minutes, EZ/UK/US Flash PMIs (Aug)

Earnings: Target, Macy’s, Analog, Snowflake, Zoom, Agilent Technologies

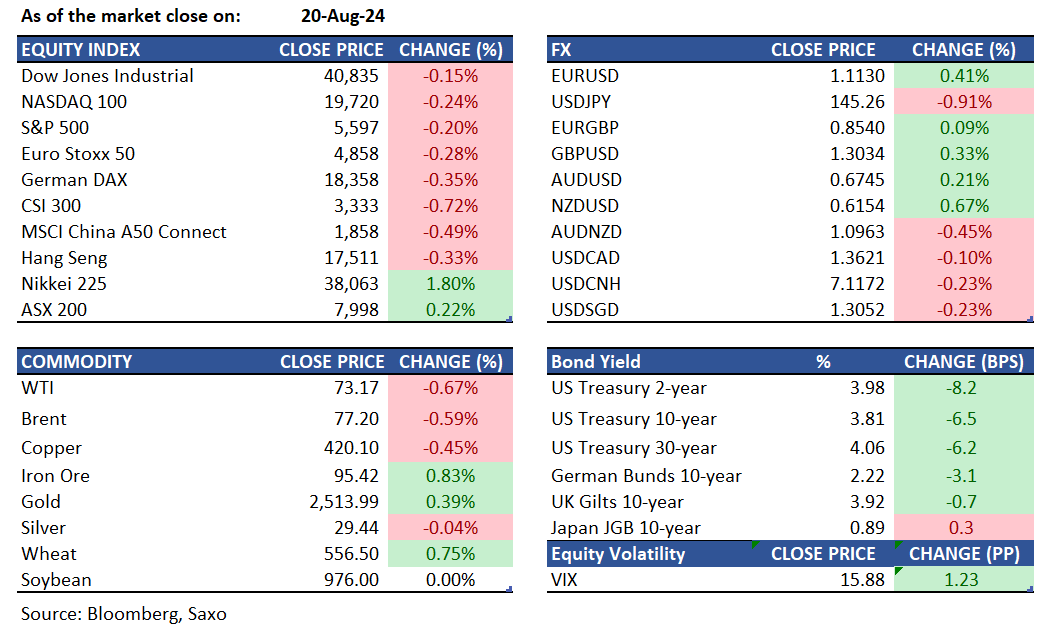

Equities: U.S. stocks concluded a volatile session lower on Tuesday as investors looked for signals from the Federal Reserve about future interest rate cuts. The S&P 500 and Nasdaq 100 both ended their eight-day winning streaks, each dropping by 0.2%, while the Dow Jones decreased by 61 points. Volatility heightened ahead of the Jackson Hole symposium and the release of the Fed's latest meeting minutes, which could provide insights into the expected September rate cut. Energy and material stocks were among the biggest decliners, while health and consumer staples saw the most gains. In corporate news, Lowe's fell 1.2% after missing revenue expectations and lowering its profit outlook, despite surpassing Q2 profit estimates. Boeing declined 4.2% after grounding its 777x test fleet due to structural cracks. On the other hand, Palo Alto Networks surged 7.1% on strong Q4 results and positive guidance, and Eli Lilly gained 3% following favorable results for its weight-loss drug tirzepatide.

Fixed income: Yields on U.S. government debt broadly decreased, with the 30-year rate hitting its lowest point in over seven months. Treasuries closed higher, driven by gains in Canada’s bond market following benign July CPI data from Canada. The rally, led by short-maturity tenors, saw Canadian rates rise as the swaps market priced in three 25bp rate cuts by the Bank of Canada by year-end. A similar dovish shift in Fed-dated OIS contracts supported U.S. front-end rates, with approximately 96bp of easing priced in for the year compared to 91bp at Monday’s close. By shortly after 3pm New York time, front-end Treasury yields had fallen by about 7bp in a bull-steepening move, widening the 2s10s spread by more than 1bp on the day. The 10-year yield ended around 3.81%, down roughly 6bp. Most of the movement occurred during the U.S. morning, with additional gains in the afternoon. The investment-grade credit new-issue slate featured a significant $10.5 billion bond sale from Kroger, though hedging flows appeared to have little impact. Open interest in futures, or the amount of risk held by traders in long or short positions, peaked at a record of nearly 23 million 10-year note futures equivalents last week, according to CME Group Inc. data.

Commodities: Gold hit a record high of over $2,520, driven by expectations of less restrictive monetary policies and geopolitical concerns. Disinflation signs in the US have raised hopes that the Federal Reserve might lower interest rates. U.S. WTI crude oil futures fell to $74.04 per barrel, down 0.44%, as Israel's steps towards a Gaza ceasefire eased supply worries, and China's economic weakness weighed on demand. Brent Crude futures also declined to $77.20 per barrel, down 0.59%. Copper futures stayed above $4.1 per pound, recovering from a five-month low, as markets evaluated weak demand from top consumers.

FX: With markets sideways ahead of the key events at the end of the week (PMIs and Powell at Jackson Hole), the US dollar continued its decline. The Swedish krona gained despite a dovish cut from the Riksbank because market has fully priced in the extent of easing from Sweden’s central bank. The gains in Japanese yen could have been a large driver of US dollar weakness, and these came on the back of Bank of Japan paper that signaled more rate hikes remain on the table. Softer Canadian inflation continued to put CAD on the backfoot among the major currencies, while softer equities also pushed Australian dollar and the British pound towards the weak end of the pack, albeit still ending the day higher against the US dollar. The British pound, in fact, rose past the big 1.30 level against the US dollar, rising to its highest levels in a year. The Euro also went past 1.11 against the US dollar.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.