Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: China Caixin Services PMI Final (Jul), UK/EZ/US Services & Composite PMI Final (Jul), US ISM Services PMI (Jul), EZ Producer Prices (Jun)

Earnings: Palantir, BioNTech, Tyson, Lucid

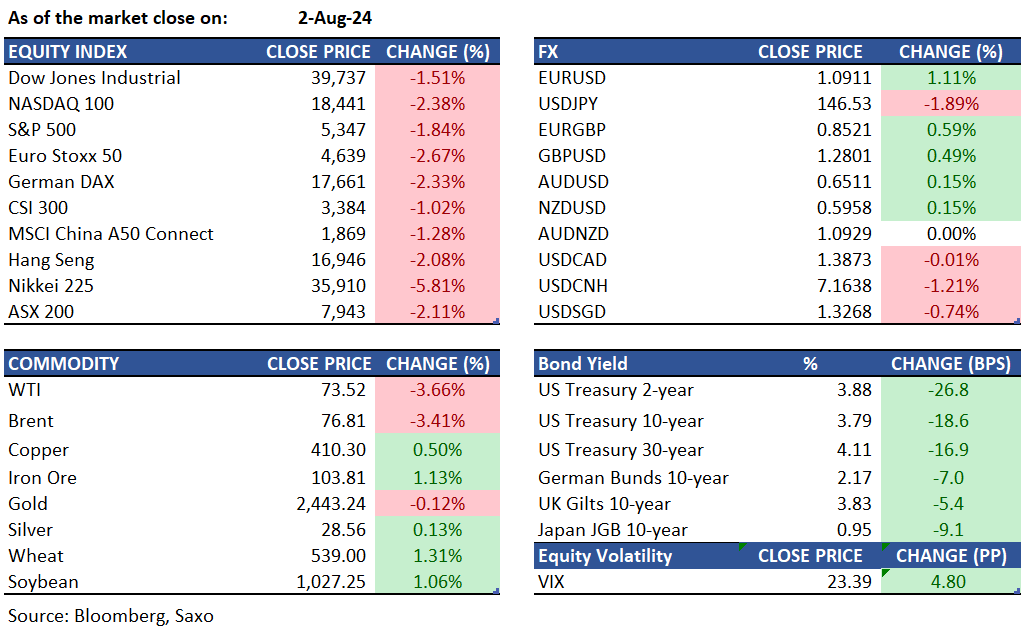

Equities: US stock futures dropped significantly on Monday, continuing last week's selloff amid growing fears of a US economic downturn. The Dow fell 2.1% last week, ending a four-week winning streak. The S&P 500 and Nasdaq 100 also declined by 2.06% and 2.38%, respectively, marking their third consecutive weekly drops. The Nasdaq 100, heavily weighted with tech stocks, is now down over 10% from its record high last month, entering correction territory. In Japan, the Nikkei 225 is also down a further 7%, having already fallen more than 20% from the highs. Disappointing July job data on Friday heightened concerns that the Federal Reserve might be too late in cutting interest rates, potentially pushing the economy into recession. Investors are now focused on US services PMI data and a speech by San Francisco Fed President Mary Daly for more insights. Additionally, markets will watch Apple closely after Warren Buffett’s Berkshire Hathaway sold nearly half its stake in the company.

Fixed income: On Friday, Treasury debt saw its largest gain of the year after July's employment data came in weaker than expected, causing traders to anticipate additional Federal Reserve rate cuts both this year and next. Leading Wall Street banks adjusted their forecasts, with some predicting a half-point rate reduction at the September meeting, or possibly sooner. Fed-dated OIS contracts showed a higher probability of a 50 basis point cut in September over a 25 basis point cut, closing the session with 44 basis points of easing priced in. Interest rate futures volumes surged, especially in fed funds futures, as traders bet on more Fed rate cuts, including the possibility of action before the next scheduled policy announcement on September 18. Yields plummeted, pushing the 2-year and 5-year yields to their lowest levels since May 2023, while the 10-year yield dropped to 3.79%, its lowest point since December. Yield premiums on Asian investment-grade dollar bonds widened by 6.4 basis points on Friday, their largest one-day increase since the US mini-banking crisis in March 2023. Similarly, US investment-grade credit spreads widened by a comparable margin, nearing their year-to-date high reached in January.

Commodities: Gold fell by 0.12% to $2,443 per ounce, reversing from earlier highs due to midday selling pressure. Initially, prices had risen due to a drop in Treasury yields and the US dollar, influenced by expectations of aggressive rate cuts. Oil prices also declined, with WTI crude dropping by 3.66% to $73.52 per barrel, and Brent Crude falling by 3.41% to $76.81 per barrel, amid concerns over slowing demand. Nymex natural gas prices decreased by 4.10% this week, settling at $1.9670 per mBtu.

FX: The US dollar slumped on Friday, closing the week down by over 1%, with the Federal Reserve keeping the door to a September rate cut open as US economic data continued to weaken. Gains were led by the Japanese yen which was up 4.7% in the week on the back of a hawkish BOJ pivot complementing the Fed’s dovish tilt. Other safe-havens such as Swiss franc and Gold also gained. Meanwhile, activity currencies Australian dollar and British pound were the weakest in the G10 FX space, with the latter also impacted by the Bank of England’s rate cut which was not fully priced in by the markets. US ISM services data out today will be in focus after the manufacturing PMI and jobs data last week resulted in risk-off moves.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.