Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

Saxo’s Quarterly Outlook is out and can be accessed here.

The title is Sandcastle economics reflecting that the economy and financial markets look pretty with resilient growth and equities at an all-time high. We expect favorable market conditions to continue in Q3, but sandcastles are naturally fragile and thus our clients should be aware of the potential risks lurking around the corners ranging from geopolitics, US election in Q4, unsustainable fiscal trends, and demographics longer term.

In this Q3 Outlook, you can get our take on why European equities and short-duration quality bonds look interesting. You can also read why energy commodities may come in focus and where to look within forex.

In the news:

Macro:

Macro events: UK General Election, ECB Monetary Policy Minutes, US Fed’s Balance Sheet

Earnings: N/A

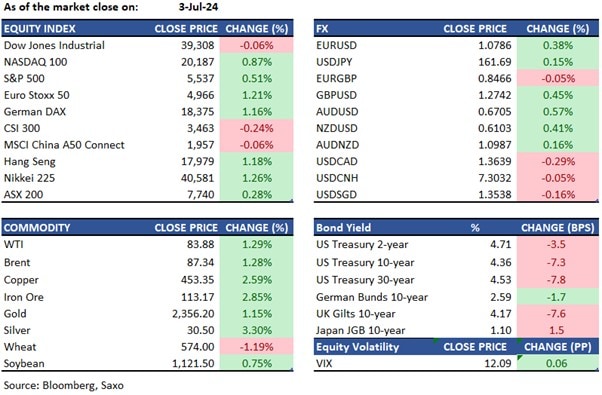

Equities: U.S. stocks hit new records with the S&P 500 closing above 5,500 for the first time and Tesla's (TSLA) 10% rise boosting the Nasdaq to fresh highs. The Nasdaq Composite advanced 0.8%, ending near 18,028. The rally was supported by a decline in Treasury yields after Federal Reserve Chair Jerome Powell noted that inflation is decreasing. U.S. markets will have a shortened session on Wednesday and will be closed Thursday for the Fourth of July. European and Asian markets also saw gains, with notable increases in the Nikkei, Hang Seng, and German DAX indices.

Fixed income: 10-year treasury yields dropped to 4.35% from a three-week high of 4.46%, driven by economic data that increased expectations for a Fed rate cut this quarter. ISM data showed the largest decline in US services sector activity in four years for June, and the sector's inflation rate slowed more than expected. The ADP report also revealed fewer private sector jobs added than anticipated, and continuing unemployment claims rose for the ninth straight week to their highest level since 2021. Despite positive JOLTS job openings and Challenger job cuts, the data indicated the labor market is starting to feel the effects of higher interest rates. The market generally expects the Fed to make the first of two 25bps rate cuts this year in September.

Commodities: West Texas Intermediate (WTI) remained steady near a two-month high due to indications of a significant drawdown in U.S. crude stockpiles. Silver prices climbed above $30 per ounce, marking their fifth consecutive session of gains amid expectations of increased demand for the metal in renewable energy expansion. Meanwhile, gold rose to $2,360, its highest level in a month, benefiting from a decline in the dollar and Treasury yields following new data that bolstered expectations for a Federal Reserve rate cut in September.

FX: The USD weakened across the board, with the Euro trading above 1.08, the GBP above 1.2770, and the AUD above 0.67. This decline was driven by increasing expectations of a Fed rate cut in September following disappointing economic data. While economic data in the Eurozone met expectations, President Lagarde noted that there was insufficient evidence to suggest that inflation is diminishing. JPY dropped to its lowest level since 1986, nearing 162 per dollar, due to interest rate differences with the US and potential for a second Trump presidency. The Bank of Japan's reluctance to change monetary policy and rising import costs are also factors.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration