Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Australia CPI (May), Germany GfK Consumer Sentiment

Earnings: Paychex, General Mills, UniFirst, Micron, BlackBerry, Levi’s, Concentrix, AeroVironment, HB Fuller, Jefferies, MillerKnoll, CULP, FranklinCovey

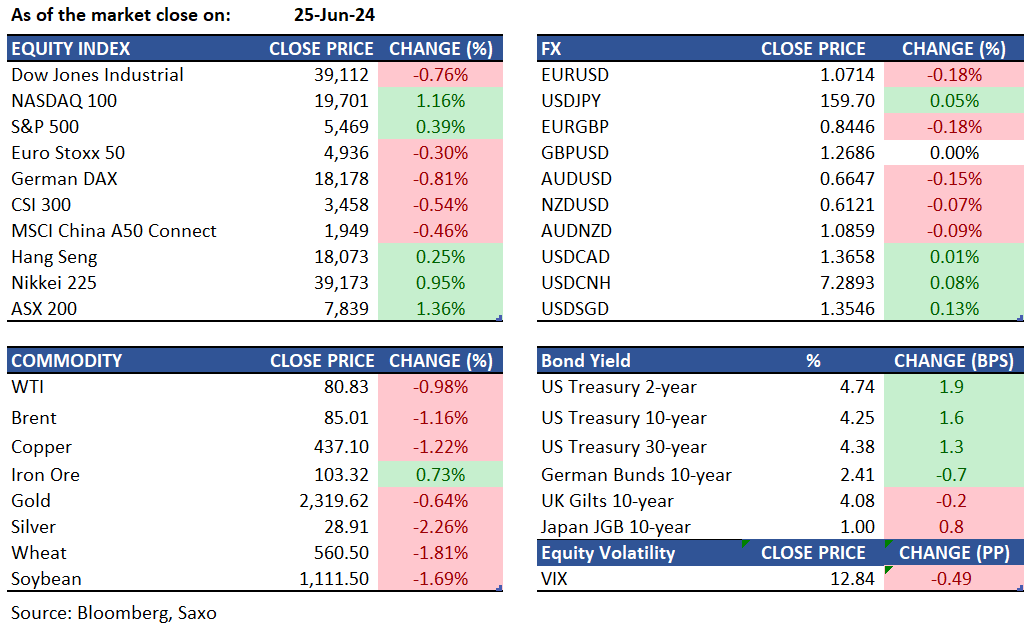

Equities: U.S. equities closed mixed, reflecting a notable reversal from recent trading sessions. The technology sector demonstrated resilience following a brief three-day downturn, with the Nasdaq advancing 1.25%. This period saw a temporary rotation into Small caps, Financials, and Energy, among other sectors. However, this rotation proved short-lived as semiconductors staged a robust recovery, with the SOX index rising 1.5%, driven by NVDA which surged over 6% after a 13% decline over the previous three days. META and GOOGL appreciated by 2%, while AAPL and AMZN posted gains of 1% each. Fedex is up 14% after reporting earnings post the close that was above expectations and said it would buy back $2.5b of its stock while Rivian rallied 50% post market after Volkswagen said it will invest $5 billion into the EV maker.

Fixed income: Treasuries ended Tuesday relatively unchanged after fluctuating within narrow ranges. Losses, driven by a significant selloff in Canadian bonds due to inflation data, were mitigated following strong demand in the US 2-year note auction. Earlier, yields hit session lows following a large block trade in Treasury futures. Yields were narrowly mixed, with short-term tenors slightly cheaper and long-term maturities marginally so. Traders in the US rates options market are increasingly backing a bold bet on the Federal Reserve’s interest-rate trajectory: a substantial 3 percentage points worth of cuts over the next nine months. In the past three sessions, options market activity tied to the Secured Overnight Financing Rate (SOFR) has shown a rise in positions that would profit if the central bank lowers its key rate to as low as 2.25% by the first quarter of 2025.

Commodities: Oil prices have dropped as investors await US inflation data, but they remain near a two-month high due to geopolitical tensions and expected summer demand. US oil and fuel stockpiles have decreased, and gasoline demand is rising as summer peak consumption approaches. Crude oil stockpiles are expected to have fallen by 3 million barrels, and gasoline stocks are also projected to have declined. Ongoing Ukrainian drone attacks on Russian oil infrastructure have also supported oil prices. Meanwhile, silver prices fell below $29 per ounce due to caution ahead of US inflation data, and precious metals are under pressure amid uncertainty about interest rate cuts. Copper also decreased to a 9-week low of 4.37 USD/Lbs.

FX: Recent hawkish comments from the Federal Reserve provided a modest boost to the US dollar across various currency pairs. The EURUSD pair tested but did not sustain a break below the 1.07 level due to supportive buying, and uncertainties related to the French elections continue to underpin. The GBPUSD pair remained under pressure, trading below 1.27. In the Japanese yen space, intervention concerns persisted, keeping USDJPY around 159.70. Both AUDJPY and GBPJPY hit record highs, with AUDJPY reaching 106.40 and GBPJPY touching 202.73 before pulling back slightly. The USDCAD pair resisted upward momentum and stayed below 1.3680, following an unexpected rise in Canadian inflation, which cast doubt on the likelihood of a rate cut by the Bank of Canada in July. Today, attention is on the AUDUSD pair, which is trading near its 21-day moving average of 0.6640, as the market awaits key inflation data from Australia.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.