Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: EZ/UK/US Final Manufacturing PMI (Sep), EZ Flash CPI (Sep), US ISM Manufacturing PMI (Sep), US JOLTS (Aug), Mainland China and Hong Kong market holiday.

Earnings: Paychex, McCormick, AcuityBrands, Nike

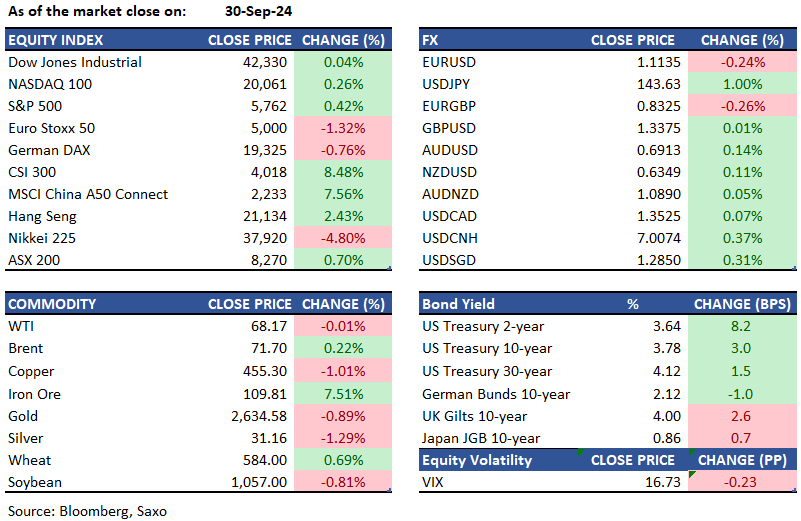

Equities: US stocks ended Monday on a positive note as investors processed comments from Fed Chair Powell. The S&P 500 reached a record high, gaining 0.4%, while the Nasdaq also rose by 0.4%. The Dow Jones saw a slight increase. Speaking at the National Association for Business Economics, Powell highlighted that the Fed does not adhere to a fixed policy path but indicated that two quarter-point rate cuts could still occur this year if economic conditions align with expectations. Investors are also preparing for significant economic data releases this week, including the jobs report, JOLTS, and ISM manufacturing and services PMIs. The probability of a 50bps rate cut in November is currently 35%, down from over 50% the previous week. Materials and consumer discretionary sectors led the declines. Among megacaps, Apple (2.2%), Microsoft (0.5%), and Alphabet (1.2%) saw gains, while Nvidia (-0.1%) and Amazon (-0.9%) experienced losses. SMCI will begin trading post 10-for-1 stock split tonight.

Fixed income: Treasury losses deepened after Fed Chair Powell indicated interest rates would be reduced "over time" and reiterated the strength of the US economy. This led to a slight adjustment in Fed-dated swaps, reducing expectations for easing in upcoming policy meetings. Earlier weakness in Treasuries followed a decline in bunds after ECB President Lagarde expressed confidence in controlling inflation, which will be considered at the ECB's October meeting. Treasury yields had risen by up to 9 basis points at the front end and around 2.5 basis points at the long end. The 2s10s and 5s30s spreads flattened by 4.5 and 5 basis points, respectively. US 10-year yields closed near the day's highs at approximately 3.795%. Most losses occurred late in the session following Powell's comments. Fed-dated OIS adjusted to price in 33 basis points of rate cuts for November, down from 37 basis points, and 70 basis points for the remaining two meetings this year, down from 76 basis points.

Commodities: Gold prices fell by 0.89% to $2,634, and silver dropped by more than 1.2% to near $31 per ounce, as investors reacted to Fed Chair Jerome Powell's remarks. Brent crude oil futures fell by 0.2% to $71.7 per barrel, ending September with a 9% decline. WTI crude oil futures remained flat at $68.17 per barrel, concluding the month with a 7% decline. Both were affected by strong supply prospects, weaker demand, and Middle East tensions. Oil price forecasts were reduced for the fifth consecutive month, with analysts citing weaker demand and uncertainty over OPEC’s plans. Despite geopolitical risks, prices are expected to remain under pressure. U.S. natural gas futures increased by about 1% to a 15-week high, settling at $2.923 per mmBtu, marking a 37% rise for the month—the largest monthly gain since July 2022. Iron ore prices jumped 7.51% for the fifth consecutive session on Monday, buoyed by China's latest property stimulus and a series of monetary easing policies that enhanced the demand outlook for the essential steelmaking ingredient.

FX: The US dollar traded higher as Fed’s Chair Powell offered a pushback on aggressive market expectations of rate cuts. However, greenback ended September with a loss of over 3%, and focus now turns to JOLTs job openings today or the ISM manufacturing print to get a sense of labor market and economic activity that will be the key drivers of the pace of rate cuts from here. The Japanese yen led the losses against the US dollar, particularly as markets erased the knee-jerk reaction to PM Ishiba’s nomination from Friday and BOJ’s summary of opinions this morning also highlighted a patient approach from the BOJ on raising rates further. The euro remains in focus as ECB’s easing expectations continue to be re-assessed after disinflation and growth weakness are expected to bring another rate cut in October. Activity currencies Aussie dollar and kiwi dollar outperformed but seen losing momentum as China goes on Golden Week holiday. For more on our FX views, read the Weekly FX Chartbook.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.