Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Japan Market Holiday (Autumnal Equinox); EZ, UK & US Flash PMIs (Sep), US Chicago Fed National Activity Index (Aug)

Earnings: AAR, RedCat

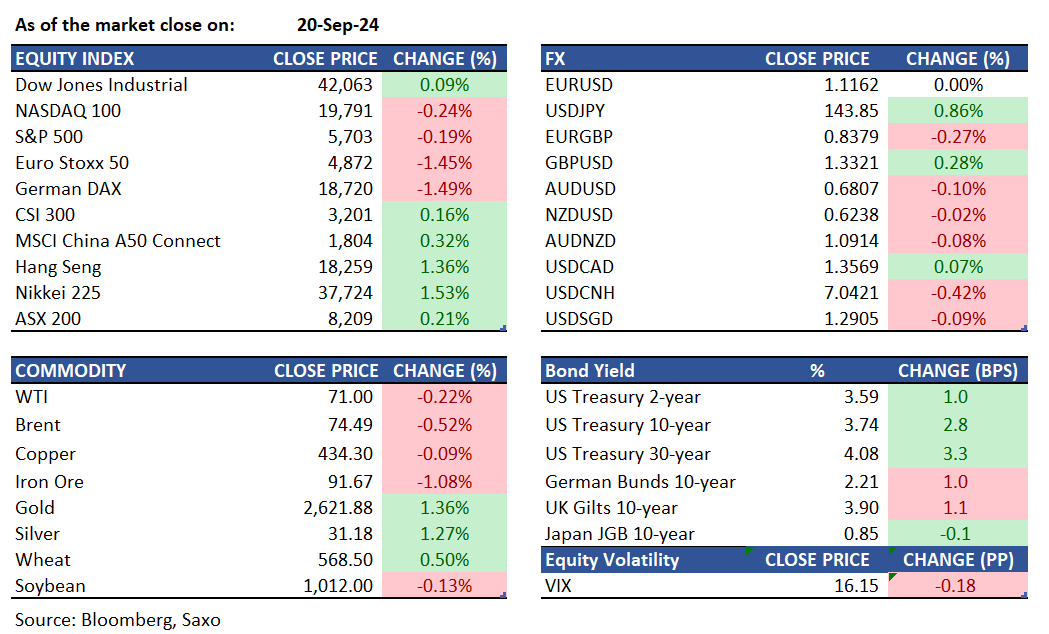

Equities: US stocks closed a volatile session mixed on Friday as uncertainty lingered after the previous session’s rally, driven by the Federal Reserve's significant interest rate cut. The S&P 500 and Nasdaq slipped 0.2% and 0.3%, respectively, while the Dow Jones rose by 36 points, extending its record close from the day before. Federal Reserve policymakers had differing opinions on inflation: Governor Christopher Waller supported the half-point rate cut due to favorable inflation data, whereas Governor Michelle Bowman, the lone dissenter, cautioned it might signal a premature victory over inflation. Among individual stocks, FedEx plunged 15.2% after weak earnings and a lowered revenue forecast, while Nike shares surged 6.9% following the appointment of Elliott Hill as the new CEO. CrowdStrike surged 8% after Piper Sandler analyst Rob Owens maintained an overweight rating on the stock with a $290 price target. Additionally, Apollo offered to invest $5 billion in Intel, following Qualcomm's interest in acquiring the troubled chipmaker.

Fixed income: Treasuries ended Friday with mixed results. Front-end yields were slightly richer, while longer-dated yields were cheaper, led by the 30-year yield rising by 2 basis points. Morning futures block trades pressured front-end tenors, but the curve steepened after Fed’s Waller suggested a 50 basis point cut might be warranted if the job market worsens. 2-year yields were richer by around 1 basis point, with the 2s10s and 5s30s spreads steeper by about 2 basis points. The 10-year yield, around 3.72%, was cheaper by about 1 basis point, similar to increases in UK and German 10-year yields. Waller’s comments spurred a recovery in the front end, re-steepening the curve. He also indicated that too-low inflation could justify a 50 basis point move. Hedge funds increased their net short position in Treasury futures in the week ended September 17, adding about 300,000 10-year note contracts, while asset managers increased their net long by about 134,000 10-year equivalents, according to CFTC data. The average junk bond yield fell to 6.96% on Thursday, its lowest since April 2022, prompting companies to continue issuing debt.

Commodities: Gold prices surged 1.3% to a record $2,621.88, driven by expectations of U.S. interest rate cuts and Middle East tensions. This marks a 26% increase in 2024, the highest annual rise since 2010. U.S. natural gas futures rose ahead of October contract expiration, with the October contract up 3.7% to $2.434/mmBtu and November delivery up 4.8% to $2.719/mmBtu, as focus shifts to winter demand. Oil prices dipped slightly with WTI crude fell 0.22% to $71.92 per barrel, while Brent Crude dropped 0.52% to $74.49 per barrel. Baker Hughes reported the U.S. rig count decreased by 2 to 588, with oil rigs unchanged at 488, gas rigs down 1 to 96, and miscellaneous rigs down 1 to 4.

FX: The US dollar faced its third consecutive decline last week as the Federal Reserve cut rates by 50bps. However, the Japanese yen underperformed with over 2% decline against the US dollar as the Bank of Japan went back on its hawkish rhetoric by sounding cautious on further hikes. Markets were also in a risk-on mode after the Fed’s jump rate cut last week came with an upbeat view on the economy, signaling short-term goldilocks as discussed here. Swiss franc also ended the week lower as a result, while activity currencies such as Norwegian krone, Australian dollar and British pound led the gains. Today’s key watch will be the flash PMIs, especially the variance between the Eurozone and UK, with the euro now trading below the key 0.84 levels again the sterling, a level that has held up since 2022.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.