Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: RBA Policy Announcement; German Ifo (Sep), US Consumer Confidence (Sep), Richmond Fed (Sep), Fed’s Bowman, BoJ's Ueda, BoC's Macklem

Earnings: AutoZone, KB Home and Thor Industries

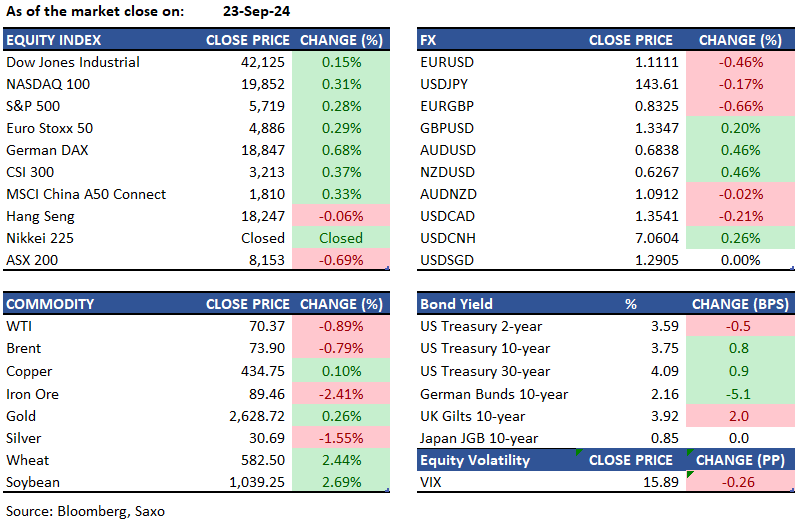

Equities: The S&P 500 rose by 0.3%, while the Dow Jones gained 0.1%, both achieving new record highs on Monday after last week's rally driven by the Fed's first rate cut in four years, set at 50 basis points. The Nasdaq 100 also edged up by 0.3%. Investors closely analyzed comments from several policymakers to understand the rationale behind the Fed's significant rate cut. Fed officials, including Raphael Bostic, Neel Kashkari, and Austan Goolsbee, expressed support for the recent cut and hinted at the possibility of further reductions in the coming months. Among stocks, Intel shares jumped 3.4% following reports of potential multibillion-dollar investments from Apollo Global Management. Tesla climbed 4.9% as investors anticipated the upcoming robotaxi launch and third-quarter sales figures. However, concerns over economic growth persist, with US manufacturing data hitting a 15-month low and job market indicators showing signs of weakening.

Fixed income: Treasuries ended with minimal changes, and the yield curve steepened after volatile trading during U.S. hours driven by Federal Reserve commentary and a sharp decline in oil prices. Initially, yields rose when two Fed officials indicated a high threshold for further half-point rate cuts. The market rebounded as oil prices plunged, supported by haven demand before Iran’s president signaled a willingness to ease tensions with Israel. Treasury yields had returned to nearly unchanged levels from the belly to the long end, with 2-year yields declining by about 1 basis point, which steepened the 2s10s spread by just over 1 basis point for the day. Fed swaps showed little price movement, continuing to price in around 75 basis points of rate cuts over the two remaining policy meetings this year.

Commodities: WTI crude oil futures fell 0.89% to $70.37 per barrel, and Brent Crude futures declined 0.79% to $73.90 per barrel, influenced by concerns over weak demand from China and an unexpected slowdown in European manufacturing. The eurozone reported a surprising contraction in business activity, with stagnation in services and further deterioration in manufacturing output. Conversely, Nymex front-month natural gas surged 7.4% to $2.613 per mmBtu, reaching its highest level in nearly three months. Gold prices hit new record highs, rising 0.26% to $2,628.72, while silver dropped 1.55% to $30.69. Iron ore prices with 62% iron content fell below $90 again due to demand uncertainties and high inventories. Recent economic reports from China continue to indicate a challenging recovery.

FX: The relative weakness in European PMI was discussed in the Weekly FX Chartbook yesterday and turned out to be the key theme in FX markets yesterday. This made euro the underperformer among the major currencies as markets increased the odds of an October ECB rate cut. Euro’s weakness was most pronounced against the activity currencies kiwi dollar and Australian dollar, and it also fell over 0.6% against the British pound amid the odds of diverging economic and policy dynamics. Germany’s Ifo will be in focus today given risks of a recession signaling need for faster rate cuts from the ECB. The weakness in euro also filtered through to other European currencies, particularly the Scandies. The Australian dollar will be on in focus today with the RBA expected to leave rates unchanged and potentially keep a hawkish stance with risks of a recession still at bay. China’s central bank has also cut policy rates yesterday, and a press conference from the PBoC is eyed today, given more stimulus measures could further boost commodity currencies.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.