Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Republican Convention; German ZEW (Jul), US Retail Sales (Jun), Canadian CPI (Jun), US NAHB (Jun), New Zealand CPI (Q2)

Earnings: Bank of America, Morgan Stanley, State Street, Interactive Brokers, Charles Schwab

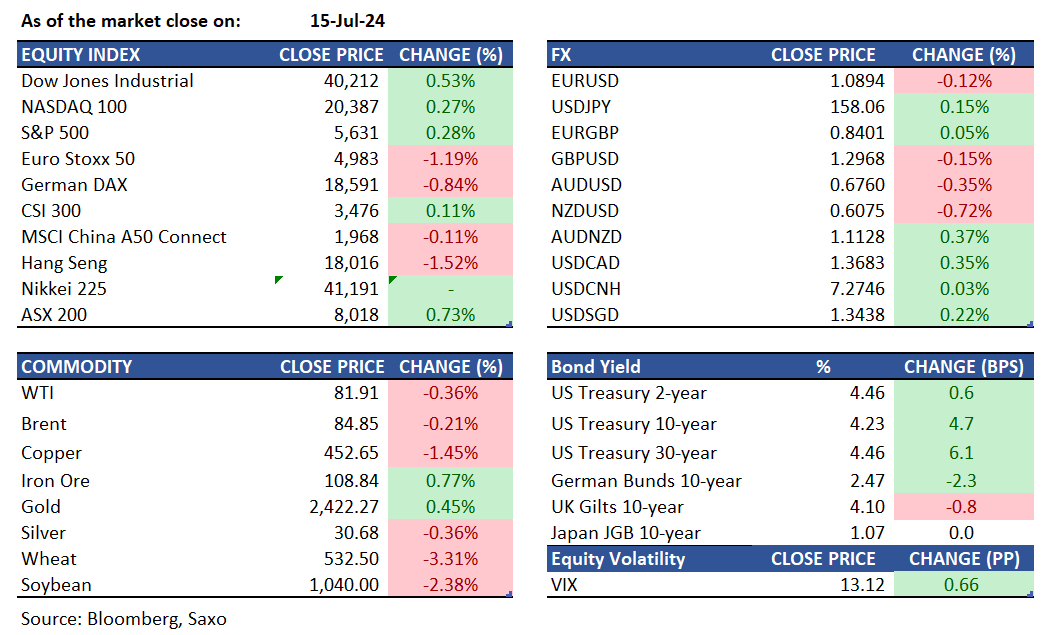

Equities: U.S. stocks traded higher throughout the day before a late selloff trimmed gains. The S&P 500 index hit an intraday high for the ninth consecutive day, underscoring strong market momentum. In July, the Nasdaq is up 5% (+22.5% YTD), while the Russell 2000 has risen 7% (+6% YTD). With only one negative day this month, high expectations are set for earnings season, particularly for chip makers and AI growth stocks. Improved odds for Donald Trump’s presidential bid lifted stocks and the dollar, reviving risk appetite. Yesterday Goldman Sachs gained 2.5% after reporting earnings that topped estimates on better-than-expected fixed income trading and debt underwriting.

Fixed income: The Treasury yield curve ended Monday significantly steeper, with long-end yields sustaining most of their increase following Donald Trump’s better election odds after an assassination attempt. Three- and six-month Treasury bill auctions saw diminished demand amid expectations for the Federal Reserve to cut interest rates sooner than anticipated. The Treasury successfully issued $76 billion in three-month bills at 5.195% and $70 billion in six-month bills at 4.985%. Swap markets are pricing in around 65 basis points of rate cuts for the December policy meeting—equivalent to two 25 basis point cuts and about 60% likelihood of a third cut.

Commodities: Gold hit $2,439 during trading session and closed at $2,422 on Monday, breaking its record high of $2,422 per ounce set on May 20. This increase followed comments from Fed Chair Jerome Powell, who suggested that the central bank might cut interest rates before inflation reaches 2%. Meanwhile, U.S. crude oil futures fell 0.36% to $81.91 per barrel, and Brent Crude futures declined by 0.21% to $84.85 per barrel. Natural gas futures dropped 7.3% to $2.158 per mmBtu, marking their lowest close since May 3. Wheat prices also decreased to $5.30 per bushel, the lowest since mid-March, due to an influx of newly harvested crops from the United States and Russia.

FX: Fed Chair Powell remained non-committal to a September rate cut, while the Trump Trade was in full display after the brutal violence against the former president over the weekend and the start of the Republican Convention yesterday. This saw the US dollar strengthen broadly with Scandie currencies Norwegian krone and Swedish krona leading the declines. The New Zealand dollar has also been on downtrend since the last RBNZ meeting that opened the door to a rate cut, and the Q2 CPI is out early tomorrow in Asia. Bank of Canada’s quarterly survey highlighted growing pessimism and Canada’s CPI is also due today, which will be key for whether the central bank cuts rates at the July meeting or not. Focus will also be on the US retail sales. The Euro remained resilience and the Chinese yuan also erased early losses in the aftermath of the Trump Trade. For more on our FX views and previews for ECB and UK data this week, go to our Weekly FX Chartbook.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.