Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Republican National Convention

Earnings: ASML, J&J, United Airlines, Alcoa, Elevance Health

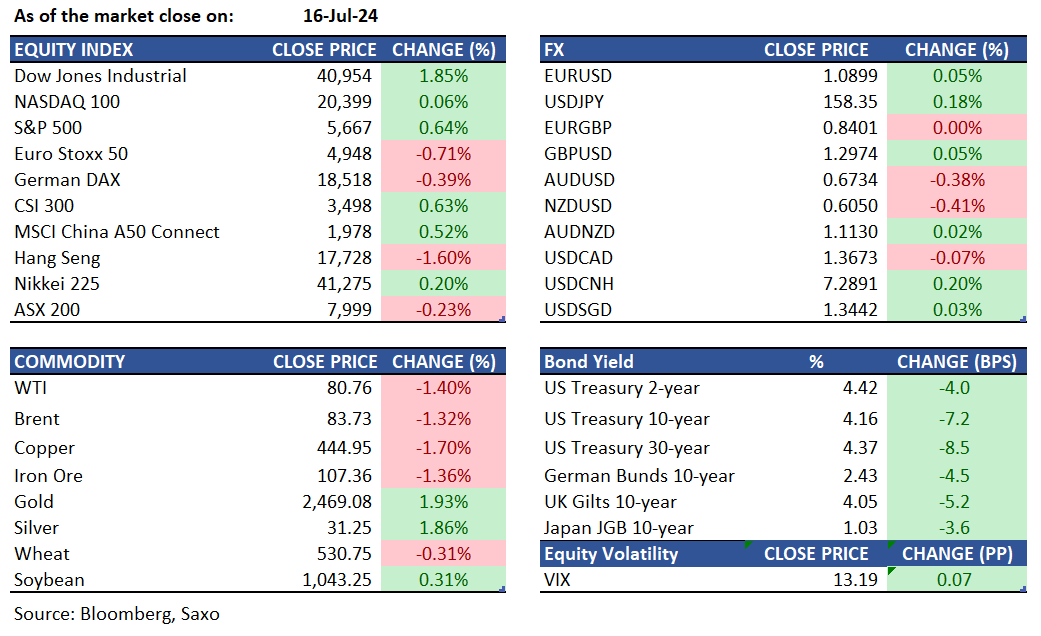

Equities: The S&P 500 increased by 0.6%, while the Dow Jones soared 1.85%, marking its second consecutive record close and its best performance since June 2023. The Nasdaq 100 inched up by 0.2% as investors moved from large-cap to small-cap stocks. Positive investor sentiment, driven by expectations of Federal Reserve rate cuts, overshadowed the minimal impact of retail sales data on risk appetite. Industrial stocks led the gains, pushing the Dow to an all-time high, with Caterpillar and Boeing rising 4.3% and 3.8%, respectively. In earnings news, UnitedHealth jumped 6.5% on better-than-expected results, boosting the Dow. Bank of America rose 5.3% on strong earnings and revenue, while Morgan Stanley gained 0.8% after surpassing Wall Street forecasts, thanks to robust trading and investment banking performance. On the downside, Charles Schwab fell 10.2% due to a 17% drop in bank deposits to $252.4 billion and a 6% decline in net interest revenue.

Fixed income: Treasuries advanced with long-end maturities leading the charge, fully recovering from the earlier decline triggered by robust June retail sales data. Yields ended near the day's lows, with long-end yields richer by up to 8 basis points. Futures block trades played a role in the rally, including a notable late-day purchase of 2-year note futures. Meanwhile, demand for the Federal Reserve’s overnight reverse repurchase agreement facility remained steady on Tuesday, indicating that balances may have stabilized despite upward pressure on funding rates.

Commodities: Gold surged 1.93% to a record high of $2,469 per ounce on Tuesday, driven by expectations that the Federal Reserve may cut U.S. interest rates in September following recent economic data. In contrast, Brent crude oil futures fell to a four-week low of $83.72, and WTI dropped 1.4% to $80.76, marking the third consecutive session of losses due to concerns over reduced demand from China. China's economy, the world's second-largest, grew at its slowest pace since early 2023, with Q2 growth at 4.7%, below the 5.1% forecast, amid property market challenges and job market uncertainties. Copper also declined by 2% to $4.4358 per USD/Lbs.

FX: The dollar trimmed most of its gains following a stronger-than-expected June retail sales report. The yen experienced its largest intraday drop against the dollar in over two weeks, with USDJPY climbing as much as 0.5% intraday, the most since July 1, reaching a high of 158.86 as Japan returned from a market holiday. EURUSD was flat at 1.0893, and GBPUSD remained little changed at 1.2962, both pairs recovering from earlier declines. USDCAD was little changed at 1.3679. Earlier, the loonie had fallen to its weakest intraday level since July 2 after Canada’s June CPI indicated a deceleration in inflation. Meanwhile, the New Zealand dollar rose following mixed June-quarter inflation data, which may temper expectations that the nation's central bank will cut rates as soon as its August meeting.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.