Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Richmond Fed index, ECB’s Lane

Earnings: Tesla, Google, Spotify, Coca Cola, Texas Instruments, Lockheed Martin, Visa

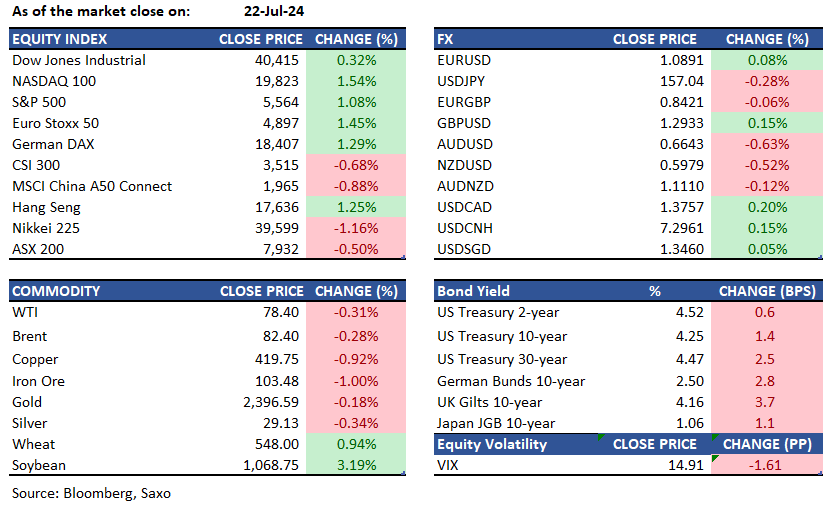

Equities: U.S. stocks saw significant gains to start the trading week, breaking a three-day losing streak for the S&P 500 and Nasdaq 100, which gained 1.08% and 1.54% respectively. Semiconductor stocks (SOX) rallied nearly 4%, rebounding from last week's decline, ahead of a busy earnings week with Tesla and Google reporting tonight. No major economic data was released today, but U.S. GDP report is expected on Thursday and June PCE on Friday. Technology and Consumer Discretionary sectors led gains with NVDA up 4.7%. In China, the PBoC cut both 1Y and 5Y loan prime rates by 10bps to support the economy, resulting in Hang Seng closing 1.25% higher.

Fixed income: Treasury yields climbed by 1 to 3 basis points on Monday, hitting their highest levels in over a week. Most of this movement occurred a few hours after the US equity market opened, coinciding with an unexplained surge in trading volume for 10-year, Bond, and Ultra Bond futures contracts. This activity reversed an earlier slight bull-flattening that had been spurred by the weekend's turmoil in the US presidential race. Investors showed a strong preference for Treasury's three-month bill auction, as traders reduced their expectations for Federal Reserve interest rate cuts this year. Treasury sold $76 billion in three-month bills at a yield of 5.19% and $70 billion in six-month bills at 4.99%.

Commodities: WTI crude oil futures fell to $79.78 per barrel, down 0.44%, while Brent crude dropped to $82.40 per barrel, down 0.28%. Gold prices decreased by 0.18% to $2,396.59, and silver prices declined by 0.34% to $29.13. Last week, gold hit a record high of $2,483.60 per ounce on expectations of interest rate cuts. US natural gas futures surged by more than 4%, reaching a one-week high above $2.2/MMBtu. This rebound follows an 8.6% decline the previous week and is attributed to Freeport LNG resuming shipments after Hurricane Beryl, along with forecasts of hot weather.

FX: The US dollar started the week lower amid news of President Biden stepping out of the presidential race, but recovered through the day to end nearly unchanged. Risk-on currencies such as the Norwegian krona and the Australian dollar underperformed safe haven’s such as the Japanese yen and the Swiss franc. The Chinese yuan was unable to gain despite the unwinding of some of the Trump Trades as China’s central banks cut to short-term interest rates weighed on the currency. To read more on our FX views, go to the Weekly FX Chartbook.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.