Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: NZ May Business, NZ Manufacturing PMI, NZ May Food Prices, Japan April F Industrial Production, BOJ’s Kazuo Ueda speaks, Hong Kong 1Q Industrial Production & PPI, BOJ Rate Decision. China May New Lending, Money Supply

Earnings: CarMax, FactSet

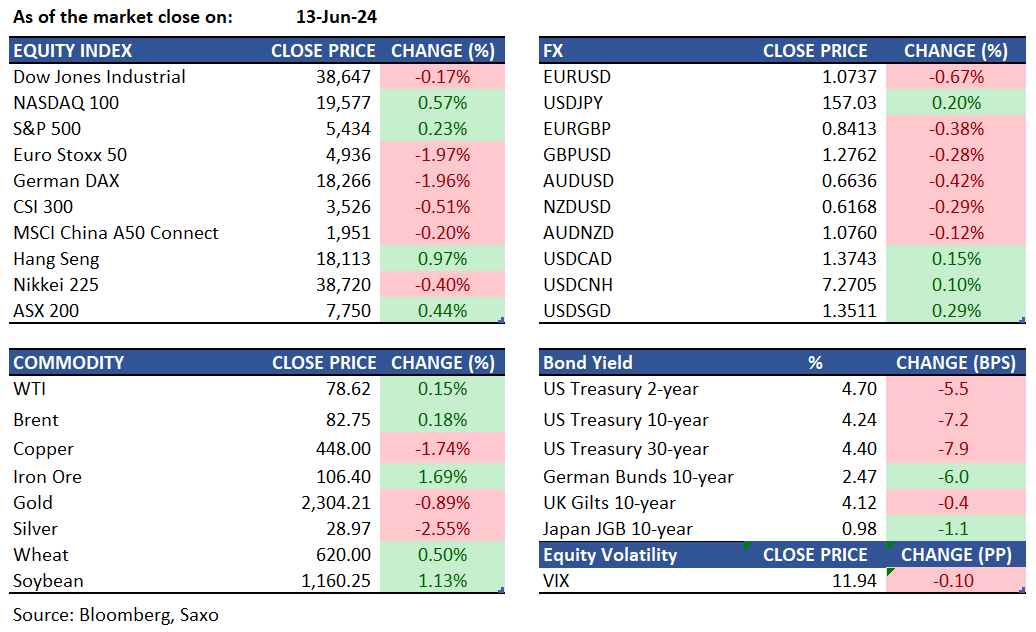

Equities: Equity markets showed little change on Thursday, with the S&P 500 and Nasdaq slightly up and the Dow dropping over 60 points. The S&P 500 reached a record high above 5,400 on Wednesday due to positive sentiments to the latest consumer price inflation report. Technology, real estate, consumer staples, and utilities performed well, while small-caps and industrials lagged. Chip stocks in general helped to lead the markets higher. Markets in general are still holding/ trading near record highs despite the US central bank dialing back rate cut expectations for this year.

Fixed income: Money-market fund assets reached a new high, with approximately $28 billion entering US money-market funds in the week ending on June 12. Total assets increased from $6.09 trillion to $6.12 trillion, surpassing the previous record set in April. Meanwhile, 10-year Treasury yields dropped by seven basis points to 4.24%. The European Union's bonds were negatively affected as expectations of their imminent inclusion in important sovereign benchmarks suffered a setback, leading to increased political uncertainty in France. In Japan, bond futures advanced ahead of the Bank of Japan's upcoming policy announcement, with the benchmark yield decreasing by 2 basis points to 0.965% on Thursday. Economists anticipate the BOJ to maintain its benchmark interest rate and reduce the pace of bond purchases from around ¥6 trillion per month. Additionally, the 10-year yield in New Zealand dropped by 4 basis points to 4.63%, while the yield on Australia's 10-year debt fell by 5 basis points to 4.14%.

Commodities: Oil price surged as indications of easing U.S. inflation, potentially leading to a Federal Reserve interest rate cut. However, the market's gains were tempered by a surprising 3.73 million barrel increase in US crude stockpiles, as well as larger-than-expected increases in US gasoline and distillate stocks. The ongoing situation in Gaza, with ceasefire negotiations and Red Sea shipping attacks, is also being closely monitored. Silver prices fell to a one-month low of $29 per ounce due to a more hawkish stance from the Federal Reserve, despite weaker inflation data. The impact was offset by recent dovish actions from major central banks. The US imposed 50% tariffs on Chinese imports of solar cells, impacting the silver industry, but strong demand in the Chinese market limited further declines in silver prices.

FX: The dollar, along with other safe-haven currencies, strengthened as market sentiment turned cautious following a relatively hawkish Federal Reserve dot plot and concerns about the French election weighing on the euro. The Bloomberg Dollar Spot Index rose by 0.1% after initially dropping to the day's low following PPI data. EUR/USD declined by 0.7% to 1.0739, approaching the weekly low of 1.0720 due to cross-related sales and downside option purchases after significant expiries at 1.0770-80 expired. USD/JPY increased by 0.1% to 156.93, with attention focused on the Bank of Japan's policy decision on Friday. Overnight volatility surged to approximately 15%, the highest level since early May but still below recent meeting dates. GBP/USD decreased by 0.3% to 1.2760. USD/CAD was up by 0.2% at 1.3746, as Deputy Governor Sharon Kozicki defended the use of quantitative easing and extraordinary forward guidance during the pandemic. AUD/USD fell by 0.4% to 0.6638 due to weakness in metal prices and the offshore yuan.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.