Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

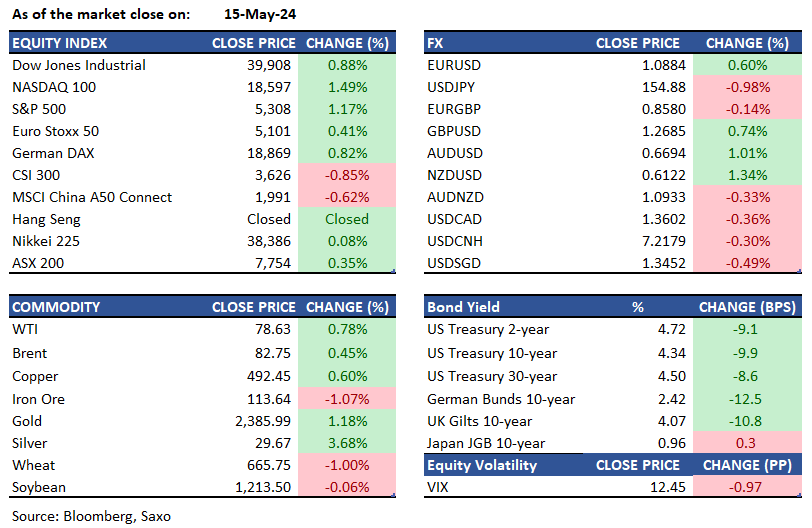

Equities: US stocks surged on Wednesday, with all three major averages reaching record highs after soft CPI readings. The S&P 500 rose by 1.2%, closing above 5,308 for the first time, while the Dow gained 349 points, and the Nasdaq 100 advanced by 1.4%. The S&P 500 has closed at a record high 23 times this year, the Dow Jones 18 times, and the Nasdaq 8 times. April's inflation data showed a slowdown in both headline and core annual inflation, and retail sales unexpectedly stalled, raising expectations of potential interest rate cuts by the Fed in September. Nvidia surged by 3.6%, and Apple and Microsoft each rose by over 1.2%. Dell soared by 11.2%, with its market cap surpassing $100 billion. In contrast, Boeing declined by 2% following reports of the Justice Department accusing the company of violating a prior agreement related to the 737 Max crashes. GameStop and AMC shares fell as the meme stock rally took a pause. Chinese EV stocks (NIO, XPEV, LI) initially weakened due to additional China tariff news from the White House. Singapore Airlines (C6L) achieved a record annual profit and raised its dividend on Wednesday, driven by robust travel demand in North Asia. Grab Holdings increased its full-year profit outlook, highlighting the positive impact of recent cost-cutting initiatives and the expansion of its ride-share and food delivery operations.

FX: The dollar sold-off with US inflation cooled and providing some relief after three straight months of overshoot. The DXY index erased the gains since the last inflation print on 10 April and is now below the 200DMA at 104.35 with key test ahead at 104. Kiwi led the gains in H10 as NZDUSD rallied past 0.61 and AUDUSD rose to 4-month highs and now testing the 0.67 handle. Lower yields helped the yen as well, and USDJPY slipped below 155, although weak Q1 GDP report from Japan this morning erased some of the decline. Given concerns on US inflation are unlikely to cool and yields could remain choppy, it remains hard to expect a turnaround in the yen for now given its demand as a funding currency in carry trades. GBPUSD rose to 1.27 and EURUSD was well past 1.0850 to highs of 1.0888 last. CAD underperformed, as was noted in our inflation preview, with USDCAD down marginally to test the 1.36 handle.

Commodities: Investors have continued to be net sellers of gold exchange-traded funds (ETFs) this year, resulting in a 5.9% reduction in total holdings. Meanwhile, silver surged to a peak not seen since 2013 on hopes of a Federal Reserve shift, aligning with gold's increase. But the outlook for industrial metals remains cautious, as they often predict inflation trends. The Bloomberg Commodity Spot Index ascended to highest point since April 2023, complicating efforts by central banks to control inflation. US crude stockpiles have decreased for two consecutive weeks, marking the first such decline since March. Crude oil saw gains from robust demand and Middle East supply concerns, and investors wary of risk have turned towards precious metals like gold and silver, with copper prices also on the rise. A significant price disparity for copper between New York and other global commodity markets has disrupted the international copper trade, leading to a rush to acquire and deliver supplies to the United States.

Fixed income: Traders, expecting the Federal Reserve to lower interest rates, see over an 85% chance of a September rate cut following a US CPI report showing easing inflation. Concurrently, there's a growing belief the Bank of Japan may hike rates. The bond market rallied with the 10-year Treasury yield dipping to 4.34%, fueled by this rate cut anticipation and weaker retail sales data. The probability of a cut by September exceeds 80%, with July's chances around 25%. Inflation expectations have also moderated, as illustrated by the five-year break-even rate falling to a five-month low of 2.3%. As a result, bond yields are dropping across the board. Amidst this recalibrated economic outlook, bonds have regained much of the sharp declines experienced in April, when high inflation readings had led to a significant yield surge, casting doubts on rate reductions in 2024.

Macro:

Macro events: Australia Labour Market Report, US Housing Starts and Building Permits, US Jobless Claims, US Industrial Production, Fed’s Harker, Mester, Bostic, Barr

Earnings: Meituan, Siemens, Deutsche Telekom, Walmart, Copart, Applied Materials, Deere, JD.com, Baidu, Swiss Re, KBC Group

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.