Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

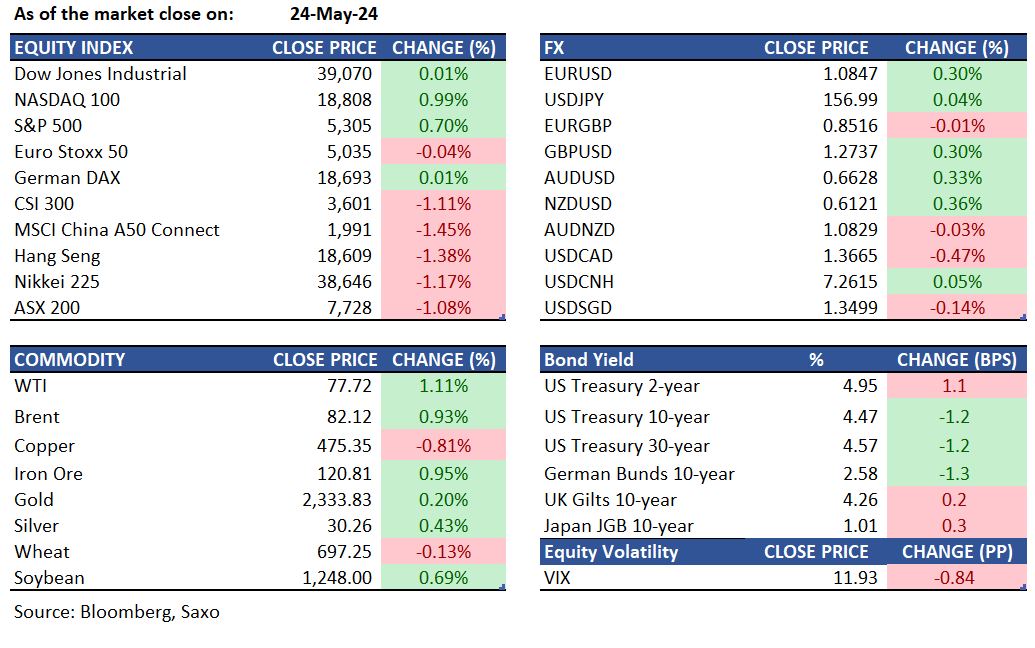

Equities: U.S. equities posted modest gains ahead of the holiday weekend amid thin trade volume and muted volatility. The University of Michigan Sentiment Index outperformance marginally lifted markets, despite a neutral Fear and Greed Index at 53. Notably, small caps recovered from prior losses, suggesting a shift in investor sentiment. Sector rotation saw Communications, Consumer Discretionary, and Utilities lead, while Health Care and Real Estate lagged. Fed rate adjustment expectations have readjusted, with a July cut now deemed unlikely, and a September cut hanging in balance with just a coin toss likely. Goldman Sachs has now deferred rate cut projections to September, aligning with less aggressive market expectations. During the final hour of the session, stock prices stayed close to their highs, with small-cap stocks showing strength and the Nasdaq 100 (+1.10%) performing strongly thanks to chip names like AMD (+3.7%) and Qualcomm (+4.2%). Looking ahead, the summer months are likely to bring a lull in trading activity, with investors keeping a keen eye on signals from the Federal Reserve as the pace of earnings growth decelerates. Over the past week, the Dow Jones Industrial Average saw a pullback of 2.3%, while the S&P 500 maintained its level, and the Nasdaq Composite gained 1.4%, marking its fifth consecutive week of gains.

FX: The US dollar closed the week marginally higher despite coming under pressure on Friday after easing price concerns from the UoM sentiment report boosted sentiment. AUDUSD was the weakest currency in the week, as it slipped from 0.67 handle but found support at 0.66, while NZDUSD performed much better on a hawkish RBNZ decision and remains above 0.61. No respite for JPY still as well and USDJPY was around 157 handle this morning despite Japanese 10-year yields hitting a 12-year high on Friday. Japan seemingly continued to push against excess FX volatility at the G7, but that remains insufficient to counter yen bears with carry trading remaining popular. EURUSD around 1.0850 as Eurozone inflation is eyed this week while GBPUSD was an outperformer last week as it climbed higher to 1.2740 as rate cut expectations were pushed out. GBPJPY was the most popular trade on Saxo’s platforms, as it rose to test a break above the 200-mark, the level from which it reversed in April following suspected intervention.

Commodities: Gold initially gained modestly but then traded mostly sideways, closing at $2,333. It had a 3% decline for the week, its worst in over five months, due to reduced optimism about potential rate cuts from the Federal Reserve and speculation about China reducing gold purchases. The Gold Fear and Greed Index remains in "Greed" territory but has decreased from previous weeks. In the oil market, July WTI crude futures ended a four-day losing streak, settling at $77.72, up 1.11%, while Brent crude settled at $82.12, up 0.93%. Weakness in WTI has been attributed to concerns about the Fed's stance on interest rates and its potential impact on economic growth and oil demand, as well as concerns about gasoline demand as the "driving season" begins. US nature gas futures dropped 6.18%. To read more about our commodity views, go to the Commodity Weekly article from Ole Hansen or this thematic podcast focusing on the trends in metals.

Fixed income: The yield on the 10-year U.S. Treasury note edged down by 2 basis points to 4.46% and yield curve flattened against both three months and two years. The Treasury Department is set to initiate a buyback program this Wednesday, targeting less liquid, older debt for the first time in decades. Come June, the Fed plans to decelerate its quantitative tightening efforts. These actions are expected to bolster a Treasury market that has been tumultuous, as investors recalibrate their rate cut forecasts amid enduring economic growth and tenacious inflation. This governmental intervention is anticipated to enhance market liquidity, building on the recent stabilization in Treasury trading.

Last week, the two-year U.S. Treasury note approached the high end of its monthly range with a yield near 4.95%, mirroring a mix of economic signals and Fed officials' readiness to maintain elevated rates. Even as some policymakers signal openness to further tightening if necessary, the derivatives market suggests such action is unlikely, which may prevent yields from surging. Looking ahead, swap contracts are pricing in a modest 32 basis point reduction in Fed rates throughout 2024, indicating market consensus for a mere quarter-point cut. This is a pullback from the 50 basis point expectation set after April's weaker inflation figures. The yield on Japan's 10-year government bonds closed the week at 1.005%, reaching a peak not seen since April 2012.

Macro:

Macro events: US and UK holiday, China Industrial Profits (Apr), Germany Ifo Survey (May)

Earnings: Agilent Technologies, Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Costco Wholesale, Dell Technologies, Dollar General, Heico, HP, Life Insurance Corp. of India, Marvell Technology, MongoDB, National Bank of Canada, Royal Bank of Canada, Salesforce, Veeva Systems, Zscaler

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.