Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: UK CPI, US Export & Import prices, Canada Housing Starts, Italy CPI

Earnings: Morgan Stanley, Abbott, Prologis, Kinder Morgan, PPG Industries, CSX Corporation, U.S. Bancorp, Discover Financial Services, Equifax

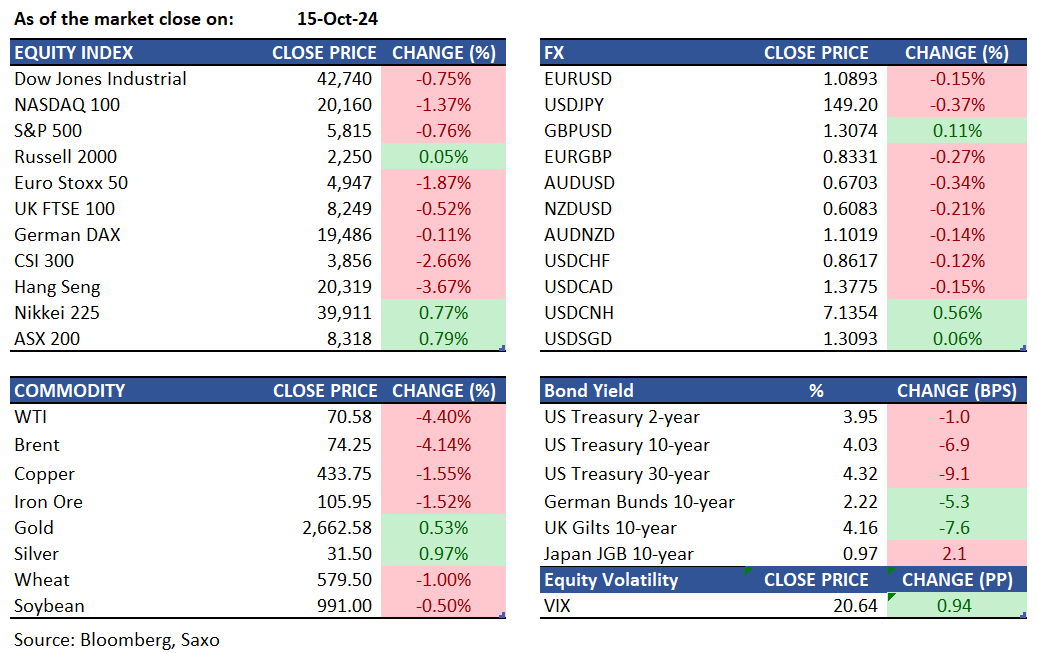

Equities: Wall Street saw a significant decline on Tuesday, largely due to weak earnings from ASML, which spurred a broad selloff in semiconductor stocks, and a sharp drop in oil prices that weighed on energy stocks. The S&P 500 dropped by 0.7%, the Nasdaq 100 fell by 1.2%, and the Dow declined by 324 points. ASML's shares plunged 16.5% after the company lowered its outlook, impacting other chipmakers such as Nvidia (-4.5%), Broadcom (-3.5%), AMD (-5.2%), and Intel (-3.3%). Energy stocks were also hit hard as Exxon Mobil (-3%) and Chevron (-2.7%) slipped following a sharp decline in oil prices. Additionally, UnitedHealth's shares tumbled 8.2% after it issued a weaker earnings forecast. On the other hand, Bank of America gained 0.5% due to stronger than expected third-quarter profits and revenue. Apple rose 1.1%, reaching a record intraday high of $237.49, as reports indicated robust demand for its previous models, boosted by the launch of the iPhone 16.

Fixed income: Treasuries ended with lower yields, led by long-end tenors dropping nearly 10 basis points. The decline was driven by gains in Canadian bonds due to benign inflation data. Block trades in Ultra Bond futures also contributed. The rally tightened the 2s10s spread by over 6 basis points and the 5s30s spread by about 5 basis points. The 10-year yield fell by 7 basis points to 4.03%, while Canada’s 10-year yield decreased by 9 basis points. Canadian bonds rallied on softer-than-expected September CPI data, with short-term interest-rate contracts pricing in around 44 basis points of easing by the Bank of Canada on October 23, up from 37 basis points on Monday. New Zealand bonds also gained after Q3 data showed easing inflationary pressures, with the yield on New Zealand’s 2-year note falling by 5 basis points to 3.87%.

Commodities: Gold prices rose to $2,662 and silver prices increased to $31.50, supported by declining Treasury yields as investors awaited key U.S. economic data for insights into the Federal Reserve's policy direction. The appeal of non-yielding assets like gold was bolstered by a drop in 10-year Treasury yields, which followed weak manufacturing data from New York. Meanwhile, WTI crude oil futures fell 4.4% to $70.6, and Brent crude oil futures decreased 4.1% to $74.2. This decline came after reports suggested that Israel might avoid targeting Iran’s oil infrastructure, easing fears of a significant supply disruption in the region. Israel indicated it may heed U.S. warnings and focus on military rather than energy targets in Iran, although tensions remain elevated.

FX: A Bloomberg index tracking the dollar climbed to session highs as Donald Trump defended his plans to significantly raise tariffs on foreign imports, citing trade with Mexico, Europe, and China. The Mexican peso dropped to session lows, with USDMXN rising 1.4% to 19.65. USDCAD reached a session high of 1.3839 after Canada’s CPI data came in below expectations, but then reversed nearly all its gains, ending a nine-day winning streak. GBPUSD edged up 0.1% to 1.3068 following data showing UK wages grew at the slowest rate in over two years during the summer. New Zealand’s dollar fell to a two-month low against the greenback after Q3 inflation data missed the median estimate in a Bloomberg survey. AUDUSD’s short-term implied volatility increased as traders positioned ahead of Thursday’s Australian employment data release.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.