Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Director of European Marketing and Education, Options Industry Council

In this short refresher we revisit some of the options strategies investors may consider when seeking protection from adverse market moves.

Exchange-listed options can be used in a variety of ways. Investors often use options to construct a defined risk strategy; to put less capital at risk versus buying the underlying asset; harnessing leverage; and to use options as protection against adverse market moves.

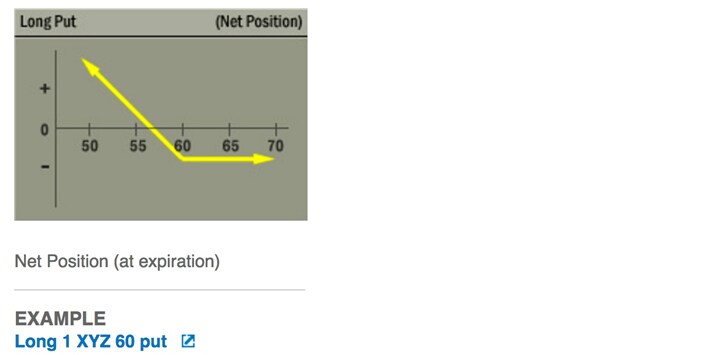

Buy an at-the-money put

Buying an at-the-money put, i.e. with an exercise price at or near the current market price of the underlying stock is a straightforward strategy.

If the price of the underlying stock declines below the exercise price, the profit on the purchased put option will offset some or all of the losses on the underlying stock held. See more details here.

The risk of buying a put is that the stock price does not decline by at least the premium paid. If the stock price remained at the same level as when the put option was bought, then the premium paid (plus fees) would represent a loss.

Buy an out-of-the-money put

This strategy is similar to the at-the-money put, but with a strike price below the current market price for the underlying asset. This means no revenue is earned until the stock price moves below the exercise price.

It also means that the option is cheaper to buy, as it is delivering less cover. Many websites, such as Saxo’s trading platform or the delayed information-only prices on the Options Industry Council website, enable investors to compare the costs of options with varying degrees of "out-of-the-moneyness".

Some investors see this as similar to an excess on an insurance policy. Out-of-the money options can offer a way of reducing the cost of protection by adjusting the amount of cover. The risk is the same as for buying an at-the-money put: that the stock price does not decline and that the premium paid (plus fees) could represent a total loss.

Buy a bear put spread

A bear put spread is another way to reduce the cost of protection. It is constructed by buying a put at a higher exercise price and then defraying the cost by selling another put at a lower exercise price. Both options have the same expiration.

The combined position still gives protection between the higher and lower exercise prices. The cover afforded is limited by the exercise price of the put option sold. To read more on this strategy go to the OIC strategy page.

The risk for the bear put spread is that the underlying stock price moves beyond the lower strike price, where the buyer of the bear put spread has no protection. In this example, the protection is only between 55 and 60. The strategy involves buying and selling options, so there is also the risk of early assignment, which will disrupt the strategy.

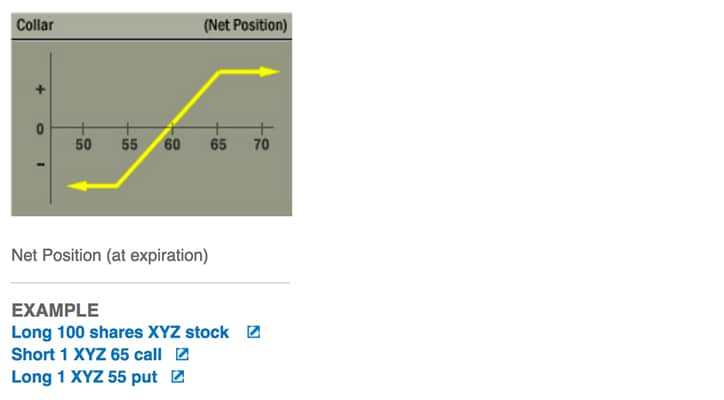

Buy a collar

A collar places two options around an underlying stock position. A put is purchased with an out-of-the-money exercise price – an exercise price below that of the underlying stock price – to give protection should the market move lower. At the same time an out-of-the-money call option is sold – this time with an exercise price above the underlying stock price, which puts a limit on the upside potential.

The underlying stock is thus collared between the long put on the downside and the call on the upside. The income generated by the sale of the call helps offset the cost of the put. As with any combined position, the exercise prices selected have an impact on the cover purchased and the cost incurred. You can read more about collars here.

The risk when buying a collar is twofold. The short call has been sold to help finance the long put. If the underlying stock rises beyond the exercise price of the call sold, then the call writer will not be able to participate in any gains above that level, meaning that he will in effect sell the underlying stock position at that price.

As for the long put purchased, if the underlying stock price does not fall below the exercise price of the long put, then the premium has been paid for nothing. The potential profit and loss of this hedging strategy are limited, with the investor seeking to balance the cost of cover with the level of cover.

Since the strategy involves buying and selling options, there is also the risk of early assignment on the put sold, which will disrupt the strategy.

Collar study

Investors considering a collar strategy may be interested in a collar study commissioned by OIC in 2011. Edward Szado and Thomas Schneeweis from the Isenberg School of Management at the University of Massachusetts updated the data in their original modified collar study to include September 30, 2010.

The research found that a long protective collar strategy using six-month put purchases and consecutive one-month call writes earned superior returns compared to a simple buy-and-hold strategy while reducing risk by almost 65%. You can read a summary here.

Conclusion

Exchange-listed options offer many possibilities to investors wishing to establish some protection. Cost and cover can be adjusted according to investor taste. We have profiled some of the more popular strategies, but more complicated strategies are also available. The strategy section on the OIC website is a useful resource, as are Saxo's trading platform and OIC’s delayed information-only prices.

Saxo Bank’s extensive educational initiatives can be found here.