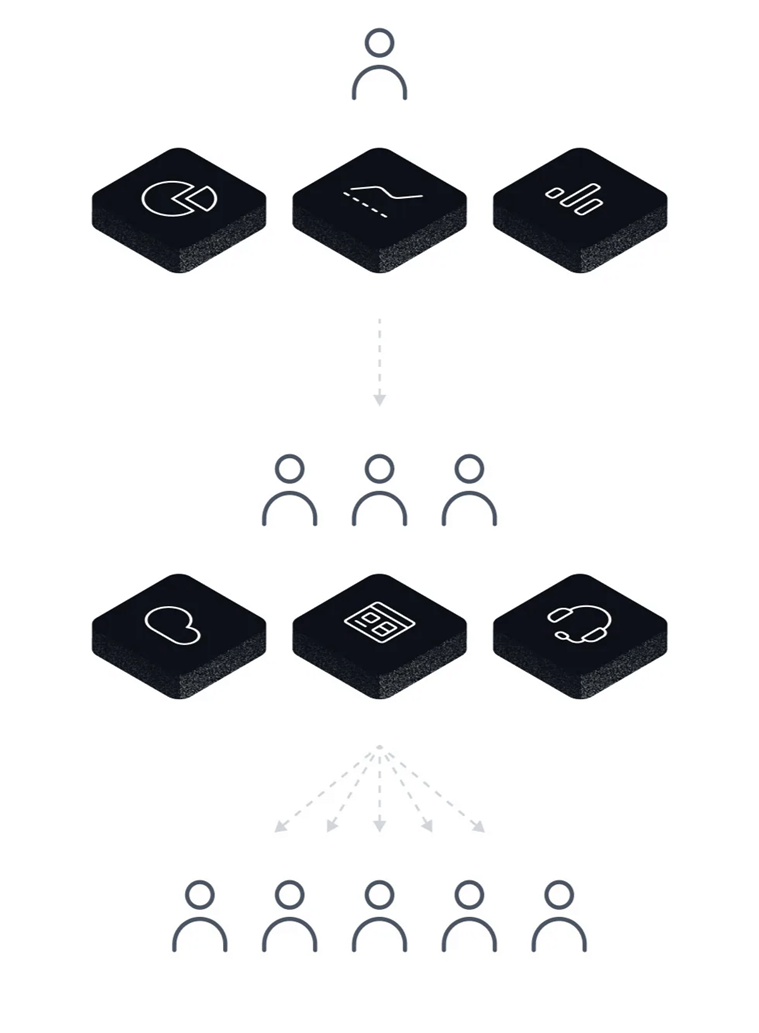

Institutional excellence with SaxoConnect

Onboarding

Transform client onboarding into an efficient process with our sophisticated yet user-friendly tool. Manage onboarding effortlessly, with the ability act on tasks and accelerate the onboarding process.

Comprehensive portfolio analysis

Dive deep into your clients' portfolios with state-of-the-art analytics tools.

Delegated trading

Execute trades on your clients' behalf efficiently, with cutting-edge execution technology and model management tools.

Client configuration control

Tailor your service with customisable client configurations to meet diverse needs.

Continuous innovation

Benefit from Saxo’s relentless pursuit of platform enhancement for your competitive edge.

Seamless Integration

Experience a smooth, integrated platform designed for the demands of institutional workflows.

Service and support

Use our library of resources within the portal to assist with day-to-day tasks or use the in-portal messaging system to communicate with our team.