Lion Global Dynamic Growth USD Q2 2023 commentary

| Asset classes | Stocks (developed and emerging markets), bonds (investment grade and high yield) and commodities |

| Instruments traded | ETFs and mutual funds |

| Investment style | Bottom up research and selection of best in class ETFs and mutual funds |

| Quarterly return | 1.33% (net of fees) |

| Annualised volatility (since Jan 2016) | 9.90% |

Market overview

Global equity markets rose by 5.6% (MSCI World Index in USD terms) in the second quarter of this year as the Federal Reserve paused its rate hikes in June 2023. U.S. markets, led by S&P 500 rallied 8.3% and Nasdaq 100 posted a strong 15.2% gain. Nikkei Index rose 8.9% in USD terms despite a weak Japanese Yen.

Markets cheered firm economic data coming out from the US and economists dialled down their recession fears. Asia (MSCI Asia ex Japan down 1.9%) was dragged down by Chinese markets posting a 7.4% decline (Shanghai Composite Index). Chinese business confidence and data coming out of real estate, manufacturing and investments worried investors, who thought that the China slowdown could persist longer as policy makers appeared reluctant to do any large scale stimulus to jump start the ailing economy.

Portfolio performance (net of fees)*

| April | -0.87% |

| May | -0.66% |

| June | 2.90% |

| Since inception (Since Jan 2016) | 65.08% |

Investment performance of the managed portfolio reflected for the period prior to the launch on 25/02/21 is simulated past performance, based on back-tested performance of portfolio components. For more detailed information, see the full disclosure in the disclaimer section of the commentary.

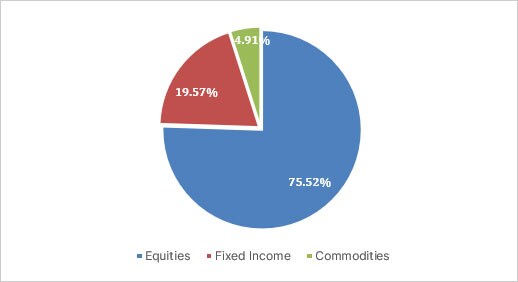

Portfolio Allocation (as of 30/06/23)

Outlook

The post pandemic recovery in the services sector continues to support the global economy as last year’s drags from COVID-19 and Russia’s invasion of Ukraine fade. It is unclear at this juncture if we are heading into a recession or a soft-landing scenario.

Recession concerns remain heightened—particularly in the US, where the shift is towards softer labour demand and tighter credit conditions. Consumer spending is supported by consumers drawing down their excess savings. There are signs that labour markets are beginning to slacken. Manufacturing activity is still contracting, albeit at a slightly slower pace.

The Eurozone economy is losing momentum after a strong Q1 as the tail winds from declining energy prices, China’s re-opening, and easing of supply chains fade. Business confidence has declined and German factory orders were weak. Inflation data has also remained stubbornly high and is hampering consumer spending.

China’s post COVID-19 rebound has been led by the swift recovery of in-person services. However, April 2023’s activity data, which were well below consensus forecasts, showed that the recovery has stalled, due partly to Beijing’s inability to boost confidence amid worsening geopolitical tensions. The risk of a double dip has continued to rise as property sales and prices have displayed sharper declines, exports have contracted by more than expected, and credit demand has weakened. China may have to introduce a new round of supportive measures to bolster growth.

Central banks are close to the end of the tightening cycle, even though the battle to lower inflation is far from over. While inflation has moderated, underlying price pressures persist. Core inflation may take longer to reach the central banks’ target of 2% as inflation responds with a lag to lower growth.