The graphics card market has been growing since the late 1990s, and Nvidia is arguably the largest supplier of GPUs to the consumer gamer market and increasingly to businesses driven by surging demand for machine learning applications across image recognition, self-driving technology, et cetera, and massive growth in datacenters driven by cloud computing demand.

The company has five main end-user segments:

1) Gaming (56.8% of total revenue)

2) Datacenter (19.9% of total revenue)

3) Professional Visualization

4) OEM & IP and 5) Automotive

In the past 12 months Nvidia delivered $12.4bn in revenue (+38% year-on-year) and $4.8bn in EBITDA (operating profit). Despite the company’s high revenue growth, the company had to adjust its FY'19 Q4 financial projections. The company reduced its Q4 fiscal guidance citing macro conditions (specifically in China), excess inventory (related to slowing cryptocurrency growth) and slower adoption of its new GPU chip. The reduced forecast could hint at a lacklustre performance in Q4 when the company announces earnings on February 14 after the close.

Performance Last year, Nvidia launched its new high-end chip on its Turing architecture. The company stated it was the fastest adoption of any server GPU in history. However, the company overestimated the adoption curve as the company is currently faced with a surplus in these high-end chips.

On the medium range of the spectrum the firm underestimated its exposure to the cryptocurrency mining market, which it has also acknowledged. A recent report suggests Nvidia has a majority market share in the GPU mining sector. The 2017 bubble in cryptocurrency caused an increase in demand for GPUs and the subsequent decline in cryptocurrency prices caused demand for the mid-range GPUs to plummet just as quickly. The lack of demand for mid-market GPUs created an oversupply for the company.

The firm's inability to accurately forecast GPU demand from China, datacenters, and cryptocurrency miners has caused it to reduce its revenue guidance by about 20% from $2.7bn to $2.2 bn.

Nvidia’s bad news unfolded in Q4, which saw the share price drop by around 57% from peak to bottom. The share price has since recovered somewhat despite the downward revision to guidance in late January. Sell-side analysts are expecting FY'19 Q4 revenue of $2.29bn, down 22% y/y, which is an astronomical collapse in y/y growth rates as Nvidia's Q3 revenue growth rate was 21% y/y.

Management and risk description The most significant risk facing the company now is the global macroeconomic outlook. A global slowdown or a worsening of the trade war between China and the US could result in further revenue pressure for the firm. Additionally, a prolonged bear market in cryptocurrencies would continue to hurt sales of GPUs that sit in the Gaming segment. A lack of funding going into AI applications and cloud computing solutions could impact sales of Nvidia’s higher-end chips. It will be interesting to see the company’s financials during its earnings release on February 14. Nvidia has tried to take most of the downside risk out of the company’s outlook with its late-January negative revision of the outlook, but more negative information could be revealed during the Q4 earnings releases and subsequent conference call.

Outlook As for now, investors should remain wary of any upside in Nvidia. An extension of the trade deadline will continue to stifle the demand coming out of China, as well as the prolonged bear market in cryptocurrencies. The company’s FY'20 Q1 fiscal guidance should give the market insight into what management is expecting. If revenue misses the guidance and the forecast is substantially below the trend, this may cause the stock to drop. However, a beat of the estimates or a trade deal could support the price. The company is likely to experience revenue growth in FY'19. By how much and to what extent is this part of a larger trend will likely determine the opening price of this key technology stock on February 15. After the earnings release we will follow up with a longer-term view.

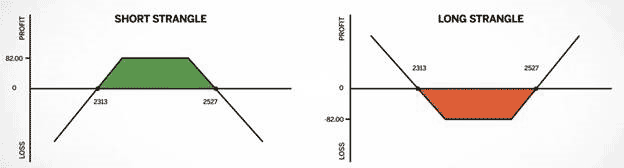

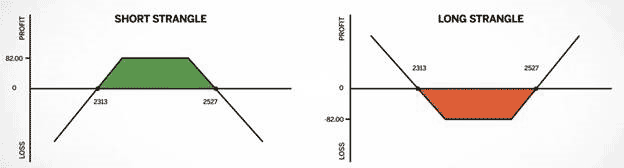

Trade recommendation The short-term risk is very high due to the FY'19 Q4 (ending January 2019) earnings release after the February 14 market close as the outlook is extremely dynamic due to the situation in cryptocurrencies, China (gaming), datacenter, and automobile growth decay. We recommend a long strangle (buying volatility, see illustration below) over the earnings release.

Historically Nvidia’s share price has moved around 7.9% in absolute terms around the earnings release and last earnings release saw massive volatility with the share price declining by 18.8%.

Tuesday’s close was $151.17

• Buy limit calls Feb 15 C157.50 in the interval $2.50 to $3.15 (last trade was at $2.80)

• Buy limit puts Feb 15 P145 in the interval $2.75 to $3.35 (last trade was at $3.05)

Assuming fills at the last traded prices on the call and put options, the combined premium is 3.9%. The call strike at $157.50 is 4.2% above the underlying price (last trade) and the put strike $145 is 4.1% below the underlying price (last trade). Assuming fills at last traded prices, the breakeven level on the upside is $163.35 and downside is $139.15.

The strategy becomes profitable on the share price moving more than 8% in either direction.

The investment recommendation has a natural expiration date on February 15 when the options expire.