Macro: Sandcastle economics

Invest wisely in Q3 2024: Discover SaxoStrats' insights on navigating a stable yet fragile global economy.

Macro backdrop

June's US CPI is anticipated to show further signs of cooling inflation, with the headline year-over-year consensus pegged at 3.1%, down from last month's 3.3%. Despite subdued inflation expectations, with the breakeven rate hovering just above 2%, gold prices remain elevated. This mirrors a similar scenario in 2020 when gold rallied ahead of declining inflation figures, which eventually aligned with easing monetary policy. In the short term, any upside surprise in the CPI is likely to drive yields higher, thereby exerting downward pressure on gold prices, and vice versa. Meanwhile, money managers reduced their bullish gold positions by 6,169 net-long contracts to 178,541, according to weekly data from the CFTC on futures and options. This net-long position marked the least bullish sentiment in over three weeks.

Price action

The last time CPI came in lower than expected, XAUUSD saw an immediate 1% gain, though it couldn't sustain the rise. Gold prices recently marked their largest weekly gain in three months, hovering around $2,359 per ounce after a nearly 3% surge last week. However, the People’s Bank of China did not increase its gold reserves for the second consecutive month in June, according to the World Gold Council. The uptrend has persisted since early April, with $2,300 serving as a support level, while the 200-day moving average lies further below at $2,137.

Trade Inspiration

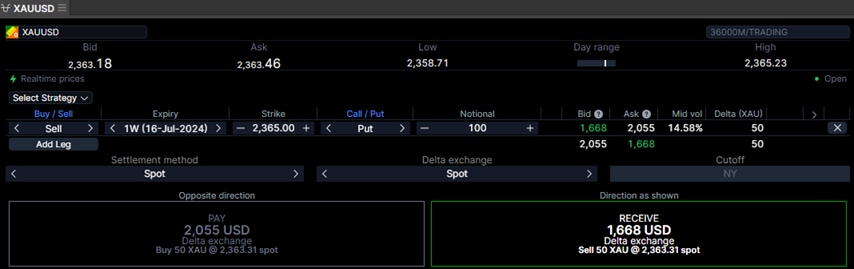

The one-week volatility spread between implied and realized for XAUUSD has widened to 3.7 vol, while one-week at-the-money (ATM) volatility has climbed to 14.5. In this context, consider shorting a one-week ATM put around $2,365 to receive premium of $1,668, anticipating a drop in volatility post-CPI release and maximise time decay. If mitigating directional risk is required, delta hedge the position by shorting spot XAUUSD.

Example:

**Forex, or FX, involves trading one currency such as the US dollar or Euro for another at an agreed exchange rate. While the forex market is the world’s largest market with round-the-clock trading, it is highly speculative, and you should understand the risks involved. FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading FX with this provider. You should consider whether you understand how FX work and whether you can afford to take the high risk of losing your money. Past performance does not indicate future performance.