Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Jobs Report (Sep), Mainland China market holidays

Earnings: Apogee,

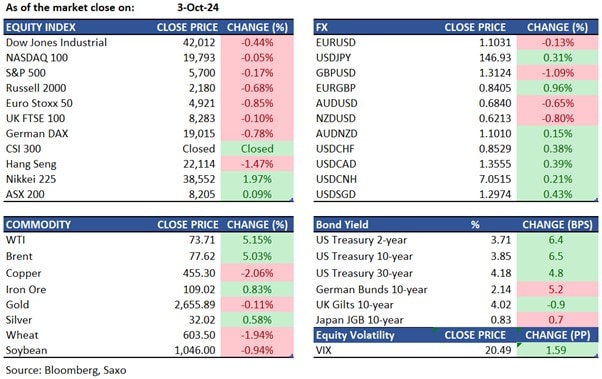

Equities: All three major US indexes ended in the red on Thursday as investors grew concerned about escalating Middle East tensions ahead of the September payroll report. The S&P 500 fell by 0.2%, the Dow Jones dropped 185 points, and the Nasdaq 100 finished almost flat. Market sentiment turned negative after President Biden suggested support for Israel striking Iran’s oil facilities, raising fears of disruptions to global energy supplies. Oil prices surged over 5% on the back of those comments, boosting energy stocks with Valero Energy Corp rising 6% and Occidental Petroleum gaining 2.5%. On the US data front, ISM services data showed expansion in September, beating estimates comfortably just before the NFP data tonight. Earnings include Levi Strauss’ (-7.6%) due to revenue forecast miss and Tesla (-3.3%) halting orders for its cheapest Model 3.

Fixed income: Treasuries fell, pushing yields to their highest levels since early September. This was driven by a stronger-than-expected ISM services index and a surge in crude oil prices due to Middle East supply risks. Both the US 10-year and 30-year yields were set to close above their 50-day moving averages for the first time in at least two months. Yields rose by 5 to 7 basis points across various maturities, with the 5-year maturity seeing the largest losses, flattening the 5s30s curve by about 2 basis points. The 10-year yield was around 3.85%, over 6 basis points higher, compared to its 50-day moving average of about 3.83%. Meanwhile, investors funneled $38.7 billion into US money-market funds, pushing total assets to a record $6.46 trillion, marking the largest quarterly inflow since the March 2023 banking crisis.

Commodities: Oil prices continued to climb, following their largest single-day surge in nearly a year, amid concerns that Israel might retaliate against Iranian crude facilities after a missile barrage earlier this week. West Texas Intermediate (WTI) rose toward $74 a barrel after jumping more than 5% on Thursday, while Brent settled near $78. Oil is on track for its biggest weekly gain since March 2023. Gold remained steady ahead of a jobs report that could provide insights into the health of the US economy, as markets considered the potential for further monetary easing by the Federal Reserve. After three consecutive weekly gains, including a record high for bullion in late September, the precious metal was set to end the week relatively unchanged. Meanwhile, copper gave back some of its recent gains driven by China’s stimulus measures, with better-than-expected US jobs data also contributing to the decline.

FX: The US dollar extended its gains further with the ISM services data coming in much stronger than expected, and lingering geopolitical risks also underpinning. The British pound underperformed, after the dovish comments from BoE Governor Bailey. He said the bank could be a "bit more aggressive" in cutting rates provided the news that inflation continues to be good. Other cyclical currencies like kiwi dollar and Aussie dollar were also down, with 0.8% and 0.65% respectively, as momentum in Chinese stocks listed in HK started to deflate with onshore China markets on holiday and questions around whether current stimulus measures could prove enough to address the structural headwinds. The euro was the most resilient, while Japanese yen and Swiss franc were down modestly.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.