Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: EIA STEO, OPEC MOMR; Australian Business Confidence (Aug), German Final CPI (Aug), UK Unemployment/Wages (Jul), Norwegian CPI (Aug), US NFIB (Aug), Chinese Trade Balance (Aug)

Earnings: Academy Sports, GameStop, Dave&Busters, Petco, Evolution Petroleum

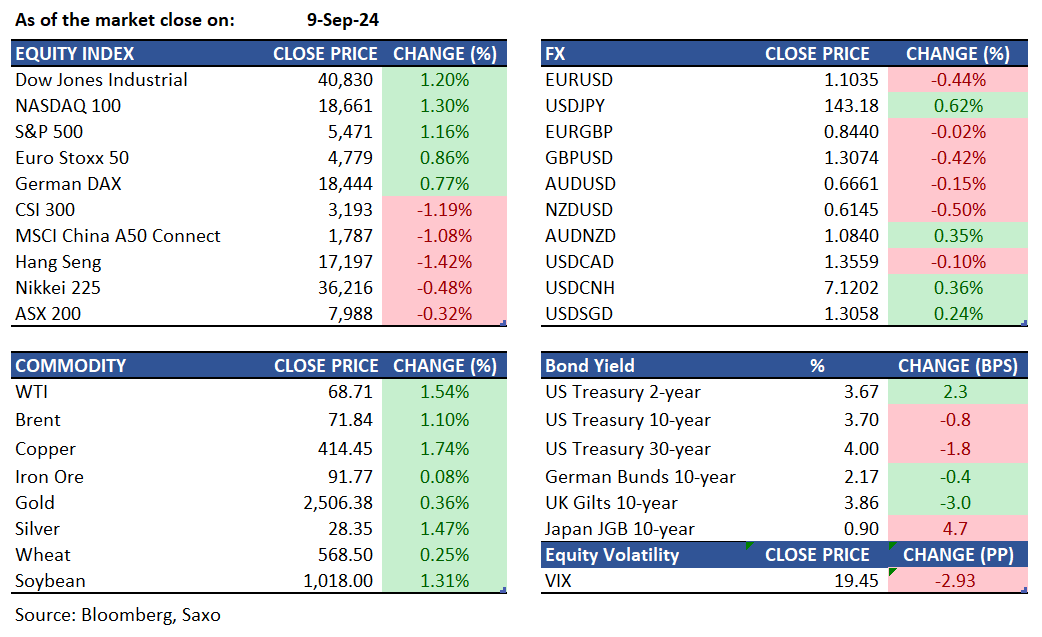

Equities: U.S. stocks closed higher on Monday, rebounding from last week’s significant losses as investors capitalized on lower prices and anticipated a potential interest rate cut from the Federal Reserve. The S&P 500 rose 1.1%, ending a five-day losing streak after its worst week since early 2023. The Dow Jones gained 484 points, and the Nasdaq 100 increased by 1.3%, driven by a 3.5% surge in Nvidia. Consumer discretionary, industrials, financials, and tech stocks led the recovery. Traders are now focusing on upcoming inflation data, which will influence the Fed's policy decision later this month, with debates on whether the rate cut will be 25 or 50 basis points. Top performers included JPMorgan Chase, Mastercard, Boeing, and Tesla, each gaining over 2%. Additionally, S&P index changes announced late Friday, effective before the market opens on Monday, September 23, will see Palantir, Dell, and Erie Indemnity replace American Airline, Etsy, and Bio Rad Laboratories in the S&P 500. Palantir share price gained 14.08% after the news.

Fixed income: Treasuries closed with mixed results; the long end of the yield curve outperformed, while the front end saw the removal of the Fed rate cut premium. Stocks partially rebounded from Friday's decline, adding a risk-on sentiment, and WTI futures increased by about 1.5% for the day. SOFR options activity was significant, with trades moving dovish protection to the Dec24 and Mar25 tenors from the Sep24 wagers expiring on Friday. Treasury yields at the front end of the curve had risen by approximately 2.5 basis points, while yields at the long end had decreased by about 2 basis points. This led to a flattening of the 2s10s and 5s30s spreads by 4 basis points and 2 basis points, respectively. Treasuries was bolstered by a broader rally in gilts, which outperformed ahead of the release of UK weekly earnings and employment data for July, expected before cash trading opens on Tuesday.

Commodities: Oil prices rose due to concerns over potential production disruptions caused by Tropical Storm Francine, which is expected to become a hurricane before reaching the Louisiana coast. Galveston, Texas faces a 30% chance of experiencing tropical storm force winds above 40 mph overnight on Tuesday. WTI crude oil futures increased by 1.54% to $68.71, and Brent crude gained 1.1% to $71.84. In contrast, U.S. natural gas futures dropped over 4% to below $2.20 per MMBtu, as the incoming storm could reduce demand by causing power outages and disrupting LNG exports. Meanwhile, gold prices rose by 0.36%, settling at $2,506, while silver increased by 1.47% to $28.35.

FX: The US dollar gained to start the new week as markets were unconvinced that the Fed can deliver a jumbo rate cut at the next week’s meeting. Gains were also seen in the commodity complex, which helped the Canadian dollar and Australian dollar to outperform the G10 FX board. The British pound also rose with equities gaining some momentum, and labor data will be key today as Bank of England is not expected to cut rates next week. Safe-haven Japanese yen and Swiss franc lagged amid the slight risk-on sentiment and focus today turns to the US presidential election debate. To read more of our FX views, go to this Weekly FX Chartbook.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.