Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: ECB Policy Announcement – preview here, IEA OMR, US Jobless Claims (w/e 7th Sep), PPI Final Demand (Aug)

Earnings: Adobe, Restoration Hardware, Kroger, Signet, Big Lots

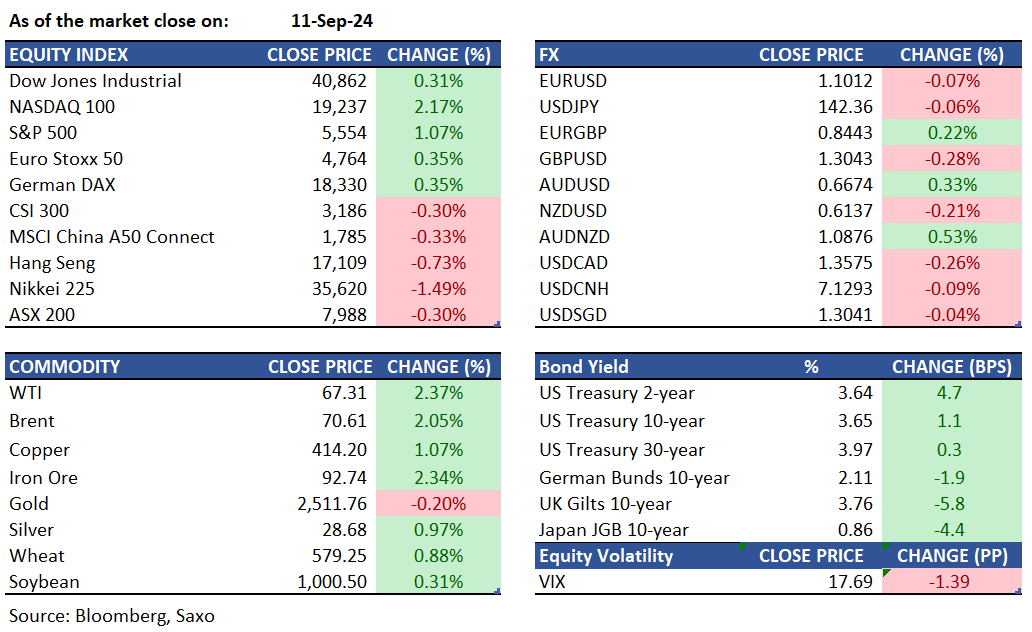

Equities: US stocks closed higher on Wednesday, driven by tech stocks as investors evaluated the latest inflation data and its impact on the Federal Reserve’s upcoming policy decision. The S&P 500 rose 1%, marking its third consecutive session of gains, while the Nasdaq surged 2.2%, led by strong performances from chipmakers like Nvidia (+8%) and Broadcom (+6.7%). Dow Jones also gained 124 points. Inflation data showed headline prices at a three-year low, but core inflation rose 0.3%, higher than expected. This led to speculation that the Fed will opt for a smaller 0.25% interest rate cut at next week's meeting, with traders reducing the likelihood of a 50-basis-point cut to 13%. Politically, the presidential debate increased the chances of a Kamala Harris election victory, boosting solar stocks like First Solar (+15.2%) and pushing down crypto-linked stocks like Coinbase (-1%).

Fixed income: Treasuries ended a volatile session with higher yields, leading to a notably flatter yield curve. This followed an initial selloff driven by the August CPI data. Recoveries in crude oil and US stocks from early losses, along with bear-flattening in gilts, also influenced the market, as did strong demand for the monthly auction of 10-year notes. US front-end yields had risen by nearly 5 basis points, while long-end yields remained relatively stable. The CPI data, which showed a larger-than-expected increase in the core index and higher real earnings growth, led Fed-dated OIS contracts to almost certainly price in a quarter-point rate cut on September 18, reducing the likelihood of a half-point cut. Specifically, 26 basis points of easing were priced in for September, down from 30 basis points on Tuesday. The 10-year note auction in the US afternoon, a $39 billion reopening, yielded 3.648%, the lowest since May 2023 and 1.4 basis points below the WI yield indicated at the 1pm bidding deadline.

Commodities: WTI crude rose by 2.37% to $67.31, and Brent Crude increased by 2.05% to $70.61. Hurricane Francine, which is expected to impact Louisiana and has caused some offshore oil platforms to shut down. Despite the rebound, oil prices remain near their lowest since May 2023 US natural gas futures climbed above $2.27 per MMBtu, driven by seasonal demand, record LNG exports, and China's growing use of natural gas in transportation. Gold prices edged lower by 0.2% to $2,511 an ounce. Iron ore prices held steady above $91 as investors assessed Chinese steel demand during its peak season.

FX: The US dollar was initially weighed by yen’s strength on Wednesday and the somewhat better performance for Harris in the presidential debate questioning the ‘Trump Trades’ that are usually seen to be USD-positive. However, the hotter-than-expected US CPI report overnight pushed the US dollar higher as odds of a 50bps rate cut from the Fed next week were wound down. The Japanese yen, that had earlier printed a YTD high of 140.72 against the US dollar in the Asian session on BoJ's Nakagawa hawkish comments, also retreated again. We discussed yen’s upside in this article, and continue to expect a move below 140 to come if US recession concerns deepen. Activity currencies such as Australian dollar and Canadian dollar outperformed while the Swiss franc underperformed as recession odds retreated. The euro is heading lower amid the USD strength and the pivotal ECB meeting coming up where a rate cut is expected but forward guidance gets more weight.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.