Quarterly Outlook

Upending the global order at blinding speed

John J. Hardy

Global Head of Macro Strategy

Global Macro Strategist

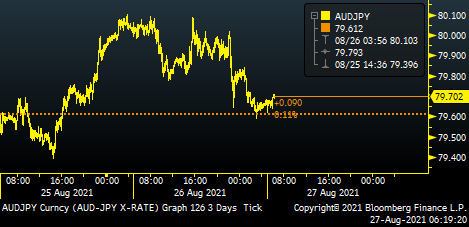

Summary: Macro Strike - We check-in on the breaking news of the blasts in Afghanistan's Kabul airport, which has left over 70 dead including at least 12 US military personnel. The pentagon & Biden have flagged the attacks come from ISIS-K, an Afghanistan faction of the Islamic Terrorist group, who are also enemies of the Taliban. With 5days to the US's Aug 31 exit, this may be a one-off attack or the start of escalating attacks aimed at sparking chaos & conflict between the US & the Taliban. Not Wed Sep 1, will see us host GeoPolitical webinar around the return of the Taliban to Afghanistan, as well as the consequences of this to US foreign policy.

-

Start<>End = Gratitude + Integrity + Vision + Tenacity | Process > Outcome | Sizing > Position.

This is The Way

Namaste,

KVP