Quarterly Outlook

Macro Outlook: The US rate cut cycle has begun

Peter Garnry

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Democratic National Convention (Aug 19-22), PBoC LPR, RBA Minutes, Riksbank Announcement, EZ Final CPI (Jul), Canada CPI (Jul)

Earnings: Lowe’s, Medtronic, XPeng, Futu, Keysight Technologies, COTY

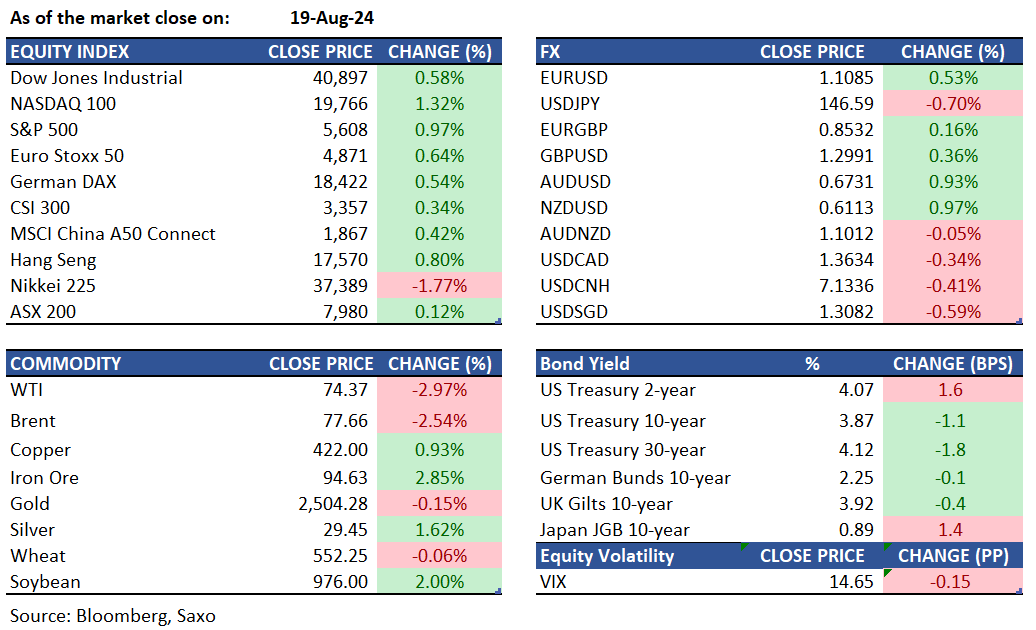

Equities: US stocks continued their upward momentum on Monday, reinforcing last week's gains—the strongest in a year—and adding over $3 trillion in market value from this month's lows. The S&P 500 and Nasdaq climbed 1% and 1.2%, respectively, extending their winning streak to eight consecutive days, while the Dow Jones rose by 236 points. Investor optimism was bolstered by expectations of a potential interest rate cut from the Federal Reserve, with keen attention on Fed Chair Jerome Powell's upcoming speech at the Jackson Hole symposium. All sectors closed in positive territory, led by gains in communication services and technology. AMD surged 4.5% after announcing its acquisition of ZT Systems, an artificial intelligence infrastructure provider. Conversely, HP Inc. dropped 3.7% following a downgrade from Morgan Stanley from Overweight to Equal Weight. Palo Alto Networks gained 2.7% during standard trading and rose an additional 1.93% in extended hours after reporting earnings that exceeded estimates.

Fixed income: Treasuries ended a quiet session with mixed outcomes, leading to a flatter yield curve. Long-term yields outperformed later in the day, narrowing the 2s10s and 5s30s spreads to their lowest points. While weak oil prices offered some support, the lack of significant catalysts kept futures volumes below average. Long-term yields improved by 2-3 basis points, and 2-year yields increased by over 1 basis point, flattening the 2s10s by more than 3 basis points and the 5s30s by over 2 basis points. The US 10-year yield closed around 3.865%, richer by about 2 basis points within a narrow range; futures and options trading was minimal. Japan’s Ministry of Finance will auction ¥1 trillion of a reopened June 2044 bond, with yields rising 3.5 basis points to 1.72%. New Zealand’s Treasury plans to price a new May 2036 bond, aiming to raise between NZ$3-6 billion.

Commodities: Oil prices continued to decline throughout the day, with WTI crude dropping 2.97% to $74.37 and Brent crude futures falling 2.54% to $77.66 due to ongoing demand concerns and potential progress in mediating the Israel-Hamas conflict. Despite suggestions of a possible pause in the Gaza conflict, both sides have accused each other of stalling negotiations as U.S. Secretary of State Antony Blinken arrived in the region. Meanwhile, gold prices increased by $3.50 to settle at $2,541.30, having hit record highs of $2,549.90 earlier, as investors await cues from the Federal Reserve's upcoming Jackson Hole symposium and monitor developments in the Middle East. Additionally, silver increased to a 4-week high of $29.45.

FX: The US dollar extended its decline from Friday, with the dollar index reaching its lowest levels year-to-date as markets positioned for the Fed’s Chair Powell to highlight the case for a September rate cut at the Jackson Hole conference this week. The weaker dollar fueled gains in Scandinavian currencies from Sweden and Norway, and Sweden’s Riksbank is expected to announce a rate cut today. Kiwi dollar and Australian dollar also rose higher but both still remain below their July highs. The euro has, however, found renewed momentum on US dollar weakness, and rose to its highest levels for this year, as British pound tested the psychological 1.30 barrier again. The Japanese yen remains key as well again this week given Bank of Japan governor Ueda will be giving his testimony in parliament to explain the July 31 rate hike decision. The underperformer amid cyclical US dollar weakness was the Canadian dollar, just as we discussed in our Weekly FX Chartbook yesterday.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.