Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Democratic National Convention (Aug 19-22), PBoC LPR, RBA Minutes, Riksbank Announcement, EZ Final CPI (Jul), Canada CPI (Jul)

Earnings: Lowe’s, Medtronic, XPeng, Futu, Keysight Technologies, COTY

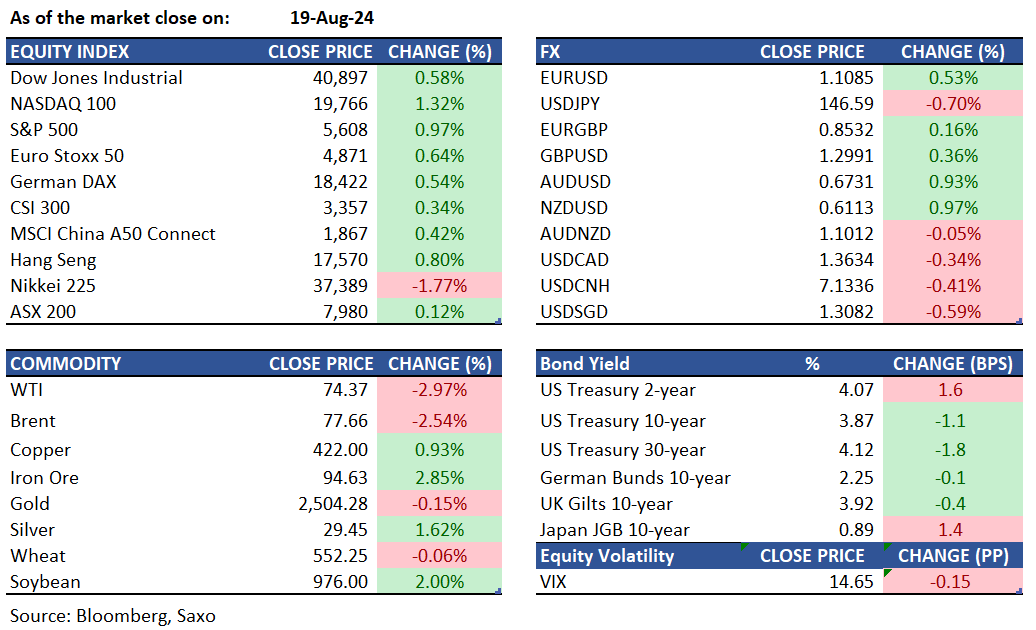

Equities: US stocks continued their upward momentum on Monday, reinforcing last week's gains—the strongest in a year—and adding over $3 trillion in market value from this month's lows. The S&P 500 and Nasdaq climbed 1% and 1.2%, respectively, extending their winning streak to eight consecutive days, while the Dow Jones rose by 236 points. Investor optimism was bolstered by expectations of a potential interest rate cut from the Federal Reserve, with keen attention on Fed Chair Jerome Powell's upcoming speech at the Jackson Hole symposium. All sectors closed in positive territory, led by gains in communication services and technology. AMD surged 4.5% after announcing its acquisition of ZT Systems, an artificial intelligence infrastructure provider. Conversely, HP Inc. dropped 3.7% following a downgrade from Morgan Stanley from Overweight to Equal Weight. Palo Alto Networks gained 2.7% during standard trading and rose an additional 1.93% in extended hours after reporting earnings that exceeded estimates.

Fixed income: Treasuries ended a quiet session with mixed outcomes, leading to a flatter yield curve. Long-term yields outperformed later in the day, narrowing the 2s10s and 5s30s spreads to their lowest points. While weak oil prices offered some support, the lack of significant catalysts kept futures volumes below average. Long-term yields improved by 2-3 basis points, and 2-year yields increased by over 1 basis point, flattening the 2s10s by more than 3 basis points and the 5s30s by over 2 basis points. The US 10-year yield closed around 3.865%, richer by about 2 basis points within a narrow range; futures and options trading was minimal. Japan’s Ministry of Finance will auction ¥1 trillion of a reopened June 2044 bond, with yields rising 3.5 basis points to 1.72%. New Zealand’s Treasury plans to price a new May 2036 bond, aiming to raise between NZ$3-6 billion.

Commodities: Oil prices continued to decline throughout the day, with WTI crude dropping 2.97% to $74.37 and Brent crude futures falling 2.54% to $77.66 due to ongoing demand concerns and potential progress in mediating the Israel-Hamas conflict. Despite suggestions of a possible pause in the Gaza conflict, both sides have accused each other of stalling negotiations as U.S. Secretary of State Antony Blinken arrived in the region. Meanwhile, gold prices increased by $3.50 to settle at $2,541.30, having hit record highs of $2,549.90 earlier, as investors await cues from the Federal Reserve's upcoming Jackson Hole symposium and monitor developments in the Middle East. Additionally, silver increased to a 4-week high of $29.45.

FX: The US dollar extended its decline from Friday, with the dollar index reaching its lowest levels year-to-date as markets positioned for the Fed’s Chair Powell to highlight the case for a September rate cut at the Jackson Hole conference this week. The weaker dollar fueled gains in Scandinavian currencies from Sweden and Norway, and Sweden’s Riksbank is expected to announce a rate cut today. Kiwi dollar and Australian dollar also rose higher but both still remain below their July highs. The euro has, however, found renewed momentum on US dollar weakness, and rose to its highest levels for this year, as British pound tested the psychological 1.30 barrier again. The Japanese yen remains key as well again this week given Bank of Japan governor Ueda will be giving his testimony in parliament to explain the July 31 rate hike decision. The underperformer amid cyclical US dollar weakness was the Canadian dollar, just as we discussed in our Weekly FX Chartbook yesterday.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)