Quarterly Outlook

Macro Outlook: The US rate cut cycle has begun

Peter Garnry

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: RBNZ rate decision, FOMC meeting minutes

Earnings: Helen of Troy, Byrna, Azz, Applied Blockchain, Bassett, E2Open, Richardson Electronics

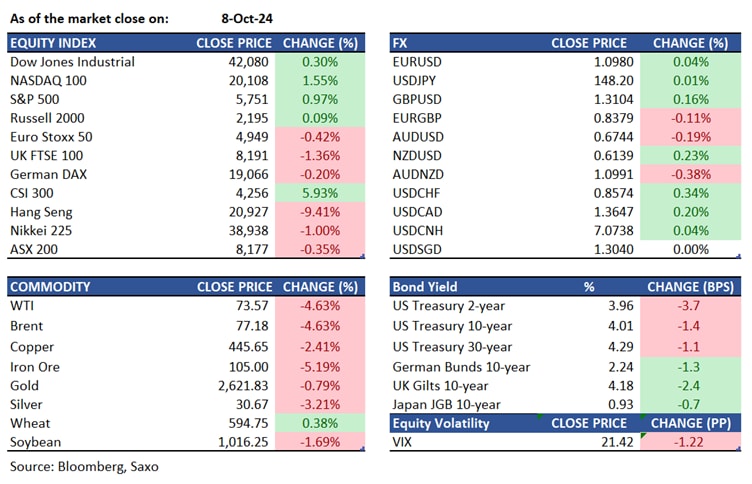

Equities: US stocks made a strong recovery on Tuesday, led by gains in tech megacaps as markets evaluated the potential scale of the Federal Reserve's upcoming rate cuts. The S&P 500 climbed 1%, the Nasdaq 100 advanced 1.5%, and the Dow increased by 126 points, partially offsetting the previous session's losses. Nvidia surged by 4%, while Apple (+1.8%), Microsoft (+1.2%), Amazon (+1%), and Meta (+1.4%) rebounded after underperforming yesterday. On the other hand, large oil companies declined due to falling Crude WTI prices with Exxon Mobil down 2.66% and Valero Energy falling 5.3%. Markets are still anticipating a 25 basis-point rate cut by the Federal Reserve in November, awaiting further insights from tomorrow’s FOMC minutes and upcoming CPI and PPI reports. Meanwhile, US-listed Chinese stocks declined as Beijing withheld major new stimulus announcements, with Nasdaq Golden Dragon Index down 6.8% and Hang Seng Index tumbling 9.4% in the Asia session.

Fixed income: Treasuries ended mixed: 2-year yields fell over 2 basis points, while long-dated yields rose up to 1.5 basis points. The front end benefited from a slight rebound in Fed rate-cut expectations, while the long end faced pressure from upcoming 10- and 30-year auctions. Front-end tenors held gains after a 3-year note auction, with direct bidders receiving 24%, the highest in a decade. The 3-year note auction tailed by 0.7 basis points, drawing a yield of 3.878%, the highest since July. The 10-year yields remained steady around 4.03%, trailing German bunds and UK gilts by 2 and 3 basis points, respectively. The front-end outperformance steepened the 2s10s and 5s30s spreads by about 3 and 2 basis points, partially reversing Friday’s jobs report-induced flattening.

Commodities: Gold dropped 0.79% to $2,621 and silver fell 3.21% to $30.67 as the dollar stabilized and Treasury yields rose, with the 10-year yield surpassing 4.05%. WTI crude oil futures fell 4.63% to $73.57 per barrel, and Brent crude declined 4.63% to $77.18 per barrel due to profit-taking after a recent rally. Prices briefly pared losses midday on reports of Israel considering an attack on Iranian energy facilities but ended the day weaker. The EIA expects U.S. oil demand to rise to 20.5M barrels per day (bpd) next year, down from a previous forecast of 20.6M bpd, with 2024 demand unchanged at 20.3M bpd. Global oil demand is projected to grow to 104.3M bpd next year, about 300,000 bpd below prior forecasts, and to 103.1M bpd this year, a 20,000-bpd reduction from previous estimates.

FX: The dollar index rose for the seventh consecutive day, its longest streak since April 2022. The yen hovered around 148 per dollar, with markets focusing on the FOMC minutes and US CPI data. Japanese government bond futures dipped slightly. USDJPY remained steady at 148.23 after reaching 148.38 overnight. The New Zealand dollar strengthened ahead of a central bank meeting, while the Australian dollar lagged due to a lack of new Chinese stimulus measures. NZDUSD fell 0.1% to 0.6135, hitting 0.6107 on Tuesday, its lowest since September 11. Economists expect the Reserve Bank of New Zealand to cut its key rate by 50 basis points on Wednesday, following a 25 basis point cut in August. Swaps traders see a 78% chance of this cut.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.