Quarterly Outlook

Macro Outlook: The US rate cut cycle has begun

Peter Garnry

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: RBNZ rate decision, FOMC meeting minutes

Earnings: Helen of Troy, Byrna, Azz, Applied Blockchain, Bassett, E2Open, Richardson Electronics

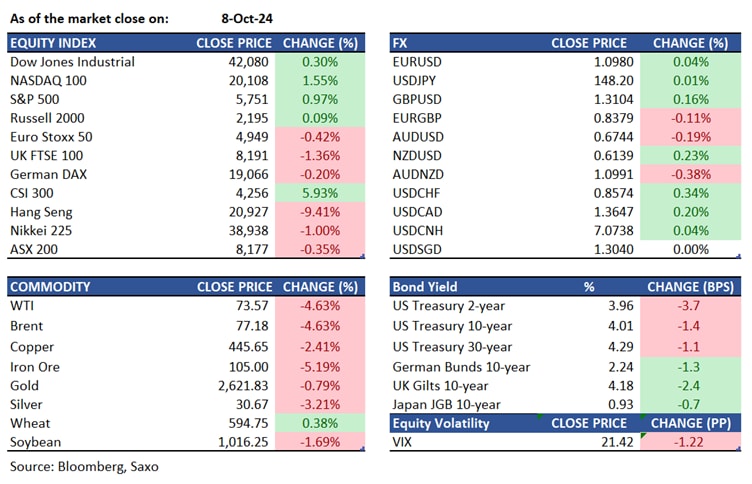

Equities: US stocks made a strong recovery on Tuesday, led by gains in tech megacaps as markets evaluated the potential scale of the Federal Reserve's upcoming rate cuts. The S&P 500 climbed 1%, the Nasdaq 100 advanced 1.5%, and the Dow increased by 126 points, partially offsetting the previous session's losses. Nvidia surged by 4%, while Apple (+1.8%), Microsoft (+1.2%), Amazon (+1%), and Meta (+1.4%) rebounded after underperforming yesterday. On the other hand, large oil companies declined due to falling Crude WTI prices with Exxon Mobil down 2.66% and Valero Energy falling 5.3%. Markets are still anticipating a 25 basis-point rate cut by the Federal Reserve in November, awaiting further insights from tomorrow’s FOMC minutes and upcoming CPI and PPI reports. Meanwhile, US-listed Chinese stocks declined as Beijing withheld major new stimulus announcements, with Nasdaq Golden Dragon Index down 6.8% and Hang Seng Index tumbling 9.4% in the Asia session.

Fixed income: Treasuries ended mixed: 2-year yields fell over 2 basis points, while long-dated yields rose up to 1.5 basis points. The front end benefited from a slight rebound in Fed rate-cut expectations, while the long end faced pressure from upcoming 10- and 30-year auctions. Front-end tenors held gains after a 3-year note auction, with direct bidders receiving 24%, the highest in a decade. The 3-year note auction tailed by 0.7 basis points, drawing a yield of 3.878%, the highest since July. The 10-year yields remained steady around 4.03%, trailing German bunds and UK gilts by 2 and 3 basis points, respectively. The front-end outperformance steepened the 2s10s and 5s30s spreads by about 3 and 2 basis points, partially reversing Friday’s jobs report-induced flattening.

Commodities: Gold dropped 0.79% to $2,621 and silver fell 3.21% to $30.67 as the dollar stabilized and Treasury yields rose, with the 10-year yield surpassing 4.05%. WTI crude oil futures fell 4.63% to $73.57 per barrel, and Brent crude declined 4.63% to $77.18 per barrel due to profit-taking after a recent rally. Prices briefly pared losses midday on reports of Israel considering an attack on Iranian energy facilities but ended the day weaker. The EIA expects U.S. oil demand to rise to 20.5M barrels per day (bpd) next year, down from a previous forecast of 20.6M bpd, with 2024 demand unchanged at 20.3M bpd. Global oil demand is projected to grow to 104.3M bpd next year, about 300,000 bpd below prior forecasts, and to 103.1M bpd this year, a 20,000-bpd reduction from previous estimates.

FX: The dollar index rose for the seventh consecutive day, its longest streak since April 2022. The yen hovered around 148 per dollar, with markets focusing on the FOMC minutes and US CPI data. Japanese government bond futures dipped slightly. USDJPY remained steady at 148.23 after reaching 148.38 overnight. The New Zealand dollar strengthened ahead of a central bank meeting, while the Australian dollar lagged due to a lack of new Chinese stimulus measures. NZDUSD fell 0.1% to 0.6135, hitting 0.6107 on Tuesday, its lowest since September 11. Economists expect the Reserve Bank of New Zealand to cut its key rate by 50 basis points on Wednesday, following a 25 basis point cut in August. Swaps traders see a 78% chance of this cut.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)