Quarterly Outlook

Macro Outlook: The US rate cut cycle has begun

Peter Garnry

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: UK Unemployment, Canada Inflation, Fed Daly Speech

Earnings: Interactive Brokers, Johnson&Johnson, UnitedHealth Group, Goldman Sachs, Bank of America, Citigroup, Charles Schwab

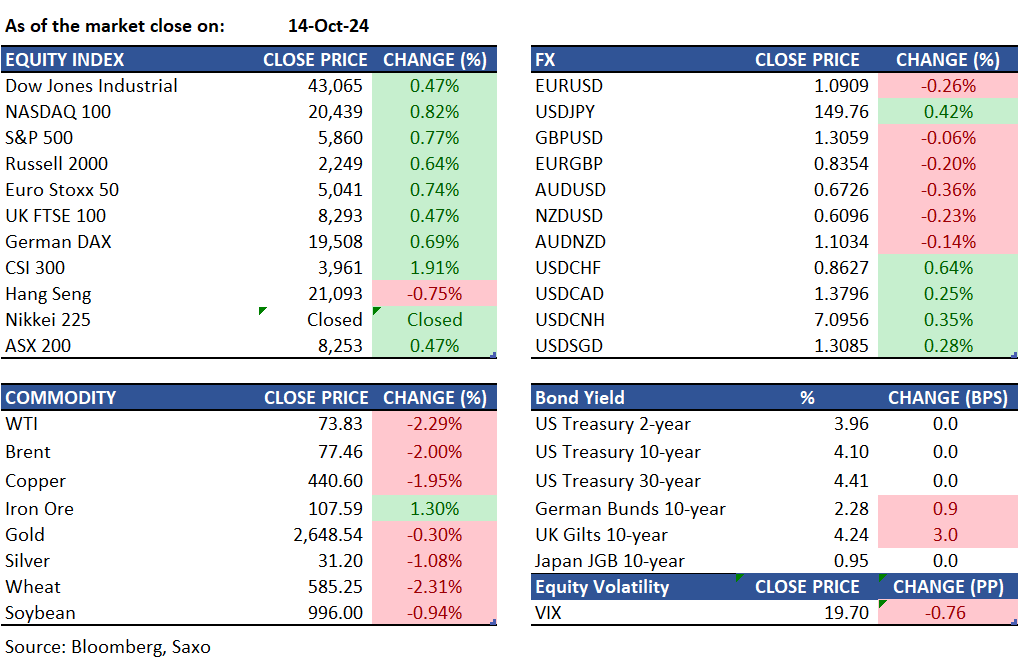

Equities: On Monday, the S&P 500 and Dow Jones reached new record highs, gaining 0.77% and 0.47% respectively while the Nasdaq 100 climbed 0.8%, driven by strong performances in tech stocks. Nvidia closed at all time highs of $138.07 after gaining 2.4% while the chip sector continues to outperform. Arm holdings led the pack with a 6.8% rally, with Qualcomm gaining 4.7%, Applied Materials up 4.3% and ASML climbing 3.7%. This week, the earnings season intensifies with major companies like UnitedHealth, J&J, Bank of America, Goldman Sachs, and Netflix set to report their results.

Fixed income: Cash Treasury yields are anticipated to reopen slightly lower by a few basis points after the US holiday. Futures declined in the morning, driven by losses in European rates. UK bonds underperformed as investors positioned for a £2.25 billion 30-year UK bond auction scheduled for Tuesday. An early large block sale in bund futures also contributed to the downward pressure. US 10-year yields are expected to reopen at approximately 4.12%, a few basis points lower than Friday's close. 10-year note futures fell by about 12 ticks but ended above the session lows reached during the US morning session. UK 10- and 30-year yields rose by up to 5 basis points, reaching 4.26% and 4.80%, respectively. Meanwhile, Italy’s yield premium over Germany decreased to its lowest level since March 21.

Commodities: Oil prices fell sharply, with WTI crude dropping 2.29% to $73.83 and Brent crude oil futures declining 2.5% to around $77. This decline followed OPEC's reduction of its global oil demand growth forecast for 2024 and 2025, and reports that Israel will not target Iranian crude infrastructure. OPEC now expects world oil demand to rise by 1.93 million bpd in 2024, down from the previous forecast of 2.03 million bpd. China's crude imports for the first nine months of the year decreased nearly 3% from last year to 10.99 million bpd. Additionally, China's recent stimulus plans did not boost investor confidence, and markets are closely watching for potential Israeli attacks on Iranian oil infrastructure. Gold prices also dropped to near $2,648 after rising for five consecutive weeks.

FX: The dollar strengthened against all G10 currencies in US holiday-thinned trading as traders assessed China’s fiscal stimulus and Fed comments. The yen weakened toward the key 150 per dollar level. The Bloomberg Dollar Spot Index rose 0.3%, with the Swiss franc and Norway’s krone leading losses. USDJPY rose 0.6% to a session high of 149.98; surpassing 150 would be the first time since August 1. The yen has been the worst-performing G10 currency year-to-date, down 5.6% against the dollar. Hedge funds bought yen for the second consecutive week, according to CFTC data. USDCAD advanced for the ninth straight session to 1.3797, matching a July streak that was the longest since 2017. The Swiss franc was among the session’s worst performers, with USDCHF rising 0.7% to 0.8630.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.