Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Sales Trader

Summary: Price action of Tesla recently has shown some signs of recovery as it managed to hold off breaking $160 area on the back of the robotaxi announcement that would be unveiled on 8 August despite disappointing delivery numbers for 1Q coming in well below both estimate and production.

Tesla's stock price demonstrated resilience by maintaining above the $160 level, despite weaker than expected delivery figures for the first quarter. This stability is likely due to anticipation of the company's unveiling event for its robotaxis scheduled for August 8 2024. Furthermore, 1Q earnings would be released in less than two weeks on 24 April.

Earnings per share (EPS) estimates have significantly decreased by 30% from $0.82 to $0.59. This decline matches the stock's year-to-date performance, which has greatly underperformed compared to Nvidia's 76% return. Consequently, the forward price-to-earnings (PE) ratio of this stock remains elevated at approximately 64 times, in stark contrast to Nvidia's more moderate PE ratio of 35 times.

Given the recent new events in Tesla, how can a trader or investor express their bullish views on Tesla using options to participate in the potential moves ahead?

Buying a call option

A long call is an options trading strategy in which a trader or investor purchases a call option on a particular security. This strategy gives the buyer the right, but not the obligation, to buy the underlying asset at a predetermined strike price on or before the option's expiration date.

Example: Buying Tesla out of the money call option at strike of $200 (assuming Tesla is trading at $174 now)

Selling a put option

A short put is an options trading strategy in which a trader or investor sells (or "writes") a put option on a particular security. By selling the put option, the seller collects the option premium and takes on the obligation to buy the underlying asset at the specified strike price if the option is exercised by the buyer. This strategy is typically used when the trader has a neutral to bullish outlook on the underlying asset.

A short put can be an effective strategy for investors looking to potentially acquire shares of stock at a lower price or simply to generate income through premium collection, with the understanding that they are comfortable owning the stock at the agreed-upon strike price should the option be exercised. This strategy also assumes the investor has done due diligence on the underlying asset and is prepared for the possible obligation of buying it if the market moves against their position.

Example: Selling Tesla out of the money put option at strike of $150 (assuming Tesla is trading at $174 now)

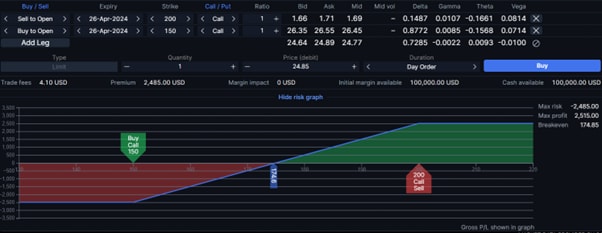

Buying a bull call spread

A bull call spread, also known as a long call spread, is an options strategy used by traders who believe that the price of an underlying asset will rise moderately over a certain period of time. This spread involves buying a call option with a lower strike price and simultaneously selling another call option with a higher strike price. Typically, both options are of the same asset and have the same expiration date.

This strategy allows traders to benefit from a bullish move while managing risk and potential losses. It's a spread with both a defined maximum profit and defined maximum loss.

Example: Tesla call option - selling higher strike of $200 and buying lower strike of $150.

Buying a bull put spread

A bull put spread, also known as a short put spread, is an options trading strategy used by traders who have a moderately bullish outlook on the underlying asset. This spread involves selling a put option with a higher strike price and simultaneously buying another put option with a lower strike price. Both options are usually for the same underlying asset and have the same expiration date.

A bull put spread is a credit spread because the trader receives up-front income and enters the trade with a net credit to their account. It is a way to generate income or buy the underlying asset at an effective price that's lower than the current market price, with risks that are lower than selling a naked put, due to the protective put option purchased at the lower strike.

Example: Tesla put option - selling higher strike of $200 and buying lower strike of $150.

For a bearish case, please refer to the article Tesla option for bears.

Options are complex, high-risk products and require knowledge, investment experience and, in many applications, high risk acceptance. We recommend that before you invest in options, you inform yourself well about the operation and risks. In Saxo Capital Markets' Terms of Use, you will find more information on this in the Important Information - Options, Futures, Margin and Deficit Procedure. You can also consult the Essential Information Document of the option you want to invest in on Saxo Capital Markets' website.

This article may or may not have been enriched with the support of advanced AI technology, including OpenAI's ChatGPT and/or other similar platforms. The initial setup, research and final proofing are done by the author.