Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

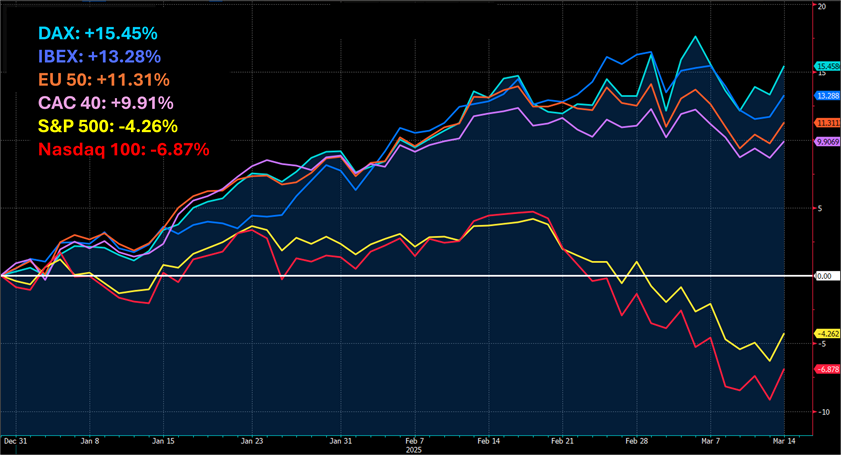

YTD performance (%): DAX Index (turquoise), IBEX Index (blue), Euro Stoxx 50 (orange), CAC 40 (purple), S&P 500 (yellow) and Nasdaq 100 (red), Source: Bloomberg

Germany is poised to transition from fiscal conservatism, with plans to invest €500 billion in infrastructure alongside a substantial increase in defence spending. This will be facilitated by amending the constitution to exempt defence expenditures exceeding 1% of GDP from the debt brake. Such strategic investment is anticipated to bolster industrial sectors, including Siemens Energy, Heidelberg Materials, and Rheinmetall, which have already experienced significant rallies.

Conversely, the United States is scaling back fiscal expenditures through the DOGE initiative, with efforts underway to implement Federal government cuts and target a reduction of the fiscal deficit to 3% of GDP. These fundamental shifts in fiscal policy are contributing to divergent market performances between Europe and the US, with European equities increasingly attracting investor interest. For a comprehensive analysis, please review the articles “Make Europe Great Again?” and "Is U.S. Exceptionalism Fading?” authored by our Chief Investment Strategist Charu Chanana.

Year-to-date, European markets have experienced strong gains, with Germany's DAX leading the way at +15.45%, showcasing robust performance. France's CAC 40 has also seen solid growth at +9.90%. On the contrary, S&P 500 has fallen 4.26% this year, while Nasdaq 100 has lost 6.87% within the same period.

DAX broke out of the ascending channel and trading at all-time highs, first short-term resistance at the last highs of 23,480, trading above this level would likely see further buying pressure. On the downside, the support level looks to be around 22,000 which is near the upper channel and also the 50-day EMA which seems to be holding as support.

CAC 40 looks to still be trading within a range. The first big resistance level would be at 8,250 where price has reversed for the 3rd time. If price can break out of the 8,250 level, we could see further upside from here. On the downside, support levels look to be around 7,900/ 7,950, breaking these levels could see further selling pressure.

IBEX Spain trading at all-time highs and broke out of the ascending channel with the first immediate support at around 13,000. Longer-term support level looks to be around 12,000 where price seems to be bouncing off the 50-week EMA.

Euro Stoxx 50 also traded to all-time highs and broke out of the resistance level roughly at 5,120. This level should hold as support if price does return to this level. This is also close to the 250 EMA where price has found support and bounced off previously.