Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Democratic National Convention (Aug 19-22), New Zealand Trade Balance (Jul). Speakers: Fed’s Waller

Earnings: Estee Lauder, Palo Alto, Agora, American Resources

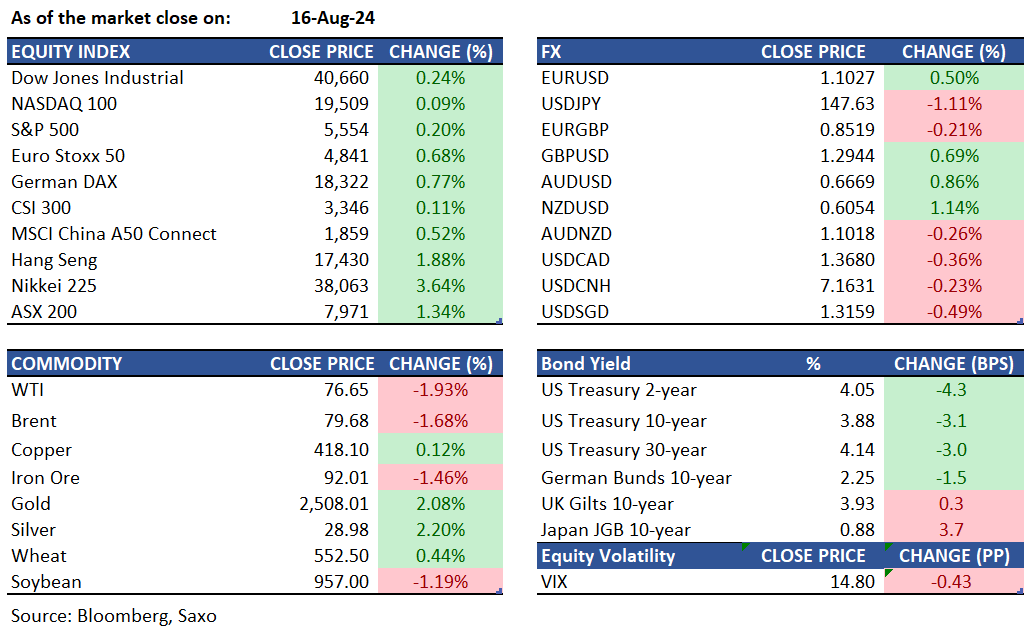

Equities: US stocks closed higher on Friday, with the S&P 500 and Nasdaq each rising 0.2%, and the Dow Jones adding 96 points, building on Thursday's strong rally. A week full of economic data fueled this recovery from August’s early losses where softer inflation, strong retail sales, and fewer unemployment claims alleviated recession fears. Investor sentiment also improved with Federal Reserve officials hinting at a potential rate cut in September. Communication services and the financial sector led the session's gains, while real estate lagged. Investors are now focused on Fed Chair Jerome Powell’s upcoming speech in Jackson Hole and the latest FOMC minutes for monetary policy guidance. Palo Alto Networks and Estee Lauder report earnings on Monday.

Fixed income: New Zealand debt declined in early trading after the government announced a new bond issue. Treasury note futures also fell as investors monitored oil prices to evaluate global inflation, with the yield on this tenor dropping 3bps to 3.88% on Friday. New Zealand’s 10-year note yield rose 2bps to 4.15%. Japanese 10-year note futures ended Friday’s session down 1 tick at 144.82, while the benchmark yield increased by 4bps to 0.87%. During the week ending August 9, foreign investors bought a net ¥1.14 trillion in Japan’s 10-year note futures and ¥1.44 trillion in Japanese debt, including government and other types. These combined purchases were the highest since March 2023, according to data from the Japan Exchange Group and the Ministry of Finance. Commodity Futures Trading Commission data show hedge funds were notably bearish on 10-year note futures, increasing their net short position by $12.5 million/DV01 before August 13. Leveraged accounts also extended net shorts in 2- and 5-year note futures. In contrast, asset managers were mostly bullish, significantly increasing net long positions in 10-year and ultra 10-year note futures.

Commodities: Gold surged to new intraday highs, closing up 2.08% at $2,508.01, as investors sought a safe haven amid early August volatility in US equities and ongoing geopolitical tensions. Meanwhile, WTI crude futures declined by 1.93% to $76.65, trading within a narrow range throughout the day. Brent crude also fell 1.68% to $79.68, was influenced by reports of Qatar urging Iran to reduce tensions with Israel during Gaza cease-fire talks, as well as concerns over weakening demand from China, the world's largest oil importer.

FX: The US dollar ended the week lower despite recession odds weakening as US economic growth continued to look resilient last week. But markets remain positioned for more than 25bps of rate cut at the Fed’s September meeting which sent precious metals soaring. UK’s sterling and Australian dollar also gained as bets on their easing cycles continue to look less aggressive than the Fed’s. New Zealand’s central bank kicked off its easing cycle last week, but the kiwi dollar still ended the week higher as rate cuts remain well priced in. The Japanese yen, however, continued to reverse it gains with the Bank of Japan diluting its hawkish posturing and US recession odds decreasing. We see the FX markets facing a tug-of-war between inflation and recession concerns, and a scenario analysis can be found here.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)