Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

Saxo’s Quarterly Outlook is out and can be accessed here.

The title is Sandcastle economics reflecting that the economy and financial markets look pretty with resilient growth and equities at an all-time high. We expect favourable market conditions to continue in Q3, but sandcastles are naturally fragile and thus our clients should be aware of the potential risks lurking around the corners ranging from geopolitics, US election in Q4, unsustainable fiscal trends, and demographics longer term.

In this Q3 Outlook, you can get our take on why European equities and short-duration quality bonds look interesting. You can also read why energy commodities may come in focus and where to look within forex.

In the news:

Macro:

Macro events: Riksbank Minutes (July), EZ Producer Prices (May), US Challenger Layoffs (June), US ADP National Employment (June), US Initial Jobless Claims (29 June), Durable Goods, Factory Orders Revised (May), ISM Services PMI (June)

Earnings: N/A

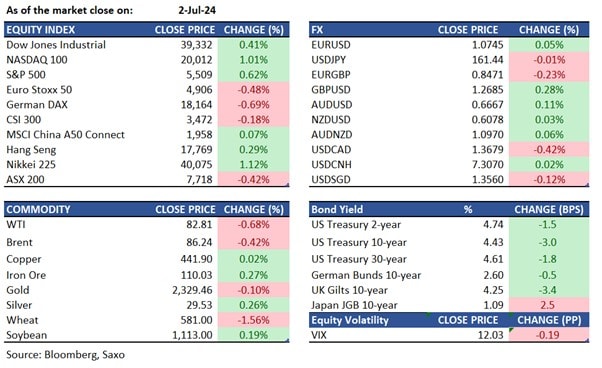

Equities: On Tuesday, both the S&P 500 and Nasdaq reached record highs, gaining 0.6% and 0.8%, respectively. The blue-chip Dow also rose by 162 points, driven by gains in megacap stocks. Investors reacted positively to comments from Federal Reserve Chair Jerome Powell and the latest job report. Sector-wise, consumer discretionary and financials led the gains, while the energy and health sectors lagged. Among the megacap stocks, Apple (+1.6%), Amazon (+1.4%), and Tesla (+10.2%) outperformed, with Tesla shares surging after surpassing delivery expectations. In contrast, Nvidia fell by 1.3% due to concerns about the sustainability of the AI-driven rally. Nikkei 225 rose 1.12% to 40,075, and the Topix Index gained 1.15% to 2,857. Japanese shares climbed for the third straight session, boosted by a weakening yen that benefits export-heavy industries.

Fixed income: The US 10-year Treasury yield hovered near 4.45% as markets assessed economic data and Fed commentary. The JOLTS report showed a rise in job openings for May, suggesting a tight labor market, but downward revisions limited the yield rebound. Markets still expect a Fed rate cut in September. In Japan, the 10-year bond yield rose to around 1.08% amid a weakening yen. Analysts suggest the BOJ might raise rates due to inflation from higher import costs. Japan's economy contracted at an annualized rate of 2.9% in Q1, worse than the previously reported 1.8%.

Commodities: Brent crude fell 0.4% to $86.24 per barrel, retreating from a two-month high. The decline was attributed to diminishing fears of supply disruptions from Hurricane Beryl, which is now expected to have minimal impact on offshore oil production. However, escalating Middle East tensions raised concerns of a broader conflict. U.S. gasoline demand is anticipated to peak this week due to Independence Day travel, with the American Automobile Association forecasting a 5.2% increase in holiday travel compared to 2023. Oil prices have been supported by OPEC+ extending output cuts until 2025. Gold price dropped 0.10% to $2,329.46 per ounce, despite easing interest rates following less hawkish comments from Fed Chair Jerome Powell. While geopolitical uncertainties continue to drive safe-haven demand, physical demand for gold remains somewhat subdued.

FX: The US dollar weakened marginally as Fed Chair Powell’s comments took comfort in disinflation, and hinted that rate cuts could come earlier this year if these trends were to continue. The weaker dollar saw high-beta currencies outperform, while Swiss franc and Japanese yen underperformed. The Japanese yen touched new lows despite the rise in Japan’s bond yields, heading to 161.74 against the US dollar. However any moves towards 165 will continue to increase intervention risks by Japanese authorities. The British pound was stronger going into the July 4 general elections, while the Australian dollar also gained with the RBA minutes from June meeting keeping an August rate hike in play.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)