Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US PPI, US Core PPI

Earnings: JP Morgan, Wells Fargo, BlackRock, BNY, Fastenal

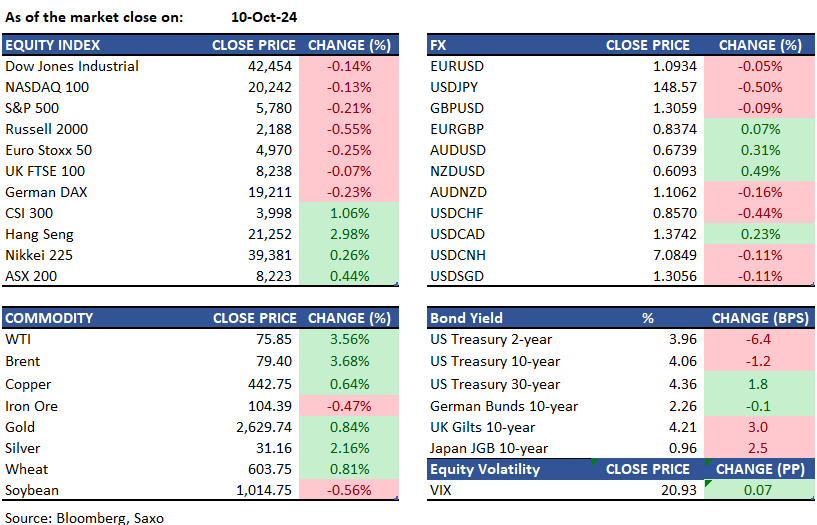

Equities: US stocks closed slightly lower on Thursday after a hotter-than-expected inflation report, adding uncertainty to the Federal Reserve's November rate decision. The S&P 500 and Dow Jones fell by 0.1% and 0.2%, respectively, while the Nasdaq also edged down. September's consumer price index rose by 0.2%, pushing annual inflation to 2.4%. Initial jobless claims hit a 14-month high at 258,000. Nvidia (up 1.6%) and Amazon (up 0.8%) helped cushion the Nasdaq's losses. Investors are also anticipating Tesla's robotaxi reveal. AMD shares fell over 4% despite unveiling new server chips designed to enhance AI processing. Hong Kong equities jumped 2.8% to 21,211 on Thursday, driven by optimism for Chinese fiscal support. Expectations include a CNY 2-3 trillion stimulus package and tax relief. Gains were led by consumer, financial, and tech sectors.

Fixed income: Treasuries ended mixed: short-term yields improved, while long-term yields declined. Despite a higher-than-expected rise in September's CPI, a significant increase in jobless claims took precedence, boosting the Fed rate-cut premium. A sharp rise in oil prices initially pushed up long-term yields, but pressure eased after a 30-year bond auction concluded with a record high indirect award. Late trading saw 2-year yields fall by about 4 basis points, while 30-year yields rose by over 3 basis points. The 2s10s and 5s30s spreads widened by around 5 basis points, below session highs reached before the auction. The $22 billion reopening of 30-year bonds yielded 4.389%, about 1.5 basis points lower than the when-issued yield. The primary dealer award was 12.2%, the lowest in a year, while the indirect award surged to a record 80.5%, offsetting a drop in the direct award to 7.4%. The market's reaction saw the long end of the yield curve outperform, with the 5s30s spread narrowing from session highs.

Commodities: Gold prices rose 0.84% to $2,629 on Thursday, rebounding from a three-week low as markets digested new economic data. US inflation eased to 2.4% in September, slightly above expectations, but rising unemployment claims supported gold by casting doubt on the labor market's resilience to high interest rates. Investors now expect the Fed to implement two additional 25 basis point rate cuts this year. Silver prices also edged higher but remained near a three-week low of $31.16. WTI crude oil futures surged 3.5% to $75.85, and Brent crude oil futures jumped 3.7% to $79.40. The increase was driven by heightened US fuel demand due to Hurricane Milton, which caused significant power outages and fuel shortages in Florida, along with concerns over Middle East supply disruptions and growing energy demand in the US and China.

FX: USD weakened due to disappointing labor market data and a modest increase in consumer prices, indicating that the Federal Reserve might continue to cut interest rates. The consumer price index (CPI) increased by 0.2% in September, marking a 2.4% year-on-year rise, the smallest since February 2021. Economists had predicted a 0.1% monthly increase and a 2.3% annual rise. The Fed has shifted its focus more towards employment, having recently reduced interest rates by 50 basis points. The dollar fell by 0.38% to 148.66 yen, partly due to comments from Bank of Japan Deputy Governor Ryozo Himino supporting further rate hikes. In contrast, the Australian dollar gained 0.14% to $0.67280, driven by an equity rally in China. Additionally, the dollar weakened by 0.12% to 7.084 against the offshore Chinese yuan, ahead of a highly anticipated news conference on fiscal policy by China's finance ministry.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)