Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Fed Kashkari Speech, Fed Waller Speech, China September Trade

Earnings: Karo

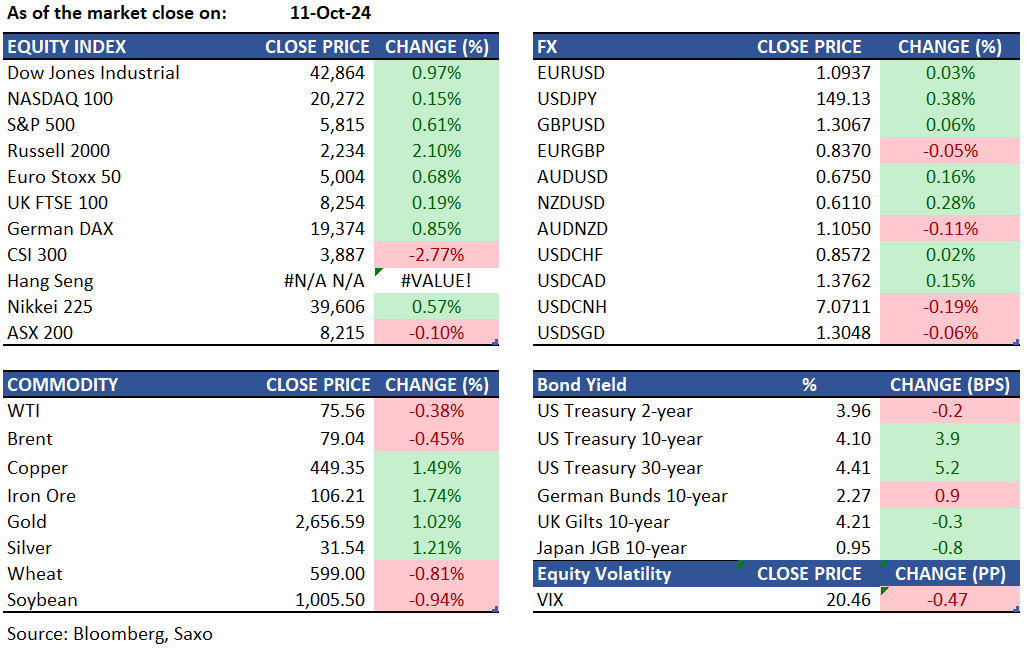

Equities: On Friday, US stocks surged, driven by robust earnings reports from major banks, setting an upbeat tone for the third-quarter earnings season. The S&P 500 and the Dow Jones both reached new peaks, rising 0.6% and 1%, respectively, thanks to strong earnings from JPMorgan (4.4%) and Wells Fargo (5.6%). Despite an 8.8% drop in Tesla shares due to a disappointing robotaxi event, the tech-centric Nasdaq still closed 0.1% higher. Economic data provided additional support, with steady wholesale inflation indicating progress in controlling inflation, although a spike in inflation on Wednesday kept some uncertainty regarding the Fed's future rate cuts. We will expect more earnings this week with more banks reporting tomorrow – Citi, Bank of America, Goldman Sachs and State Street. During a weekend briefing, China's Finance Ministry did not specify the total amount of fiscal stimulus, even though officials pledged additional support for the property sector and financially strapped local governments, which some markets participants deemed weaker than expected.

Fixed income: Treasuries ended Friday mixed, with the yield curve steepening for the second day. The 2s10s and 5s30s spreads neared session highs, aided by benign September PPI data and options flows targeting higher yields for longer tenors. Front-end yields fell by 1-2 basis points, while long-end yields rose by about 3 basis points, steepening the 2s10s and 5s30s curves by 3-4 basis points. The 10-year yield increased by 2 basis points to around 4.08%. The 2s10s spread peaked at 14.5 basis points, and the 5s30s spread exceeded 50 basis points, the widest since October 4. Canada’s yield curve bull-steepened after September employment data, maintaining expectations for Bank of Canada rate cuts. Around 38 basis points of cuts are priced in for the October 23 decision, with 75 basis points expected for the year’s remaining meetings. For the Federal Reserve, about 21 basis points of cuts are priced in for the November 7 decision, with 45 basis points expected for the year’s remaining meetings. Hedge funds reduced net long positions in SOFR futures, while asset managers remained bullish on ultra 10-year note futures.

Commodities: WTI crude oil futures dipped by 0.38% to $75.56 and Brent crude oil futures fell by 0.45% to $79.04 due to concerns over potential supply disruptions from the Middle East conflict and the impact of Hurricane Milton on Florida's fuel demand. Despite this, WTI crude marked its second consecutive weekly gain, surging over 10% since Iran's missile attack on Israel, driven by geopolitical tensions and fears of further supply issues. Hurricane Milton has temporarily boosted fuel demand in Florida, though long-term consumption may be affected by the storm's aftermath. Meanwhile, gold rose by 1.02% to $2,656 and silver increased by 1.21% to $31.54, extending gains as traders assess the Federal Reserve’s policy direction amidst mixed economic data. Copper futures also climbed 1.49% to $4.49 per pound, marking their second consecutive session of gains amid optimism that top consumer China will announce additional stimulus measures at a finance ministry press conference scheduled for Saturday.

FX: USD was flat on Friday as markets digested economic data supporting the Fed's current policy. U.S. producer prices were unchanged in September, hinting at a possible rate cut next month. Consumer prices rose 0.3%, and jobless claims surged due to Hurricane Helene, with next week's data to be affected by Hurricane Milton. USDJPY rose 0.35% to 149.12, DXY was flat at 102.91 after reaching its highest since mid-August. Markets predict a 91% chance of a 25-basis-point rate cut at the Fed's next meeting. The Australian dollar gained 0.22% to $0.6753, and the New Zealand dollar was at $0.611 after a rate cut.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)