Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: China’s PBoC loan prime rate

Earnings: SAP, Logitech, Nucor, Zions, Berkley

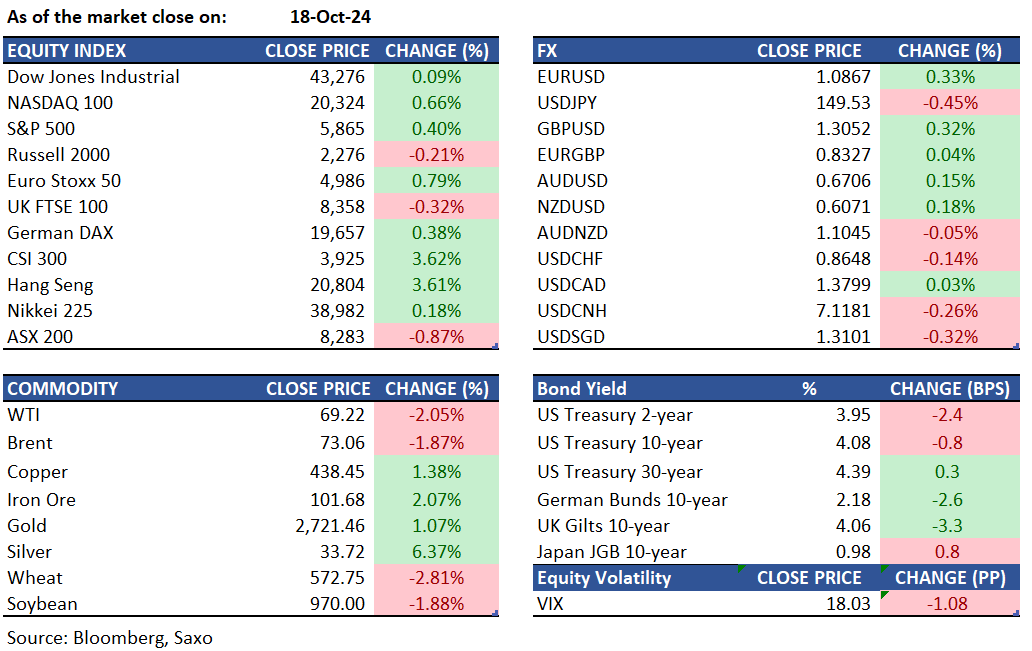

Equities: US stocks ended higher on Friday, driven by robust tech gains after Netflix reported impressive earnings. The S&P 500 climbed 0.3%, and the Dow posted a slight increase, both achieving new records, while the Nasdaq 100 advanced 0.7%. Netflix soared 11% after exceeding expectations for Q3 earnings, revenue, and subscriber growth. Additionally, Apple shares rose by 1.2% following an industry report indicating a surge in iPhone sales in China. Conversely, Procter & Gamble faced a slight decline after missing sales forecasts, and American Express fell 3.1% due to lower-than-expected revenue. Boeing has reached a tentative agreement with the union to end strikes, which includes a proposed wage increase of 35% spread over four years.

Fixed income: Treasuries ended Friday with modest gains, mainly achieved during the U.S. morning as crude oil prices fell and European bonds rallied. The yield curve steepened slightly, with the front-end and belly outperforming. This trend gained momentum in the U.S. afternoon due to significant futures block trades involving 10-year and Bond contracts. Treasury yields had improved by up to 3 basis points, with belly-led gains steepening the 5s30s curve by over 1 basis point. The 10-year yields closed around 2 basis points lower at 4.07%, trailing German bunds and UK gilts by about 1 basis point. Italian bonds notably outperformed, with the 10-year ending approximately 3 basis points richer compared to Treasuries. Gains in euro-zone bonds were driven by expectations of faster ECB easing after Reuters reported some officials pushed to drop a pledge to maintain tight policy. Asset managers liquidated net long positions in 10-year note futures while increasing net long positions in ultra-long futures, according to the CFTC.

Commodities: WTI crude oil futures fell by 2% to $69.2, and Brent crude oil futures declined by 1.9% to $73, marking their steepest weekly losses since early September, with both dropping over 8%. The downturn was attributed to reduced demand forecasts from OPEC and the International Energy Agency (IEA), China's slowing economic growth, and signs of easing geopolitical tensions in the Middle East. Both OPEC and the IEA have revised their demand forecasts downward for 2024 and 2025. In contrast, gold surged past $2,720, setting a new record high, fueled by global demand for safe-haven assets and anticipated further interest rate cuts from major central banks. Silver also saw significant gains, rising 6.37% to $33.72, reaching their highest level in nearly 12 years. This increase in silver prices mirrored the rally in gold, driven by uncertainties surrounding the upcoming US election and escalating tensions in the Middle East, which boosted safe-haven demand for precious metals.

FX: The US dollar plunged lower on Friday on renewed optimism around the Chinese economy fueling optimism for growth in Europe and the rest of world and weakening the US exceptionalism story. However, the greenback was still higher on the week against all other major currencies. The euro rebounded from a two-month low and the British pound climbed back above 1.30. The Japanese yen reversed from 150+ levels after a hot inflation print kept a rate hike on the table for this year. Focus on the Canadian dollar this week as the Bank of Canada is expected to go for a jumbo rate cut and oil prices continue to slide lower.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.