Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Sweden CPIF (Jun), French & Spanish Final CPI (Jun), US PPI (Jun), Uni. of Michigan Prelim. (Jul), Chinese Trade Balance (Jun)

Earnings: JPMorgan Chase, Wells Fargo, Citi, BNY Mellon, Fastenal, Ericsson

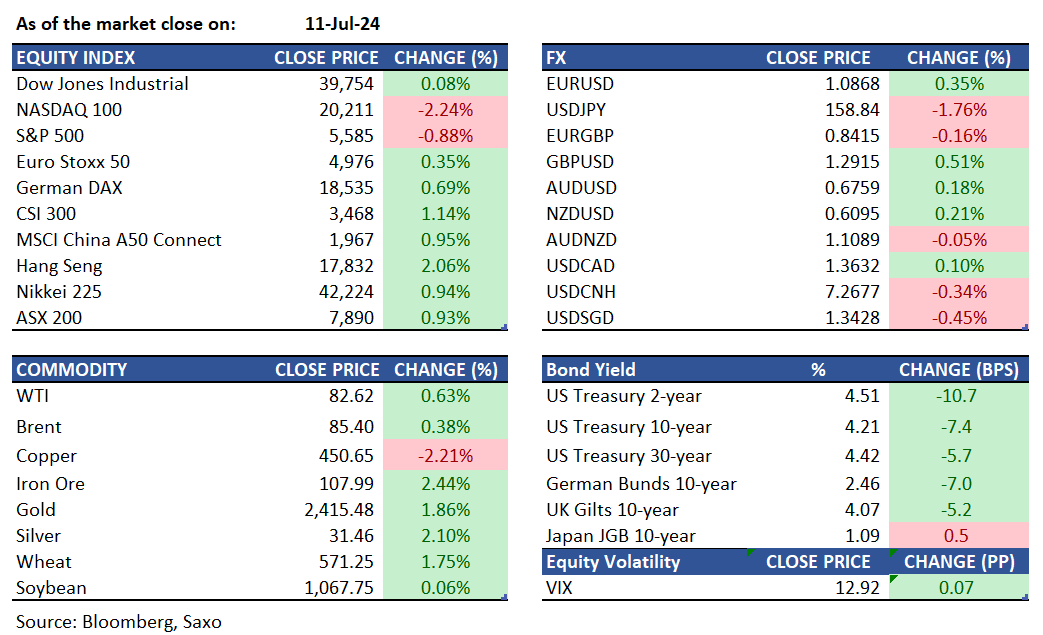

Equities: U.S. equities experienced significant sector rotation following a softer-than-expected June inflation report. The Russell 2000 index surged over 3.5% (YTD +1.2%), while the AI-driven Nasdaq 100, which had been on a 7-day winning streak and hitting record highs, dropped 2.24%. The S&P 500 (SPX), which closed above 5,600 for the first time on Wednesday, also fell more than 60 points from its intraday highs, trading below the previous day's lows. Tesla fell 8.4%, snapping an 11-day winning streak after delaying its Robotaxi launch to October from August. The CPI report increased expectations for a 25-bps rate cut from the Fed in September, with potential for another cut in late 2024, boosting interest rate-sensitive sectors such as homebuilders, finance/lending stocks, solar companies, and utilities.

Fixed income: Treasury yields plummeted after mild inflation data reinforced confidence that the Federal Reserve will cut interest rates at least twice this year. Treasuries rallied on Thursday, highlighted by a significant bull-steepening move driven by increased expectations for Fed rate cuts this year and next. The front-end and belly of the yield curve outperformed, pushing the 5s30s curve to its steepest level since February. Weak demand for the 30-year bond auction during the US afternoon further contributed to the steepening trend. Most rates fell to their lowest levels since March, with two-year yields — which are more sensitive to changes in Fed policy — dropping as much as 13 basis points to 4.486%.

Commodities: Gold surged past $2,410 per ounce, nearing its record-high close, driven by expectations of Federal Reserve rate cuts. WTI crude oil futures rose 0.6% to $82.62 per barrel due to a significant drawdown in US crude inventories and softer inflation. US natural gas futures fell below $2.3/MMBtu, hitting a two-month low due to a larger-than-expected storage build. Copper futures traded near $4.5 per pound amid demand uncertainties in China and rising inventories. Investors are looking to a key political meeting in China next week for potential economic support.

FX: The cooler US inflation fueled gains in the Japanese yen, and suspected intervention from Japanese authorities amplified the move. While Japanese authorities have not confirmed intervention, another few rounds of yen strength this morning have prompted intervention talk. Volatility in the yen remains high and BOJ may need to follow up with a rate hike at the July meeting to make this move in yen sustainable. Sterling also gained on the back of strong monthly GDP report in the UK, but Aussie dollar erased its gains. We wrote an FX note yesterday to discuss the cyclical weakness in the US dollar and which G10 currencies can benefit. Focus today will be on US PPI report to confirm the softening trend seen in the CPI. Sweden’s inflation will also be on the radar with Riksbank hinting at three more rate cuts this year.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)