Macro: Sandcastle economics

Invest wisely in Q3 2024: Discover SaxoStrats' insights on navigating a stable yet fragile global economy.

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Chinese Industrial Profit (Jun), US Dallas Fed Manufacturing Business Index

Earnings: McDonald’s, Onsemi, Philips, Tilray, Sprouts Farmers

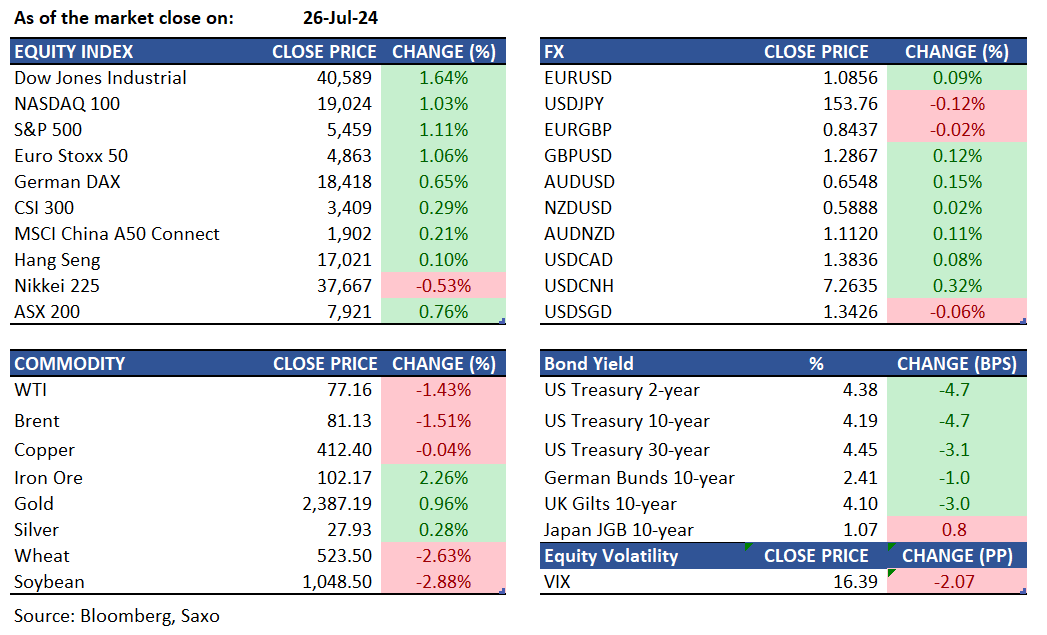

Equities: US markets experienced an upbeat session on Friday as the S&P 500 rose by 1.1%, the Nasdaq 100 was up 1%, and the Dow climbed 654 points. Investor sentiment was lifted by data showing potential signs of easing inflation, raising the possibility of an interest rate cut in September. The PCE, the Federal Reserve's preferred inflation metric, matched expectations, with the core rate rising slightly by 0.2% against a forecast of 0.2%. All sectors saw gains, led by industrials, notably 3M, which soared 23.1%, reaching a milestone not seen since 1972. Conversely, DexCom plummeted 40% after cutting its sales forecast for the year. Apple, Amazon, Microsoft, and Meta are set to report quarterly results this week, alongside McDonald's, Starbucks, Boeing, Exxon Mobil, and Chevron. Markets are also awaiting the Federal Reserve's policy decision on Wednesday.

Fixed income: Treasuries ended Friday with lower yields and a slightly steeper curve, as benign June PCE price index data reinforced expectations for Fed rate hikes starting in September. Gains were supported by favorable short-term technical factors, including no auctions until August 6 and next week’s month-end index rebalancing. The Bank of Japan will conduct its final bond-purchase operation before announcing a policy decision later this week. On Friday, the implied volatility of Japanese 10-year note futures surged to its highest level since late October. Additionally, Singapore and Australia are set to auction bonds. The Monetary Authority of Singapore will auction S$1.7 billion of July 2039 bonds, while the Australian Office of Financial Management will auction A$900 million of November 2028 notes on Monday.

Commodities: Gold prices rose by 0.96% to $2,387 an ounce, recovering some losses after a 2.5% drop on Thursday due to a non-alarming PCE inflation report. Gold is down 4.5% from its record high of $2,483.60 on July 17, amid optimism for a Federal Reserve rate cut in September. WTI crude oil futures fell 1.43% to $77.16 per barrel, and Brent crude dropped 1.51% to $81.13 per barrel. Nymex natural gas futures declined 5.73% for the week to $2.006, marking a four-session fall and a 13.87% drop over the past two weeks.

FX: The US dollar trades mixed at the start of a pivotal week with three key central bank meetings ahead from the Federal Reserve to Bank of Japan and Bank of England along with key Mag 7 earnings as well. This is pushing down the low-yielding currencies such as the Japanese yen and the Swiss franc which were the outperformers last week. The Japanese yen faced carry unwinding risks last week, which could be prolonged if the Fed signals a rate cut this week, however BOJ’s inaction could bring back yen weakness. On the flip side, the Australian dollar and New Zealand dollar are in gains, and Australia’s quarterly inflation report will also be one to watch this week. Sterling is unchanged after ending last week lower, with economists expecting the Bank of England to cut rates this week.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)