Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: BoJ Bond Meeting 9-10, EIA STEO; Australian Consumer Sentiment, Powell Testimony (Senate), NATO annual summit in Washington

Earnings: HelenOfTroy, Byrna, SGH, Kura, Saratoga

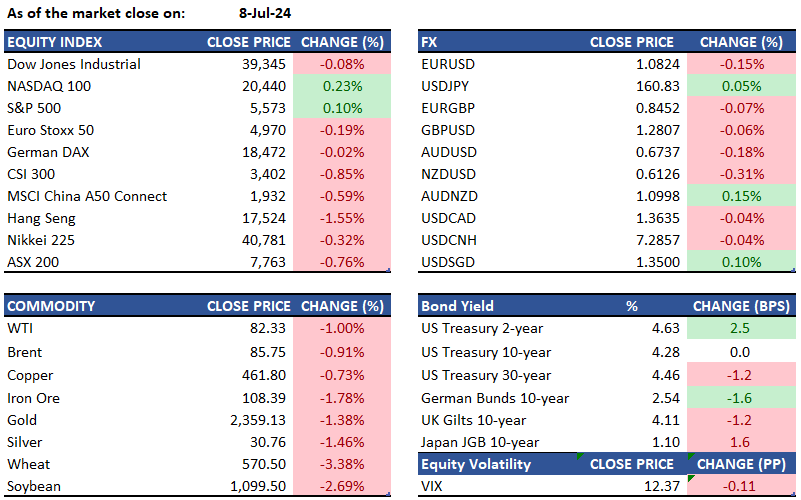

Equities: The S&P 500 and Nasdaq 100 reached new highs, rising 0.1% and 0.23% respectively, continuing strong US market momentum. The NY Fed's June one-year expected inflation was 3%, down from May's 3.2%. Three-year and five-year ahead inflation expectations were 2.9% and 2.8% respectively. Tesla achieved a ninth consecutive day of gains due to strong delivery numbers, erasing year-to-date losses. Powell's congressional testimony starts tonight, ahead of Thursday's US CPI data.

Fixed income: Treasuries ended Monday with mixed results and a flatter yield curve, largely driven by movements in European bond markets following the French election results. The front end of the curve saw significant activity as investors prepared for Fed Chair Jerome Powell's two days of congressional testimony on monetary policy starting Tuesday. Investors eagerly purchased Treasury's three- and six-month bills at Monday's auctions, spurred by expectations of Federal Reserve interest-rate cuts that prompted a shift further out on the yield curve. The Treasury auctioned $76 billion of three-month bills at a yield of 5.23% and $70 billion of six-month bills at 5.08%. Data from the Commodity Futures Trading Commission revealed that asset managers increased their net long positions in Treasury futures for the week ending July 2, displaying notable bullishness in 10-year and ultra 10-year note futures. In contrast, hedge funds expanded their net short positions in both the 10-year and ultra 10-year contracts.

Commodities: Gold fell over 1% to below $2,360 per ounce, retreating from a six-week high due to market pauses after a rally driven by potential Fed rate cuts. Silver also dropped below $31 per ounce amid technical corrections and profit-taking. Brent crude oil futures decreased to $85.7 per barrel, continuing the pullback from a two-month high of $87.5 reached on July 4th. Despite Hurricane Beryl hitting Texas and causing major oil producers to adjust operations, expectations that the storm would not significantly impact output led traders to reduce positions reflecting earlier supply concerns. Iron ore prices fell 1.55% to $111.31 per tonne after a four-day rally, with investors assessing China's outlook. Copper futures decreased to around $4.60 per ounce following a surprise decline in copper cable and wire production in China, indicating weak demand.

FX: The US dollar struggled to find a direction in Monday’s trading and ended marginally higher. The kiwi dollar came under pressure ahead of the Reserve Bank of New Zealand’s decision due on Wednesday as discussed above. The Swiss franc also could not maintain its early gains that were seen on the back of haven flows as French election jitters continued. However, markets were relatively calm on the outcome of French elections and concerns regarding an unstable coalition were offset by a relief that right-wing parties did not get an absolute majority. The euro also recovered from its early weakness. The only major currency to close in green against the US dollar was the Canadian dollar, but gains were trivial.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.