Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

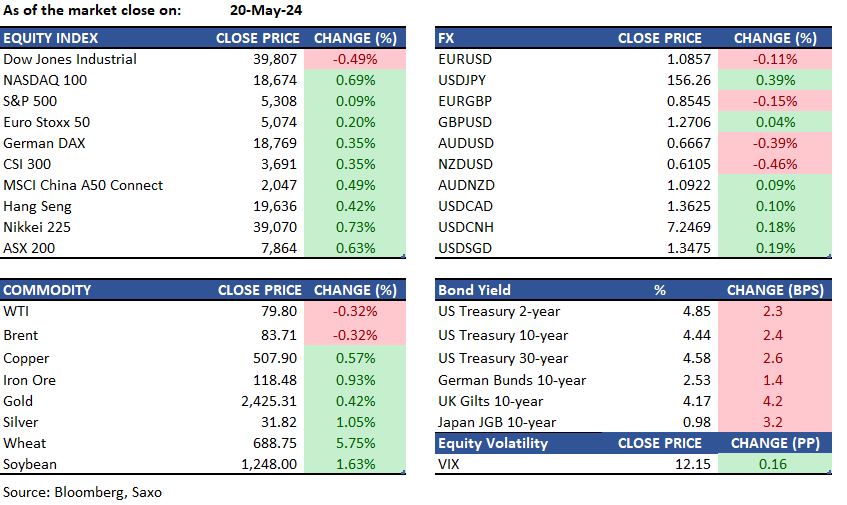

Equities: The S&P 500 inched up, buoyed by hopes for rate cuts and positive sentiment around Nvidia's upcoming earnings, stirring a risk-on mood. Nvidia's rise, echoed by other AI-focused firms like AMD and Intel, contributed to the Nasdaq 100's 0.7% rally, despite a tick up in the CBOE Volatility Index. Asian markets had a tepid start, with mixed futures as investors await Nvidia's report, the final of the "Magnificent Seven" tech giants to announce earnings, which could reinforce the strong demand for its AI chips. U.S. futures remained stable amid the anticipation. Microsoft has revealed new PCs featuring AI chips from Qualcomm. These new Surface PCs will be designed to meet Microsoft's Copilot+ standard for executing artificial intelligence models.

Jamie Dimon stated that JPMorgan would not engage in significant stock buybacks at current high prices, indicating a preference for repurchasing when the stock value drops. Following these remarks, the bank's shares, which had recently closed at a record high, declined by 4.5%. Despite the day's losses, the bank's shares have still risen 15% this year. Palo Alto Networks dropped 9% in post-market following the fourth-quarter guidance, which was less optimistic than anticipated at the midpoint of its projections.

FX: The U.S. dollar strengthened on Monday, echoing an uptick in Treasury yields as Federal Reserve officials reiterated a commitment to maintaining a tight monetary policy. The Bloomberg Dollar Spot Index saw a modest increase of 0.1%, with the Mexican peso's gains helping to temper the index's rise. USDJPY climbed to 156.23, a 0.4% increase, driven by stop-loss actions and yen sales, with the May high of 156.74 in sight if the uptrend continues. The euro dipped against the dollar, with EURUSD down 0.1% at 1.0861, as ECB's Martins Kazaks commented on aligning rate cuts with the slowing inflation in the eurozone. GBPUSD remained relatively unchanged, with upcoming UK CPI data drawing attention. USDCAD held steady before Canadian CPI figures are released, while the Australian dollar weakened slightly alongside a retreat in copper prices and a decline in the offshore yuan. The New Zealand dollar underperformed, falling 0.4% as the market anticipates the upcoming RBNZ meeting.

Commodities: Gold prices reached record highs, settling at $2,438.50 an ounce, driven by safe-haven demand. Copper prices surged, with three-month copper on the London Metal Exchange rising 2% to $10,897 per metric ton, peaking at $11,104.5. Bitcoin prices rose by 2.5% to above $68,650 and Ethereum soared 18% amid new speculation that spot Ether ETF could be approved this week, boosting other cryptocurrencies and related stocks. Brent Crude futures settled at $83.71/bbl, while U.S. WTI crude oil futures settled at $79.80/bbl. Natural gas futures settled at $2.751/mmBtu, reach 4-month highs, driven by early season heat in Texas.

Fixed income: Treasuries experienced a third consecutive day of decline, offsetting the previous week's bond rally due to indications of reduced inflationary pressures in the US. The 10-year yield remained around 4.43% at 2:45 p.m. in New York, with a surge in futures market selling contributing to an early session slump. Although losses were partially reversed throughout the day, yields for all maturities were still elevated by approximately 1 basis point

Macro:

Macro events: Australia May Westpac consumer confidence, Canada April CPI

Earnings: XPeng, James Hardie, Kingfisher, Lowe’s, Macy’s, Toll Brothers

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)