Saxo Bank’s High Conviction Equities is a list of investment recommendations on stocks that are viewed to be an attractive investment theme with return expectations above the expected market return. The investment horizon is long-term which is typically one year or more unless the price target has been reached. Lynas is one of our high-conviction equity ideas over the coming years as Rare Earth demand enters a new and interesting phase in the new energy revolution.

Rare Earths are essential for many future-facing technologies Lynas Corp (ASX:LYC) explores, mines, and produces Rare Earth (RE) minerals. RE are counterintuitively not “rare” but are difficult to find in deposits that are not contaminated with other materials and with a concentration high enough to be mined economically. Lynas operates the world’s highest grade operating Rare Earths mine in Mt. Weld (a collapsed volcano), Western Australia, and a chemical processing operation, Lynas Advanced Materials Plant, in Kuantan, Malaysia.

The most valuable Rare Earth Oxide (REO) produced at the LAMP is Neodymium-Praseodymium (NdPr), of which Lynas is the second largest producer globally and leading supplier to the free market. Other REO’s produced by Lynas include, Cerium, Lanthanum, Dysprosium, and Terbium.

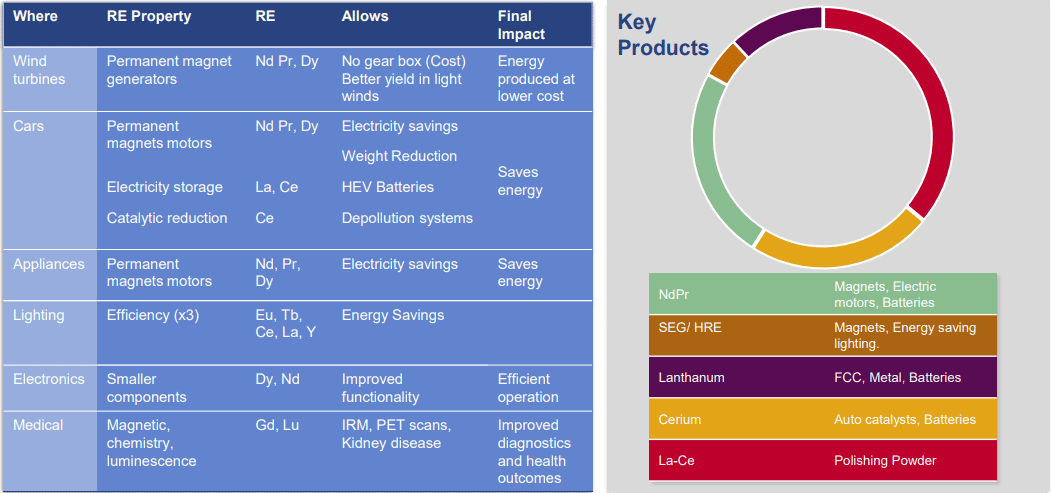

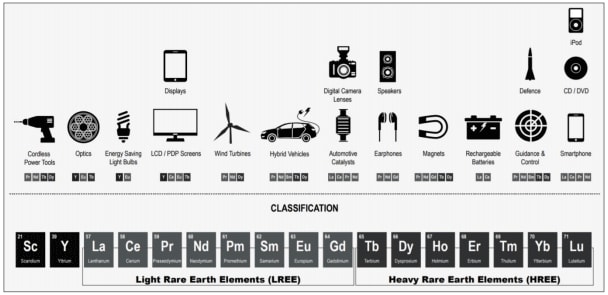

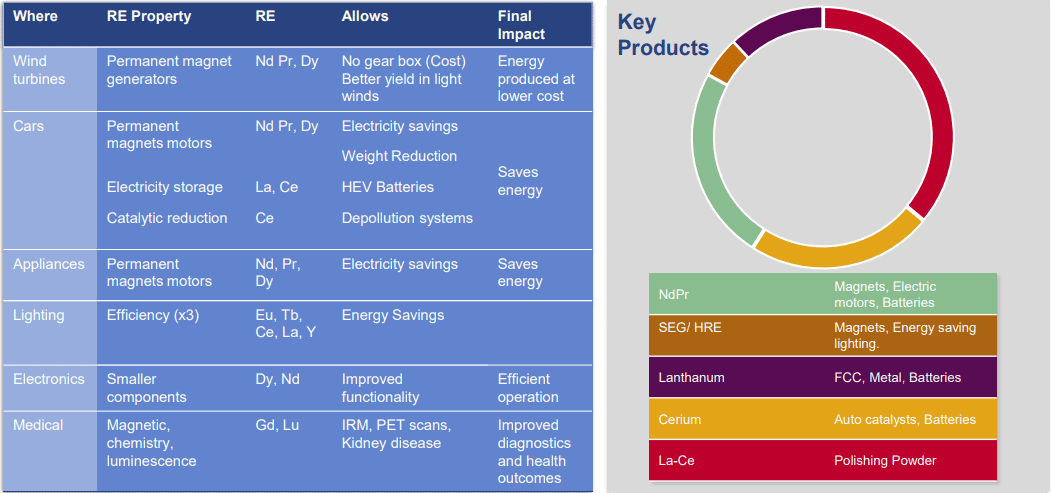

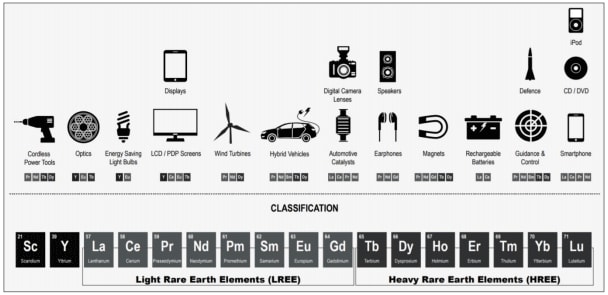

Rare earths are crucial for a number of high growth, high-tech commercial industries including hybrid and electric vehicles, renewable energy (wind turbines), energy-efficient lighting, advanced electronics, chemicals, and medical equipment. Without rare earths a number of high-tech industry applications would not be viable. Take the iPhone as an example: screens are polished with lanthanum and cerium and within the phone is a magnet made with neodymium and praseodymium.

Rare earth applications:

Source: Lynas

Source: Shades of Grey, Wikipedia

The rare earth market is significantly dominated by low-cost producer China, both in terms of supply and demand. Chinese rare earth producers have benefited from strong governmental support aimed at providing downstream consumers with a competitive advantage as the high-tech and green tech industries that rely on rare earths are crucial to propelling the next phase of China’s economic expansion. But although China is currently a major producer, the source is not sustainable and over the coming years China could become a net importer of rare earths, particularly of Dysprosium.

Although China dominates the rare earths market, for now, Lynas benefits from strong demand for RE sourced outside of China and Lynas has long-term relationships with end users globally. Lynas is an attractive investment option to gain exposure to the RE thematic, being the only miner and processor of RE worldwide outside of China but also maintaining efficient processing capabilities and quality customer relationships. Lynas is one of our high-conviction equity ideas over the coming years as REO demand enters a new and interesting phase.

Lynas' average selling price (revenue basis) of REO has increased from AUD 15.7/kg in 2016 to AUD 18/kg in 2017 according to the annual report. UBS forecast this average basket of REO will rise to AUD 23/kg by 2020.

As demand for magnetic materials grows Improved pricing for REO is expected to continue, benefitting Lynas. Permanent magnets, containing NdPr which Lynas is the second largest producer of globally, are a key enabler of electric vehicle technology, a sector which we expect to grow considerably in size becoming a game changer for NdPr demand.

NdPr analysts are more bullish than other REO with UBS having a long-run target for NdPr prices stabilising at $60/kg.

According to Peak Resources NdPr white paper the automotive industry alone will have the potential to absorb today’s global annual production of legally manufactured NdPr in just one year when electric mobility reaches

a global market share of approximately 40%.

The electric vehicle industry is one of the most topical investment themes today with government backing meant to kickstart a revolution in transportation away from the internal combustion engine (ICE). There are vast opportunities to reshape the global economy with the application of clean energy to cars, but the transport industry doesn’t stop there, aviation, shipping, and trains are all forecast to become part of the green revolution within which REO currently feature heavily in the clean energy technology.

Forecasted new BEV sales globally (via Bloomberg):

Valuation Aside from the current trajectory for RE demand, Lynas itself is a high-quality profitable producer with sufficient ore reserves to maintain future growth. The company's half-year FY'18 results delivered record profits stemming from operational and cost improvements over the past four years, revenue growth of 75%, and REO production growth of 21% from the previous year indicative of strong relationships with customers in Japan and China.

Balance sheet improvements were also attained in FY'18. Lynas reduced debt and increased EV by nearly five times through early repayment of US$20 million to the Japan Australia Rare Earths (JARE) and conversion of convertible bonds. The current Enterprise Value (calculated as the market capitalisation plus debt, minority interest and preferred shares, minus total cash and cash equivalents) is AU$1,433.4m, translating to a trailing 12-month EV/EBITDA multiple of 13.6 compared to 11.7 for global equities.

Sector multiple comparisons are limited given Lynas is the only miner and processor of REO worldwide outside of China; Chinese counterparts lack compliant data points to perform a valid comparison. Another listed Australian NdPr miner has yet to generate revenue from sales so a valuation comparison is defunct.

Lynas' free cash flow yield (FCFY - a representation of the income (free cash flow) created by an investment), based on enterprise value is 5% indicating the company is generating 5% of its EV in free cash flow yearly to reinvest and grow the business. Free cash flow yield combined with capital growth generates an attractive rate of return for an investment in Lynas.

Another key consideration for this investment is Lynas' ability to maintain margin expansion as REO demand picks up and the cost improvements continue to take effect. Sell side analysts estimate EBITDA margins will expand from 34% this year to 49% in 2021.

In 2017, Lynas announced the AUD 35m NEXT project in order to increase output, expand its product range and deliver increased production efficiency. As part of this project, Lynas commenced a drilling project at Mt. Weld to ensure future demand can be met. In August 2018, the results of the first drill confirmed a 25+ year economic life at increased output rates allowing the company to cement long-term commitments to customers and continue to invest in mining technology and improvements at the LAMP processing plant.

Lynas is now on track to produce 600 tonnes/month of NdPr by January 2019, highlighting its capability to improve performance within production volumes and not just across the balance sheet.

As production volumes increase, sales revenues rise, and EBITDA margins expand, Lynas’ balance sheet will continue to improve. In the next three years, gross profit is estimated to more than double from AUD 121m to AUD 387m, which combined with the aforementioned should provide accretive earnings per share expansion to investors and a higher valuation.

Source: Lynas