Courses

CFDs - An introduction

In this module we’ll explore Contracts for Difference, better known as CFDs, and learn what they are and how they work. You’ll see the difference between a CFD trade and a stock trade and get an insight into the pros and cons of CFD trading.

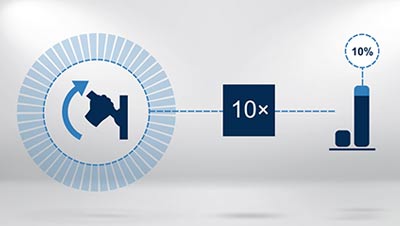

CFDs Margin, leverage and assets for CFD trading

In this module we’ll expand on the subject of margin and leverage and look more closely at the key characteristics of CFDs. We’ll also explore ‘short’ positions and how they impact profits and losses.

Equities - An introduction

Equities, or stocks, are one of the simplest ways to trade. You’ll be introduced to the basics of what they are, what owning them means and how you can buy and sell as a trader. Because the principles of stock trading are simple and this is usually where novice traders like to start.

Equities - Why do investors buy shares?

Dividend income and capital growth are the two major reasons investors buy shares. These two groups have different investment objectives. In this module we’ll explore the rationale and objectives of different types of investors.

Equities - How do investors choose shares?

In this module we’ll explore the reasons why investors choose to buy or sell shares. In particular we’ll focus on the differences between fundamental and technical analysis and factors that may impact a decision for both.

Forex - An introduction

In this introduction to Forex module you’ll be taken through the basics of the market. We’ll introduce you to the key concepts and terminology and look at who and what is involved in Forex trading.

Forex - Margin and leverage

In this module, we’ll explore the concept of margin and leverage in more depth. It is not only a key part of forex trading, it can potentially make a huge difference to your trades – positively and negatively – so we assess the various aspects here.

Forex - Technical analysis introduction

Are you new to technical analysis? Then look no further! This course will introduce you to technical analysis and ‘charts’ to give you a solid understanding of these two core concepts.

Forex Options - An introduction

In this introduction to you’ll be taken through the basics of trading forex options. ‘Options’ may sound like a complicated and complex financial term but in reality they don’t have to be. We’ll introduce you to the key concepts and look at what’s involved.

Futures - An introduction

This module is all about futures trading, what futures contracts actually are, how they work in the marketplace and why you might want to start trading them. Though not a preferred instrument for risk-averse investors, the futures market is extremely liquid and is therefore highly attractive to the more enterprising trader.

Futures - Discovering technical analysis

In this course we will introduce you to basics of technical analysis and why it’s important. We’ll also describe some key terminology and start to examine chart trends.

Futures - Support, resistance and trends

Markets tend to move in a general direction, or trend. In this module we’ll explore technical analysis in more detail, including how to identify trends, as well as key levels of support and resistance.

Options - An introduction

This course is all about stock options – which are a by-product (or a derivative) of stocks. You’ll explore how they work, the key terminology involved and how options can be used to buy and sell.

Options - Long vs short, assignment, exercise & ‘moneyness’

In this module, you’ll learn the difference between being long and being short on an options contract. And, in addition, we’ll explain the process of assignment and exercise and also look at the ‘moneyness’ in an option contract.

Options - Trading long calls and puts

In this module, you’ll learn how to trade a 'long call' and a 'long put' through a couple of real examples. We’ll walk you through the process looking at the background of the trade, the market outlook, choosing an expiration date and so on. And you’ll see how a trade develops.

Bonds - An introduction

In this first module about bond trading you’ll be given a broad understanding of the bond market. You’ll look at those people and institutions that issue bonds as well as what bonds are actually used for.

Bonds - How is a bond structured?

In this module, we'll describe what happens when a bond first comes into existence. This is called the bond’s ‘issuance’ and there are a number of decisions that have to be made around this process. We'll look at how bonds are structured to make them attractive to investors and how the end-to-end process works.

Bonds - The price of a bond (part 1)

This module is part one of two on the topic of the price of bonds. The course is the beginning of our exploration of bond trading in the secondary market.

Bonds - The price of a bond (part 2)

Following on from part 1, we now need to understand the market influences that can change the price of a bond. This second tutorial on bond prices will explore the primary market factors that can cause prices to change.

IMPORTANT INFORMATION

The materials published on all Saxo Group websites should not be considered as financial, investment, tax, trading or other advice, or recommendation to invest or disinvest in a particular manner. Saxo assumes no liability for any losses resulting from trading in accordance with a perceived recommendation or reliance on Saxo material. Past performance is not indicative of future results.