Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Trading Desk – Navigating BoJ’s Rate Decision

Macro backdrop

Markets are uncertain if the Bank of Japan will raise interest rates or maintain its current policy on Thursday 19th Dec 2024, as BOJ officials suggest more time is needed to evaluate economic data. Japan's core machinery orders surpassed expectations in October, suggesting a positive outlook for capital spending, with manufacturing and services improving in December. Traders see just a 20% chance of a Dec rate hike as the BOJ views delaying tightening as low-risk and waits for more wage growth evidence and Trump policy risks in Jan 2025.

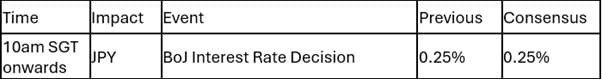

BoJ Interest Rate Decision

Price action

The last time the Bank of Japan raised rates in July earlier this year, its first after 17 years, the USDJPY fell nearly 14% over the next three months while the Nikkei 225 dropped almost 30% over a shorter period. The options implied volatility for USDJPY has surged to 20% from an average of about 10% ahead of the event, with the market currently pricing a potential USDJPY movement of +/- 2.3% following the rate decision. If the BoJ decides not to hike rates, USDJPY is unlikely to move significantly, as traders have largely anticipated a no-change scenario. However, if the BOJ delivers a hawkish commentary during the press conference, it could trigger a significant yen recovery, even without a rate hike, especially following a potential Fed rate cut the previous night.

Trade Inspiration Short Strangle Strategy:

A short strangle involves selling both a call option and a put option with the same expiration date but different strike prices. This strategy is typically employed when a trader anticipates minimal movement in the underlying asset's price and seeks to profit from the decay of the options' premiums over time.

Example:

Key Risks:

This strategy is suitable for traders who expect the USDJPY to remain within a specific range until the expiration date. Strikes can be tweaked to your preference, changing the premiums received in the process.