Key points:

- Macro: Trump wants to remove Powell as rates aren’t coming down fast enough

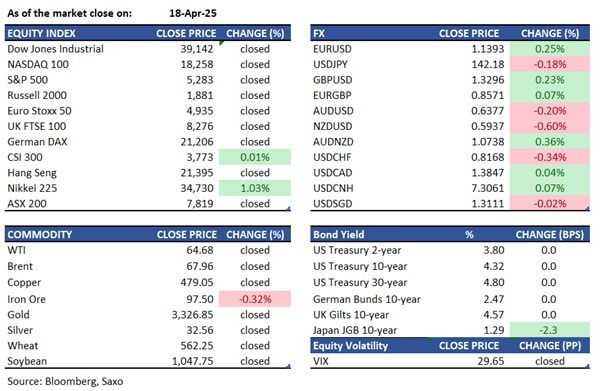

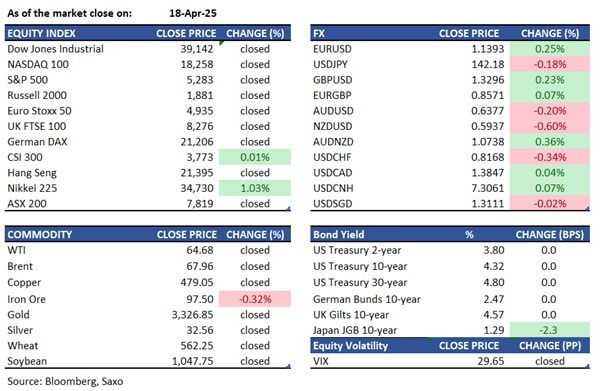

- Equities: Easter Monday with many markets closed. US opens tonight after 1 day break.

- FX: The US currency has fallen for three weeks, reaching its lowest since September 2024

- Commodities: Gold has set records this year, with ETF holdings rising for 12 weeks

- Fixed income: Treasuries bear steepen amid reduced trading volume

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- FDI in China dropped 10.8% year-on-year to $36.9 billion in Q1 2025, after a record 27.1% fall in 2024. The decline reflects reduced foreign confidence due to deflationary risks, delayed government stimulus, and the threat of US tariffs.

- Japan is considering relaxing automobile safety rules and increasing US rice imports in tariff negotiations, as reported by Nikkei and Yomiuri. South Korea's acting President Han stated they won't oppose US tariffs and are open to reducing trade barriers, recognising a historical debt. South Korea's Trade Minister confirmed trade consultations with the US this week at their request, according to FT.

- Fed's Goolsbee observed that businesses are pre-emptively purchasing ahead of tariffs, potentially causing a temporary activity spike before a decline, though April's data was positive, according to CBS Face the Nation. Fed's Daly said the economy is on track, but inflation risks are high, suggesting policy might stay tighter longer, but not indefinitely.

- Trump is studying if he can remove Fed Chair Powell as he laments that rates are not coming down fast enough.

Equities:

- US - US stock futures fell on Monday after the long holiday weekend, as concerns persisted over the lack of direct US-China trade talks. Despite ongoing tariff discussions with other economies, Chicago Fed President Austan Goolsbee cautioned tariffs might hurt US economic activity by summer. Investors face a busy earnings week, with over 100 S&P 500 companies reporting, including Tesla and Alphabet, alongside Verizon, AT&T, Boeing, American Airlines, and Intuitive Surgical. Last week, the Dow, S&P 500, and Nasdaq Composite declined by 2.66%, 1.5%, and 2.62% respectively.

- EU - European stock markets trimmed earlier losses to end nearly flat on Thursday after the ECB delivered a widely expected rate cut. The Stoxx 50 dipped 0.2%, while the Stoxx 600 edged down 0.1%. Siemens Energy surged 10% after raising its 2025 outlook, while Hermès fell 3.2% after posting slightly weaker-than-expected sales. The ECB lowered rates by 25 basis points for the third time this year, citing subdued inflation and ongoing risks to Eurozone growth amid global trade tensions. On the trade front, sentiment improved slightly after President Trump said “big progress” was made in talks with Japan, raising hopes for broader deals.

Earnings this week:

Monday: BOH, BOKF, CADE, CATY, CMA

Tuesday: VZ, GE, LMT, SAP, TSLA

Wednesday: BA, T, IBM, NEE, TXN

Thursday: INTC, GOOGL, TMUS, LRCX, PEP

Friday: ABBV, CL, PSX, POR, CNC

FX:

- The dollar weakened against all G10 currencies due to trade war concerns and potential early exit of Fed Chair Powell. The Bloomberg Dollar Spot Index fell 0.2%, extending last week's decline, amid reports Trump may dismiss Powell. The US currency has dropped for three weeks, reaching its lowest since September 2024.

- EURUSD rose 0.4% to 1.1443. USDCHF fell 0.5% to 0.8129.

- USDJPY dropped 0.5% to 141.52, its lowest since September 18. Japanese Finance Minister Kato and US Treasury Secretary Bessent plan to meet in Washington on April 24.

- NZDUSD edged up 0.3% to 0.5953.

Commodities:

- Oil prices fell due to concerns over the US-led trade war and US-Iran nuclear talks. Brent dropped over 1% to near $67, while WTI fell below $64. Data on Trump's trade policies may provide new direction this week.

- Gold hit a record high due to the US-led trade war, boosting safe haven demand. It approached $3,354 as the dollar weakened. The IMF will revise growth forecasts, and data on economic activity will follow. Gold has set records this year, with ETF holdings rising for 12 weeks, the longest run since 2022.

Fixed income:

- Treasuries ended lower on Thursday in a holiday-shortened session, with the yield curve steepening because of a large Ultra Bond futures sale and rising oil prices. European bonds contributed to the shift after ECB remarks on trade tensions impacting growth. Trump's criticism of Fed Chair Powell earlier also affected the US curve.

For a global look at markets – go to Inspiration.