Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

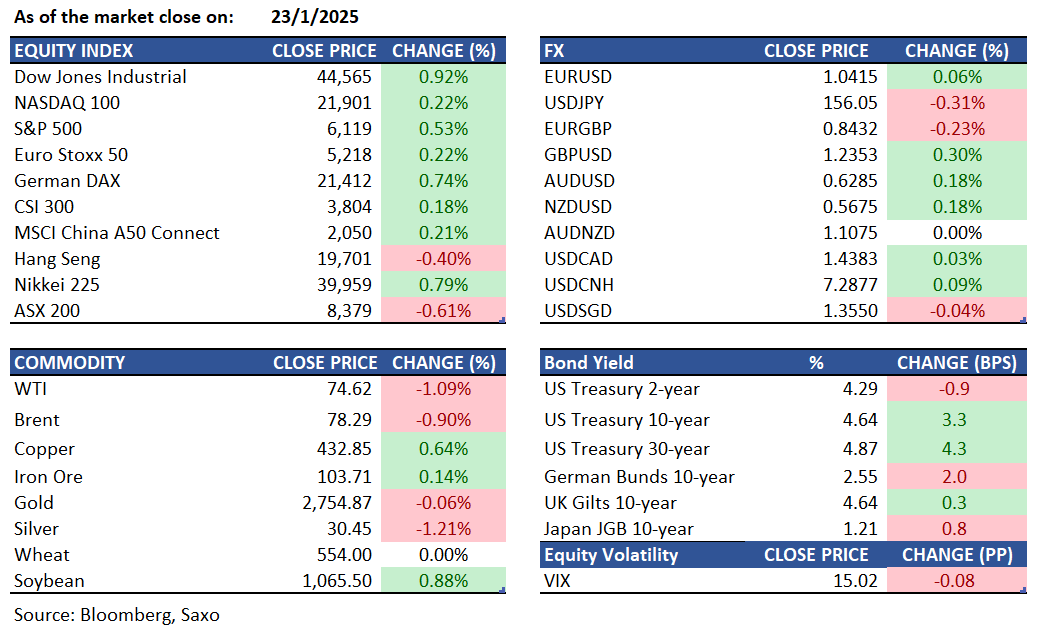

Macro:

Equities:

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.