Saxo launches SaxoPartnerConnect, a one-stop digital advisory solution enabling wealth managers to provide value-added scalable services

• Available to Saxo’s partners globally, SaxoPartnerConnect empowers advisors in the wealth management space by addressing common pain points, including operational and productivity challenges, business success challenges and relational challenges

SINGAPORE, 3 NOVEMBER 2022 – Saxo, a leading Fintech specialist that connects people to investment opportunities in global capital markets, announced today at the Singapore Fintech Festival that it has launched SaxoPartnerConnect, a one-stop digital advisory solution that supports self-directed, advisory and discretionary business, enabling wealth managers to better service their clients, while offering scalability and reducing costs and complexities.

Currently, wealth management services typically come from five sources: Banks, brokers, independent financial advisors, external asset managers, and robo advisors. The most common pain points for wealth managers in terms of the tools available to them to support their business model include:

• Scalability

• Regulatory requirements

• Non-scalable and expensive legacy tech stack

• Surrounding services, such as reporting, corporate actions, execution and settlement, and market data, are rarely well integrated

Besides its direct business offering trading and investing platforms and services for retail investors, Saxo Institutional covers wholesale clients (B2B2C) and direct B2B clients. Institutional partners utilise Saxo’s platforms, technology and capabilities to give their end clients access to global capital markets, allowing Saxo’s partners to focus on servicing their clients (Banking as a Service). Partners are serviced via dedicated partner tools and through all of Saxo’s platforms, including Open API and FIX API.

“From Saxo’s position as a provider of solutions across this whole universe, we have seen a significant increase in activity from banks and other financial institutions looking to build scalable digital solutions using tools developed by external partners. The massive operational efficiency we offer with SaxoPartnerConnect means wealth managers can now handle more clients while not compromising quality and remaining compliant to regulatory needs,” Ivan Chang, APAC Head of Saxo Institutional, said.

SaxoPartnerConnect: Key features

For advisory companies that do not have the IT budgets to run their own in-house Portfolio Management System and consolidated client front end, the choice of technology provider is vital to reduce cost and complexity and to maximise advisors time on understanding their clients so they can provide more value-added services.

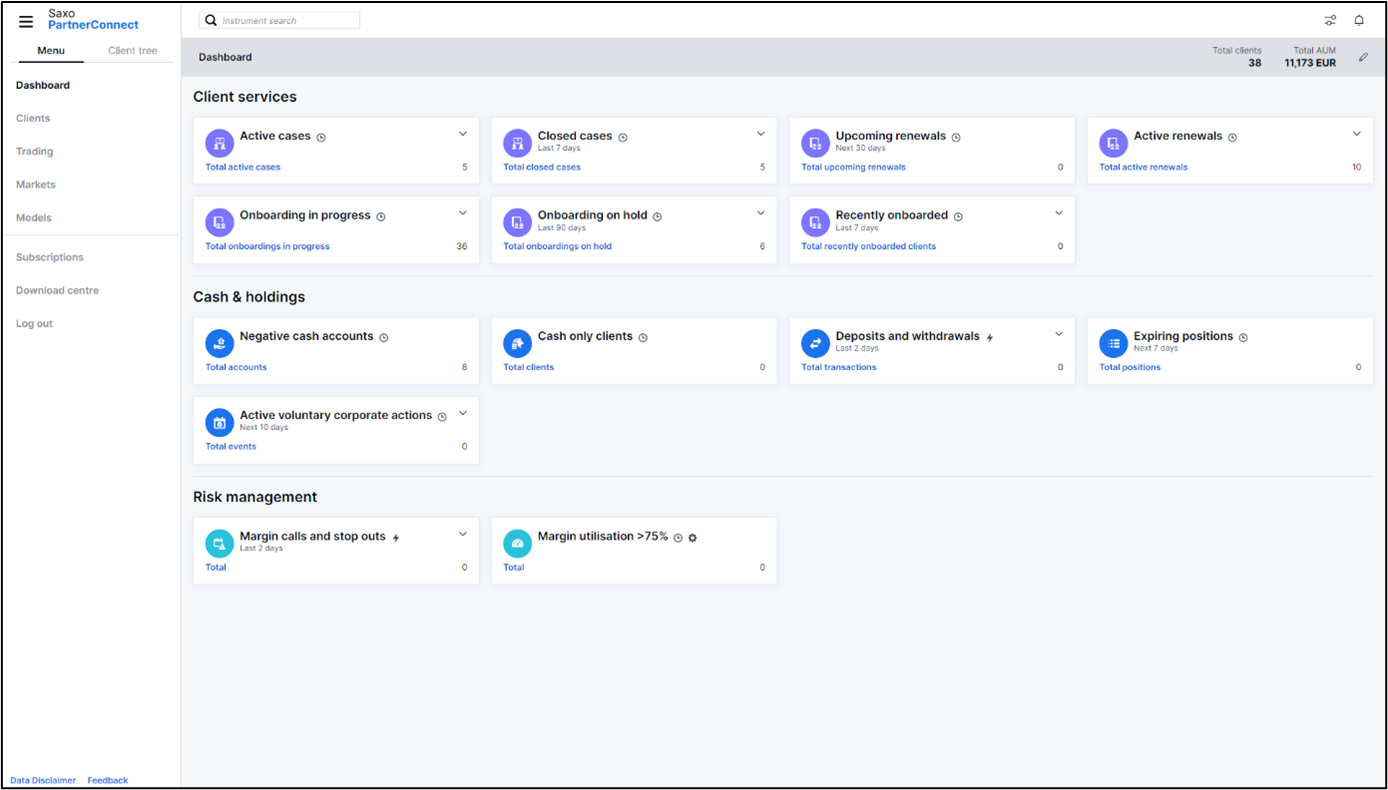

With SaxoPartnerConnect, which is designed and developed for Independent Asset Managers and Financial Advisers, partners can look forward to the following key features to make a real difference to their business models:

• The Model Manager: Partners can create dedicated model portfolios. These can be used for both discretionary and advised clients, and they can choose scheduled and ad-hoc rebalancing.

• SaxoAdvisor: Built into SaxoPartnerConnect, this suite of end-to-end financial advisory tools lets partners create investment proposals. It includes a digital client approval flow, advisory sessions spanning multiple accounts, and allows for accounts with different ‘management types’ on a single client. It can support advised accounts, managed accounts and self-directed accounts.

• Client screener: This allows users to get a full overview of their client base including the ability to generate portfolio and transaction reports in bulk.

• Efficient Client Management Portal: One stop system to access multi-asset classes with advanced allocation and rebalancing tools. The easy and efficient client management portal comes with digital communication throughout investment circle, letting advisors manage the full client lifecycle such as onboarding, funding, trading, corporate actions and renewal on behalf of clients.

1https://bfi.smu.edu.sg/knowledge-research/insights/growing-ecosystem-wealth-management-singapore-lenses-external-asset

2https://newsroom.accenture.com/news/providing-advisory-services-is-increasingly-critical-for-wealth-management-firms-looking-to-seize-growth-opportunities-in-asia-accenture-report-finds.htm

Yvette Lim

Head of Strategic Communications and PR APAC

Saxo Bank

+45 31 39 45 04 (DK)

yvel@saxobank.com

Saxo Markets is a licensed subsidiary of Saxo Bank, a leading Fintech specialist that connects people to investment opportunities in global capital markets. Saxo Markets has operated in Singapore since 2006 and serves as the APAC headquarters. As a provider of multi-asset trading and investment, Saxo Bank’s vision is to enable people to fulfil their financial aspirations and make an impact. Saxo’s user-friendly and personalised platform experience gives investors exactly what they need, when they need it, no matter if they want to actively trade global markets or invest into their future.

Founded in 1992, Saxo Bank was one of the first financial institutions to develop an online trading platform that provided private investors with the same tools and market access as professional traders, large institutions, and fund managers. Saxo combines an agile fintech mindset with close to 30 years of experience and track record in global capital markets to deliver a state-of-the-art experience to clients. The Saxo Bank Group holds four banking licenses and is well regulated globally. Saxo offers clients around the world broad access to global capital markets across asset classes, where they can trade more than 71,000 instruments in over 33 languages from one single margin account. The Saxo Bank Group also powers more than 150 financial institutions as partners by boosting the investment experience they can offer their clients via its open banking technology.

Headquartered in Copenhagen, Saxo Bank’s client assets total more than 115 billion USD and the company has more than 2,300 financial and technology professionals in financial centers around the world including London, Singapore, Amsterdam, Shanghai, Hong Kong, Paris, Zurich, Dubai and Tokyo.

For more information, please visit: www.home.saxo/en-sg/.