Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Empire State Manufacturing

Earnings: IpA, Hightide, RF Industries, Vince

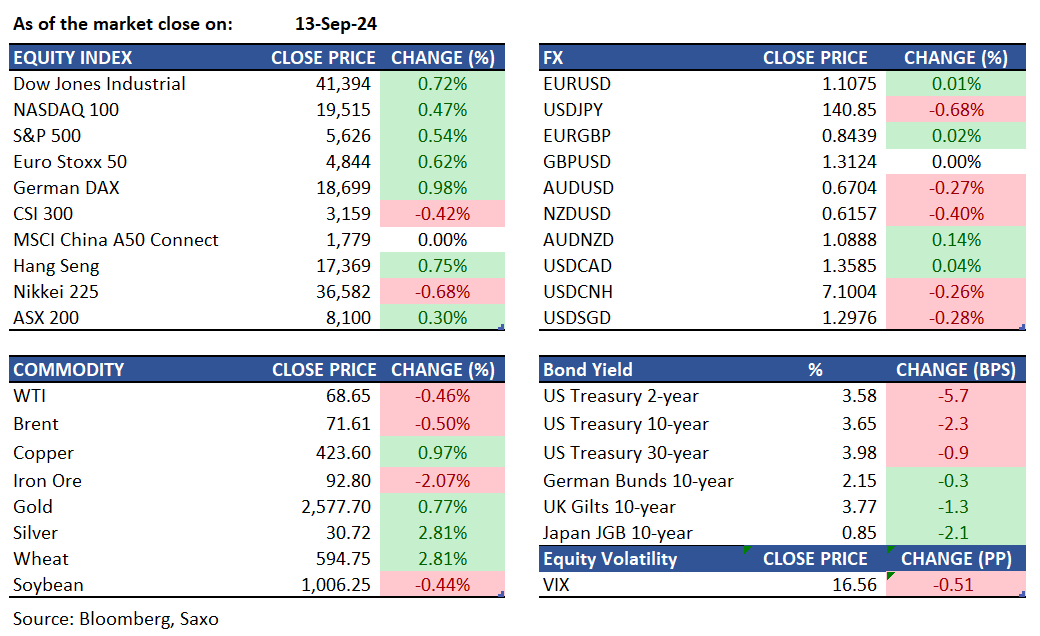

Equities: U.S. stocks closed higher on Friday amid rising expectations of a larger interest rate cut at the Federal Reserve's upcoming meeting. The S&P 500 gained 0.5%, while the Nasdaq rose by 0.6%, both aiming for their fifth consecutive session of gains. Leading the rally were mega-cap tech and semiconductor stocks, with Super Micro Computer and ARM Holdings up by 3.4% and 6.9%, respectively while Uber surged 6.4%. Conversely, Boeing shares fell 3.7% due to a strike by its largest labor union, affecting airplane assembly while Adobe plummeted 8.5% following a bleak earnings outlook. Investors now see a 64% chance of a 50-basis-point rate cut by the Fed, up from 15% early last week.

Fixed income: Treasury yields dropped on Friday as traders adjusted their expectations to a half-point rate cut at next week’s Federal Reserve meeting, instead of a quarter-point cut. October fed funds futures trading surged to the second-highest level on record due to the prospect of a larger rate cut. Front-end yields fell by nearly 7 basis points, widening the 2s10s and 5s30s spreads by 4 and 3 basis points, respectively. The 2s10s spread hit 8.5 basis points, its steepest since July 2022, before settling around 7.5 basis points. Fed-dated Overnight Index Swap (OIS) contracts indicated further Federal Reserve easing. For September, 35 basis points of easing were priced in, equating to about 40% odds of a 50 basis point move. Approximately 115 basis points were priced in for December, up from 110 basis points at Thursday’s close. October fed funds futures volume exceeded 581,000 contracts, the second highest after September 6, when over a million contracts were traded following weak jobs data and comments from Federal Reserve Governor Christopher Waller. JPMorgan economists reaffirmed their prediction of a half-point rate cut next week. CFTC data showed hedge funds increased net short positions in long-bond and ultra-long bond futures up to September 10, while asset managers continued to extend duration long positions.

Commodities: Gold prices reached new all-time highs, increasing by 0.77% to close at $2,577.70. Silver also saw a significant rise, climbing 2.81% to $30.72, driven by a declining dollar and lower Treasury yields ahead of the FOMC policy meeting next Wednesday, where rate cuts are widely anticipated. Over the week, gold surged more than 3.5%, while silver jumped over 10%. Oil prices close lower for the day; however, they still managed to post a weekly gain for the first time in over a month (+1.45% WTD) due to output disruptions in the U.S. Gulf of Mexico caused by Hurricane Francine, which led to evacuations and production platform shutdowns. U.S. WTI crude oil futures settled at $68.65 per barrel, down 0.46%, while Brent crude settled at $71.61 per barrel, down 0.5%.

FX: The US dollar drifted lower on Friday, and closed the week down slightly with mixed performances against the major currencies. Most of the pressure on the greenback came from gains in precious metals and Japanese yen, as markets tilted back towards expecting a bigger rate cut of 50bps from the Fed this week. Swiss franc also rose on Friday but ended as the underperformer for the week, with Kiwi dollar and the Canadian dollar also in losses. Bank of Canada governor raised the prospect for faster rate cuts in an interview with the Financial Times, saying that the labor market is hinting to some downside risks. While the focus will be on the Fed this week, Bank of Japan and Bank of England also announce policy decisions and could be able to add resilience to the Japanese yen and British pound respectively.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)