Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Sales Trader

Summary: Price action of Tesla recently has shown some signs of recovery as it managed to hold off breaking $160 area on the back of the robotaxi announcement that would be unveiled on 8 August despite disappointing delivery numbers for 1Q coming in well below both estimate and production.

Tesla's stock price demonstrated resilience by maintaining above the $160 level, despite weaker than expected delivery figures for the first quarter. This stability is likely due to anticipation of the company's unveiling event for its robotaxis scheduled for August 8 2024. Furthermore, 1Q earnings would be released in less than two weeks on 24 April.

Earnings per share (EPS) estimates have significantly decreased by 30% from $0.82 to $0.59. This decline matches the stock's year-to-date performance, which has greatly underperformed compared to Nvidia's 76% return. Consequently, the forward price-to-earnings (PE) ratio of this stock remains elevated at approximately 64 times, in stark contrast to Nvidia's more moderate PE ratio of 35 times.

Given the recent new events in Tesla, how can a trader or investor express their bearish views on Tesla using options to participate in the potential moves ahead?

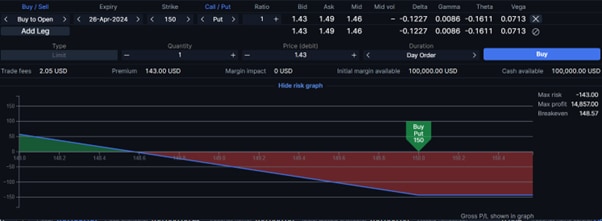

Buying a put option

A long put is an options trading strategy where an investor or trader purchases a put option on a particular underlying security. This strategy provides the buyer the right, but not the obligation, to sell the underlying asset at a predetermined strike price within the timeframe leading up to the expiration of the option.

In summary, a long put is an attractive strategy for traders who have a bearish market outlook on a security and wish to take advantage of a potential decline in its price with limited risk and high leverage potential. However, it's important to manage this strategy actively, taking into account the effects of time decay and changes in volatility.

Example: Buying Tesla out of the money put option at strike of $150 (assuming Tesla is trading at $174 now)

Selling a call option

A short call is an options trading strategy where a trader or investor sells (or "writes") a call option without owning the equivalent amount of the underlying asset. This means the seller provides the buyer of the call option the right, but not the obligation, to buy a specified quantity of an underlying asset at a predetermined strike price within a specified time frame up to the option's expiration date.

In summary, a short call option strategy can be used to generate income if the trader believes that the price of the underlying asset will not increase. The trade-off is that, while the profit is limited to the premium received, the risk is theoretically unlimited should the underlying asset's price soar.

Example: Selling Tesla out of the money call option at strike of $200 (assuming Tesla is trading at $174 now)

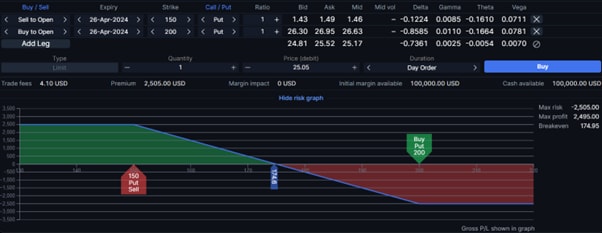

Buying a bear put spread

A bear put spread is an options trading strategy that a trader can use when expecting a moderate decline in the price of the underlying asset. This spread strategy involves buying one put option with a higher strike price (which costs money) and simultaneously selling another put option with a lower strike price (which brings in money). Both put options typically have the same expiration date. Bear put spreads is a cheaper way for traders to bet on the decline of an asset’s price especially when your view is a moderate decline as opposed to a sharp one.

Example: Tesla put option - Buying higher strike of $200 and selling lower strike of $150.

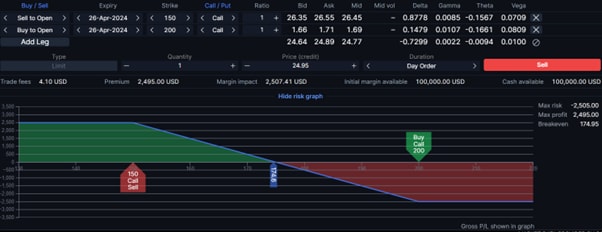

Buying a bear call spread

A bear call spread, also known as a short call spread, is an options trading strategy used when an investor anticipates that the price of the underlying asset will decline moderately or at least not increase significantly. This strategy involves selling a call option at a lower strike and simultaneously buying another call option at a higher strike with the same expiration date.

The bear call spread limits potential gains in exchange for limiting the potential losses, making it a defined risk strategy. It allows traders to profit from time decay (theta) if the stock price remains below the breakeven point.

Example: Tesla call option - buying higher strike of $200 and selling lower strike of $150.