Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Macro backdrop

The June non-farm payrolls and unemployment data, expected at 200K and 4.0% respectively, will be released this Friday at 8:30 am EST. Recent payroll figures have generally exceeded expectations, while unemployment data has been mixed. The Federal Reserve projects one rate cut in 2024, but the timing is uncertain due to early 2024 inflation concerns. Recent data however shows weakening inflation pressures, with consumer price growth slowing for two months. Despite this, some officials caution against overvaluing a few positive reports. Fed Chair Jerome Powell emphasized that rate cut decisions will depend on various data, including labour market conditions and price trends.

Price action

The USDJPY has been on an upward trend since the start of the year, gaining approximately 15%. The market recently traded above the key level of 160.20, which is approximately where the Bank of Japan previously intervened.

Trade Inspiration**

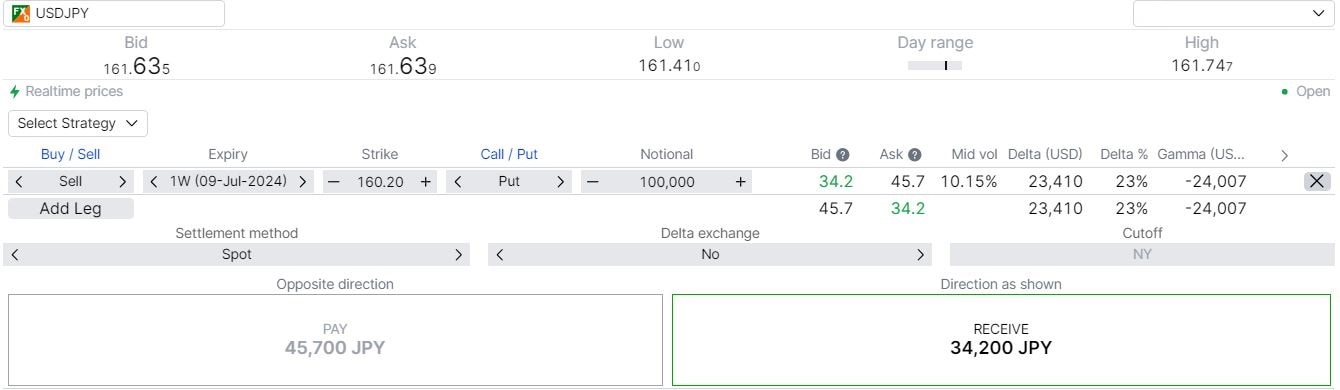

Bullish view – You can consider selling a 1 week put option at strike 160.20 if you wish to be long USDJPY. The option premium received would be about 0.23% or approximately 12% annualized. If USDJPY falls below 160.20 in 1 weeks’ time at expiry, you will be long USDJPY from 160.20. However, if USDJPY stays above 160.20 by expiry, you get to keep your premiums without further obligations.

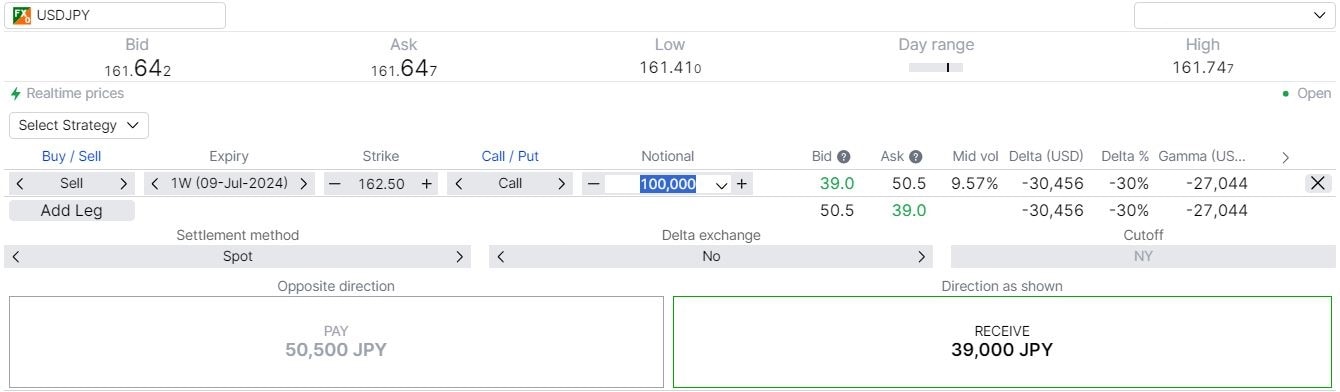

Bearish view – You can consider selling a 1 week call option at strike 162.50 if you wish to be short USDJPY. The option premium received would be about 0.27% or approximately 14.24% annualized. If USDJPY rises above 162.50 in 1 weeks’ time at expiry, you will be short USDJPY from 162.50. However, if USDJPY stays below 162.50, you get to keep your premiums with no further obligations.

**Forex, or FX, involves trading one currency such as the US dollar or Euro for another at an agreed exchange rate. While the forex market is the world’s largest market with round-the-clock trading, it is highly speculative, and you should understand the risks involved. FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading FX with this provider. You should consider whether you understand how FX work and whether you can afford to take the high risk of losing your money. Past performance does not indicate future performance.