Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: OPEC Monthly Oil Market Report, US NY Fed 1-Year Inflation Expectations

Earnings: Barrick, Terawulf, Monday.com, Esperion, Freightcar

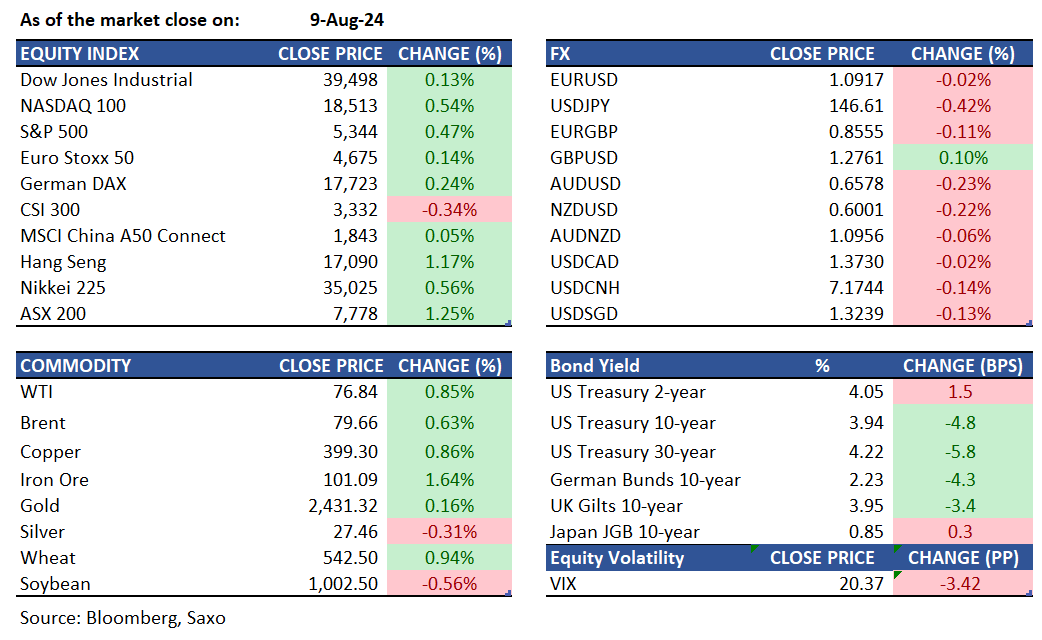

Equities: Wall Street ended a turbulent week on a quieter note, with the session featuring little activity and no significant economic reports or earnings announcements. The S&P 500 rose by 0.4%, the Nasdaq by 0.5%, and the Dow Jones gained 51 points. All sectors finished in positive territory except for materials. Notable gains included Expedia, which surged 10.2% after reporting second-quarter results that beat expectations. Eli Lilly also rose by 5.5% following price target increases from several Wall Street firms, including Morgan Stanley. Take-Two Interactive Software climbed 4.3% after exceeding analysts' expectations. On the other hand, elf Beauty shares plummeted 14.4% due to disappointing quarterly results and concerns about slowing growth. Wrapping up a week of significant volatility, the S&P 500 recorded its fourth consecutive week of losses, down 0.04%, while the Nasdaq fell 0.2%, and the Dow Jones declined 0.6%. Investors are now focused on US producer inflation data due on Tuesday and consumer inflation figures on Wednesday for signs that price growth is stabilizing. US retail sales numbers will follow on Thursday.

Fixed income: Treasury futures fell as no US cash bonds were traded during Asian hours due to a holiday in Japan. Kiwi bonds also edged lower ahead of the Reserve Bank of New Zealand’s rate decision later this week. On Friday, the Treasury yield curve flattened significantly as the expected Federal Reserve easing priced into swap contracts for this year decreased. Long-term yields improved by nearly 5 basis points, while short-term 2-year yields rose by about 2 basis points. The 10-year yields ended around 3.95%, down roughly 4 basis points but still near the upper end of the weekly range of 3.665%-4.02%. Among curve spreads, the 2s10s spread flattened by 6 basis points, and the 5s30s spread by 2 basis points. Fed-dated Overnight Index Swap (OIS) contracts priced in about 100 basis points of rate cuts for the year, down from approximately 120 basis points at Monday’s close. For the September meeting, around 36 basis points of cuts were priced in, compared to nearly 50 basis points on Monday.

Commodities: WTI crude oil futures rose 0.85% to $76.84 per barrel, and Brent crude futures increased 0.63% to $79.66 per barrel, marking their first weekly gain in five weeks due to tightening supplies and Middle East tensions. Oil prices rebounded from a seven-month low thanks to improved risk appetite, positive U.S. jobs data, and a sixth consecutive weekly decline in U.S. crude inventories. Natural gas prices surged nearly 9% for the week to $2.143 per million BTUs. Gold climbed 0.16% to $2,431.32 an ounce, remain supported by geopolitical risks and anticipated Federal Reserve rate cuts amid heightened tensions involving Iran, Israel, and Ukraine.

FX: The US dollar had a choppy amid a volatile last week, slumping earlier but recovering later to end the week nearly unchanged as US recession concerns eased. Focus ahead will remain on US economic data, such as inflation and retail sales to continue to assess the recession probability. Eventually, activity currencies such as Australian dollar, Kiwi dollar and Norwegian krone rose for the week after being thrashed lower at the start of the week. The Canadian dollar also rose as oil prices jumped higher and Canadian jobs data was less bad than feared. Japanese yen also ended the day barely changed as it lost its early gains amid Thursday’s jobless claims lowering the chance of a US recession and risking a rapid unwinding of carry trades. Monday’s early Asian hours saw US dollar rising higher and geopolitical risk is on the radar.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration